This has been the best year for tech stocks so far. The COVID-19 pandemic accelerated the move to digitization, especially e-commerce and video calling. Companies that facilitated this move skyrocketed. Three tech companies grew triple-digit from the March low. Shopify (TSX:SHOP)(NYSE:SHOP), Enghouse Systems (TSX:ENGH), and Lightspeed POS surged 154%, 119%, and 315% between March 23 and September 2. But their rally faded from September. While Lightspeed stock is still growing, Shopify and Enghouse stocks seem to have reached their peak.

Have these two tech stocks reached their valuation peak

It is not that Shopify and Enghouse don’t have the growth potential. Both are fundamentally strong, reporting double-digit revenue growth. But it is their valuation that has limited their upside. The value of such high-growth tech stocks lies in their sales.

Shopify stock is trading at almost 80 times its sales per share on the back of its 97% year-over-year (YoY) revenue growth in the second quarter. This is the first time in four years its quarterly revenue surged past 90%. When the company’s size increases, its growth rate slows. Before the pandemic, Shopify’s annual revenue growth was decelerating from 95% in 2015 to 47% in 2019. But the pandemic acted as a catalyst and accelerated its growth, which made investors bullish and sent the stock soaring as high as to $1,502.

Shopify’s revenue would continue to grow strong double-digit, but its stock won’t as investors have priced in their bullish expectation of an eight-fold increase in sales. If Shopify maintains its current growth rate, it would take the company at least six to seven years to achieve an eight-fold growth in sales.

In the case of Enghouse, it is trading at almost eight times its sales per share as the pandemic increased its sales by 58% YoY in the quarter ended April. It benefitted from the move to video calling and video services in the pandemic. It saw higher demand for Vidyo, Dialogic, and Espial products. This revenue growth is reflected in its stock price. However, its revenue growth normalized to 30% in the third quarter, and so did its stock price.

Technical indicators show investors are divided on these tech stocks

The stock price rally of Shopify and Enghouse has become range-bound since July. Shopify has been trading in the price range of $1,200-$1,450 and Enghouse in the $70-$80 range.

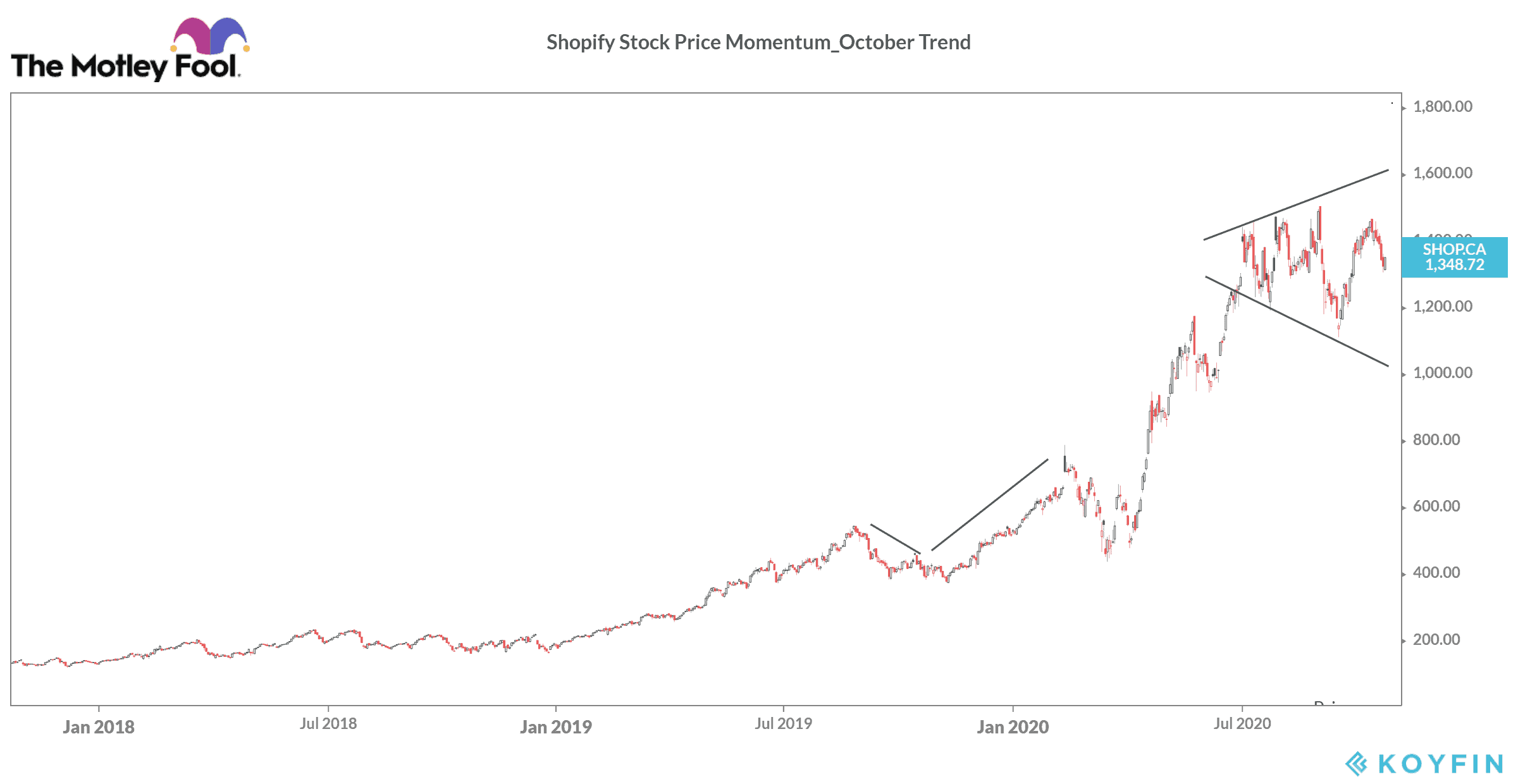

The above graph shows that Shopify stocks’ price momentum is forming a megaphone pattern where two lines move in opposite directions. This pattern forms when the stock makes two peaks and two troughs, indicating that investors are split. Similar is the case with Enghouse. Some bullish investors are buying the stock at a premium and pushing it to the higher side of the price range. Some bearish investors are cashing out their profits, thereby pulling the stock to the lower side of the price range.

The broader the megaphone becomes, the higher would be the volatility in the short term. The stock price rally has stalled as investors don’t have a motivation to be bullish. The past six months’ growth came on the back of the pandemic-induced traffic and its reflection in the revenue.

The next growth momentum hinges on the third-quarter earnings. The bearish investors believe that the growth would normalize as the economy reopens. The bullish investors believe that the pandemic has opened the gate to multi-year growth.

Should you buy these stocks now?

All the information puts us at the crossroads of whether it is wise to buy these stocks at their current valuation. The technical pattern shows heavy volatility and a broader move to correction in the stock price. Shopify and Enghouse stocks have declined 9% and 13%, respectively, from their September high.

October is a weak month for these stocks. The last two years’ stock price momentum shows a dip in their price in October followed by a rally in late November.

If you own these stocks, hold them and buy more now. If you don’t own these stocks, this is the right time to buy as they are trading at the lower end of their price range.