Finding growth stocks like Shopify (TSX:SHOP)(NYSE:SHOP) is one of the biggest factors in the long-term performance of a portfolio. These once-in-a-lifetime stocks bring huge growth and can lead to massive gains for investors.

You can’t have your whole portfolio invested in them, because these stocks are a lot riskier. However, having some exposure is important, especially for investors who are a little more risk-averse.

Once you’ve done your research and understand how a company makes money, you’ll be able to make educated investment decisions.

Investors who knew Shopify was a main player in the growing e-commerce trend and were quick to buy the stock back in March have already made huge returns.

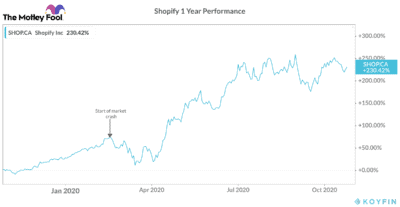

Shopify stock performance this year

This time last year, Shopify was worth just over $400. That means if you decided to buy shares at the end of October, you would have made more than 230% on your investment already.

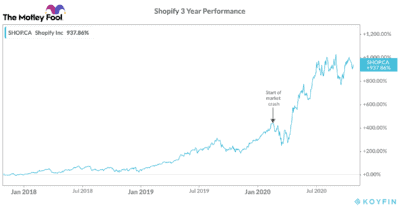

As you can see, the company has had impressive growth this year. This is just more of the same from the last five years, as Shopify stock has returned nearly 1,000% over that period. However, this time around, the growth has been aided due to the situation caused by the pandemic.

It’s clear from the graph how much of a boost the pandemic has had on Shopify’s long-term performance.

Obviously, nobody last October could have predicted that a pandemic would sweep across the globe or that Shopify would gain because of it. However, once it was clear that’s what was happening, investors who were quick to react would have been rewarded.

If you’d bought Shopify stock at the end of last October, you would have already made more than 3.4 times your investment.

Reasons why Shopify investors were more than just lucky

It may seem like investors got lucky buying a stock right before another major catalyst sends its shares soaring. However, investors who’d researched Shopify would have known all its qualities and that a performance like this is not surprising.

The tech stock has been growing its revenue massively as well as consistently. This is extremely important, and one of the major reasons why Shopify stock is growing so fast.

It also has an extremely impressive business model — one that is set up to earn recurring revenue. So, as Shopify continues to grow its sales rapidly, investors know a lot of that revenue will continue for years.

Shopify is also extremely attractive, because it is as much a part of driving the e-commerce trend with its impressive platform as it is benefitting from the e-commerce trend.

Shopify continues to be one of the top long-term growth stocks in Canada. The company is reporting earnings this Thursday, so that will be something to watch. However, even if the numbers are down, I would consider using that as a buying opportunity.

One bad quarter doesn’t make a trend, and with the second wave of coronavirus looking worse than the first, a big wave of business could be coming for Shopify over the winter.

Bottom line

Finding high-potential stocks like Shopify can make a massive difference in your long-term performance. It’s not just about finding companies with a business model like Shopify. Instead investors should be focused on businesses that are dominant, disrupting major industries, and are opportunistic.

Shopify could still be worth an investment today for long-term investors. However, if you’re looking for the type of stock to deliver the returns Shopify has in the past, you may have to look elsewhere.