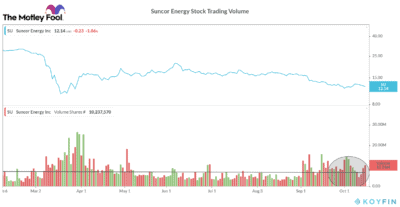

There is a lot of trading happening around Suncor Energy (TSX:SU)(NYSE:SU), Canada’s largest integrated oil company. There are more sellers than buyers for the stock. It comes as no surprise, as Canada’s oil patch had come under a lot of controversy for environmental issues. Many investors have been avoiding investing in Canadian oil producers due to high production costs, environmental concerns, and difficulty in crude transmission through clogged pipelines.

The COVID-19 pandemic made matters worse for the entire oil industry. Many North American oil producers are struggling to raise capital to refinance their huge debt, leading to bankruptcies. But the billionaire value investor Warren Buffett is betting on one oil company. He purchased around five million Suncor Energy shares in June, increasing his stake to 1.3%, or 19.2 million shares. Is he right in investing in this energy company?

The bear case for Suncor Energy

Buffett is a dividend- and stock-buyback-loving investor. Buffett’s Berkshire Hathaway has held Suncor shares since the fourth quarter of 2018. At that time, the stock was trading at $34 per share, and it was a juicy dividend stock. The energy company had been raising its dividends for 18 years in a row till February 2020.

But then in May, Suncor broke its 18-year trend and cut its dividends by 55% in a move to preserve cash burn. This was not its only move. It also reduced its capital spending and operating costs by $1.9 billion and $1 billion, respectively, and increased liquidity to $8.65 billion in the second quarter. With all this, it aims to lower its net loss, which has widened to $4.14 billion in the first half.

The recovery in oil demand is slow, as the rising cases of coronavirus have extended international travel restrictions. It will take at least three to five years for oil demand to return to pre-crisis levels. Once the pandemic ends, Suncor will face the challenge of debt piling up on its balance sheet ($21 billion in second quarter).

The International Energy Agency’s (IEA’s) World Energy Outlook and BP’s report suggest that oil consumption will increase with the economic recovery but flatten over the next 20 years. The emission policies, increased use of cleaner energy and electric vehicles, and a slowdown in population growth will flatten oil demand. Hence, many investors don’t find oil an attractive investment anymore.

The bull case for Suncor Energy

Buffett has bet on Suncor as he believes oil prices will rise once again. No doubt, a 45% dip in Suncor stock price from January to June made it an attractive value stock. But the stock has dipped a further 60% year to date. If it is about valuation, a 0.74 price-to-tangible-book-value ratio is more appealing than the industry median of 0.86.

Buffett is known for buying strong companies at great values when they are distressed. He has a track record of benefitting from his value investments, but not all his investments generate profits. What can work for Suncor is its size and integrated business model. When travel resumes, its gas station and jet fuel revenues will surge. Until oil prices rise, it is shifting its product mix to higher-margin synthetic crude oil to mitigate the losses. Its oil sands won’t dry up for over 26 years, which means it has time to recoup losses.

Moreover, Canada is the world’s fourth-largest oil producer and earns 7% of its gross domestic product (GDP) from this industry. The country won’t let the industry suffer. Canadian oil producers are facing issues like high production costs, environmental emissions, and transmission difficulty.

The Justin Trudeau government is promoting innovation in nuclear energy to reduce carbon intensity and make oil sands more efficient and clean. The U.S. has also approved a rail line from Alberta to Alaska to carry oil for international shipment.

Investor takeaway

If you have the patience to wait for five to seven years, Suncor Energy stock could more than double. In the meantime, it might give you a 5% dividend yield. But if you are only looking for dividends, Suncor’s dividends are not safe for the next three years.