Earnings season is upon us, and once again, this will be extremely important for investors. Earnings is always a crucial time to get an update on how your TSX stocks have been performing. However, this year with so much uncertainty and so many unprecedented events, earnings season is all the more meaningful.

After the last earnings season, investors already got a good glimpse into what businesses and industries have been able to handle the pandemic and which have struggled. Last earnings season was extremely crucial, too, as most companies reported their first full quarter that was impacted by coronavirus.

However, in some cases, this earnings report can be considered even more important. The massive shutdowns in the second quarter may have led to a one-off in terms of companies’ earnings being impacted.

However, this time around, it will be crucial to see how each company has coped with the short-term headwinds, what they have done to continue to operate in the meantime and what the outlook is going forward from here.

It’s also a great opportunity for investors of undervalued stocks that the market may have missed last quarter.

Here are two stocks that could surprise investors during this season’s earnings reports.

TSX media stock

The first stock to consider is one of the cheapest stocks on the TSX, Corus Entertainment (TSX:CJR.B).

During the spring, Corus investors were concerned that an impact on advertising revenue could cause big problems for the company. It was only a few years ago the stock had to trim its dividend severely. This was crucial so Corus could reduce its debt and improve its capital position.

Plus, history has shown that media companies such as Corus see notable revenue impacts during recessions. There was major concern that Corus would be impacted enough that the stock would need to trim its dividend.

However, as investors have seen since, that work Corus did to reduce its debt has been key during the pandemic. While the company did see a sizeable reduction in advertising immediately following the start of the pandemic, the company was able to weather the storm.

This was key, as it allowed Corus to maintain its dividend — something a lot of investors and analysts doubted. So far, Corus has done all it can to tread water and wait for the advertising environment to pick up.

However, looking at similar U.S companies that have already reported earnings, it looks as though a lot of strong advertising dollars returned over the summer.

Corus reports earnings this week on Thursday, October 22, so you can bet many investors will be watching the TSX stock closely. There are clearly still some headwinds impacting Corus’s business, but if it can report strong results, the stock could rally as a result.

Top blue-chip stock

Another high-quality TSX stock that could get a boost from strong earnings is Enbridge (TSX:ENB)(NYSE:ENB).

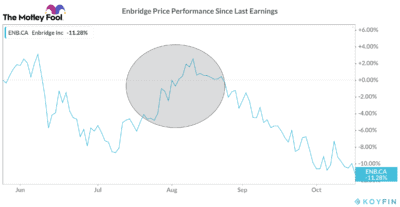

The stock has been on a downward trend lately. This is due to investors’ fears that demand for oil will continue to fall with the second wave of coronavirus. This is similar to what happened before its last earnings report in July.

As you can see, the stock was sold off before its last earnings. Then once the company reported better-than-expected numbers, the stock rallied, which we can see in the shaded circle on the graph. However, after that slight rally, the stock has sold off once again. This has created a major opportunity for long-term value investors.

Enbridge’s business continues to be one of the strongest. There may be no other midstream energy company that could handle the pandemic as well as Enbridge.

While the massive TSX stock saw a 40% decline in revenue during the last quarter, it actually managed to grow its gross profit by 0.5% and its operating income by more than 2%. Plus, the company is doing everything it can to keep its massive dividend intact, which shouldn’t be a problem either.

Of course, the longer the pandemic rages on, the more uncertainty and risk will increase. However, Enbridge is such a high-quality TSX stock and a great business you can certainly count on it for a long-term investment.