Warren Buffett once said, “Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.” Although the markets have yet to shut down, it has felt as if many parts of our world and economy have. This year, investors have had to face down a pandemic, an oil price war, the downfall of the economy, and now a dramatic and highly publicized election in the U.S.

Think “forever” like Warren Buffett

Many investors are trying to understand how to properly play the election in the short term. I think investors need to take one of Warren Buffett’s great quotes to heart: “Our favourite stock holding period is forever.”

When you invest, you buy real businesses. Regardless of elections or pandemics, I want to own businesses that are not just operating 10 years from now but still growing and thriving.

Considering Warren Buffett’s buy-and-hold-forever strategy, here are two stocks that I’d take a look at owning.

This railroad stock will be chugging away for a very long time

Warren Buffett has often promoted stocks with solid competitive moats and consistent cash flows. I can’t think of any business with a stronger competitive moat than Canadian Pacific Railway (TSX:CP)(NYSE:CP). There are only two major Canadian railroads, so CP operates purely in a duopoly.

CP faced a number of volume challenges when the pandemic hit. However, it utilized that time to upgrade its network capacity, create more efficient routes, and complete maintenance. As a result, CP is a leaner, more efficient earnings machine than it was previously.

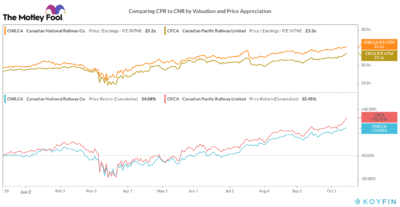

In fact, you can see in the chart below that CP has been able to outperform CN Rail stock by 8.5% year to date. Yet, its price-to-earnings ratio continues to still trade at an 8% discount to CN. This simply demonstrates that much of CP’s stock appreciation has actually been due to true earnings growth as opposed to only multiple expansion.

CP’s stock is not necessarily cheap today. Yet its transportation infrastructure across Canada is essential to the Canadian economy. It’s hard to imagine a world where we won’t need CP, and that is why it is great Warren Buffett stock to own forever.

This stock has assets that even Warren Buffett would envy

Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) is another stock that might fulfill Warren Buffett’s investing criteria. BIP has the corporate capacity, the financial strength, and the expertise to employ economies of scale across the world. It owns essential infrastructure assets like regulated electric and gas transmission lines, natural gas midstream assets, railroads, toll roads, and data storage/distribution assets.

In typical Warren Buffett fashion, BIP acquires, manages, and transforms distressed infrastructure assets into highly predictable cash cows. In the 2009 financial crisis, BIP acquired a number of utility assets that then fueled +10 years of CAGR FFO per unit growth of 15%!

Today, BIP’s balance sheet is primed with $4.3 billion of dry powder. I believe this sets it up to prosper out of this economic crisis as well. This stock has the resilience and stability of a utility but a better growth profile than many ordinary companies. Combine acquisitions and organic growth, and it could achieve 7-14% annual cash flow growth for many years to come.

While there is nothing exciting about BIP’s portfolio of pipelines and power poles, nobody can complain about the potential for 7-14% annual growth. All this while the stock pays a growing 4.2% dividend! All in all, BIP’s assets should be producing strong cash flow for many years to come, making its portfolio one even Warren Buffett would envy.