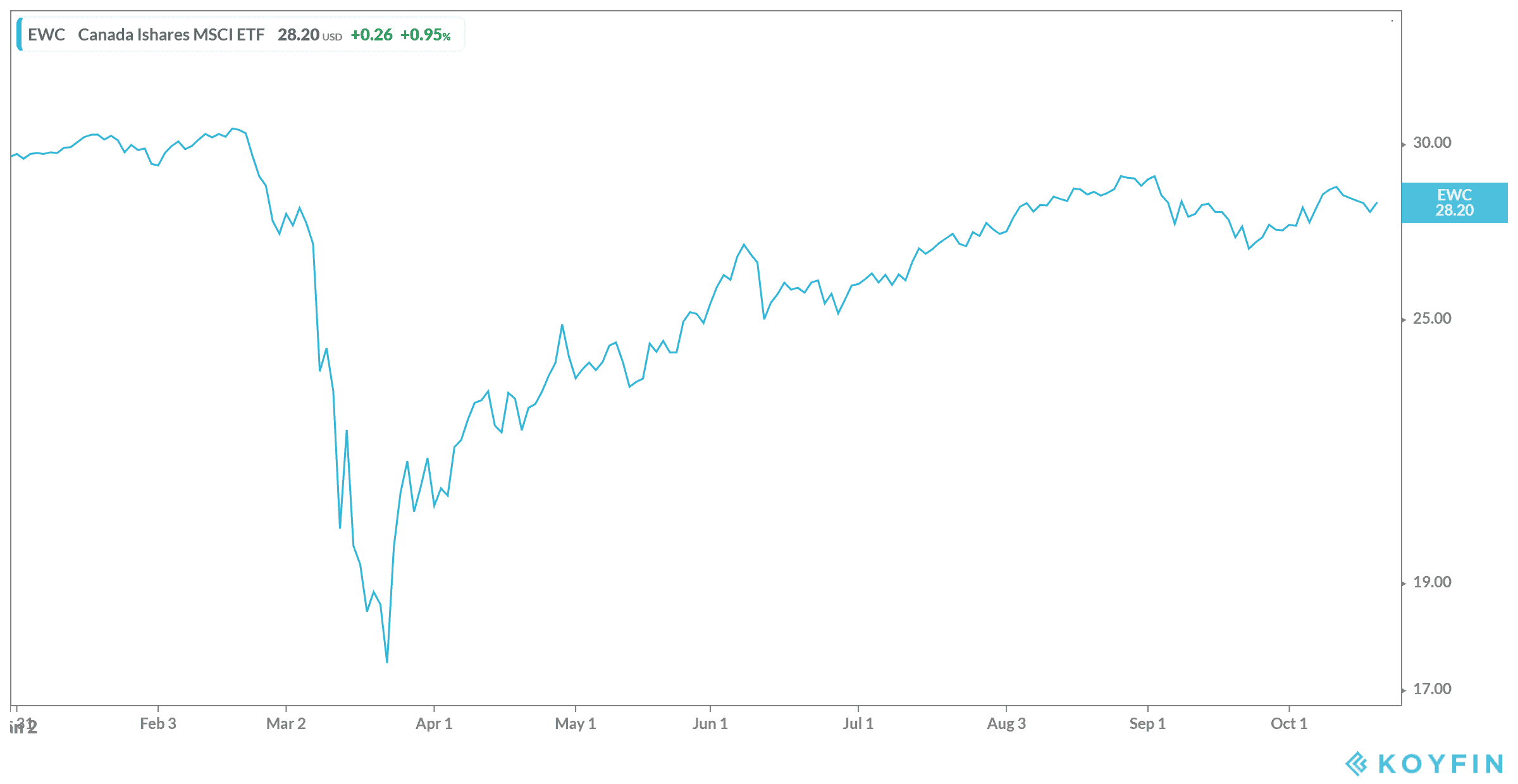

It looks like investors are still waiting to see another stock market crash as economists predicted. After the crash back in March, many thought we saw a V-shaped recovery. However, as you can see, it doesn’t look like that is the case.

Instead, it looks like we saw a V-shaped curve that now has quite a wobbly end on the tail of it. Just as stocks were starting to reach pre-crash levels, another wave of the virus hit. While we are better equipped to handle it this time around, we are still worried none the less. If another lockdown happens, everything could go south.

So that’s why you want to protect your portfolio now more than ever. Start investing in stocks that could provide you some defense both now, and decades from now. It’s simple enough to do, all you need is the right stock, and a Tax-Free Savings Account (TFSA).

Banks are best

There are many of you who have likely done some preliminary research and found that banks aren’t highly recommended right now. That’s true, if you’re a short-term investors. Banks are likely to continue suffering under the weight of both a pandemic and an economic downturn.

The economy isn’t likely to recover for quite some time. That’s because the entire world is under a mass amount of debt. That debt has to be paid sometime, and yet every country now has to take on even more debt because of the virus. So that also means banks aren’t likely to receive payments as well, both from corporations and citizens alike.

So why are banks best? Most Canadian Big Six Banks prepared for the downturn. It wasn’t a secret that some economic fallout was about to happen, so each got prepared. Now, most have almost a trillion in assets to fall back on. Each also tried to expand as much as possible and diversify the portfolio. That would leave a higher chance of recovering faster.

Go with TD

If you’re going to follow this advice, I would go with Toronto-Dominion Bank (TSX:TD)(NYSE:TD). TD Bank checks all the boxes. It has about a trillion in assets to fall back on. It’s expanded into the wealth and commercial management sectors, as well as becoming a top 10 bank in the United States. But it also has plenty of room to grow.

It also has the added benefit of providing a high number of options for loan payments. This likely means that both businesses and clients will pay back debts sooner, because it doesn’t have to be a lump sum payment but smaller payments. Anything is better than nothing at this point.

Finally, this stock has the historical growth investors can fall back on. If you had invested $6,000 in TD Bank 25 years ago, today those shares would be worth $60,000! And that’s without dividends reinvested.

Bottom line

If you were to follow that same rate of growth for the next 25 years, you would be laughing. Even better, if you invest dividends you could be well into six figures in the next few decades. TD Bank has over a hundred years of growth, so you don’t have to worry about this stock going away any time soon. So if you took that $6,000 and invested today, in 25 years you could easily have $889,049.46 at today’s numbers in your TFSA!