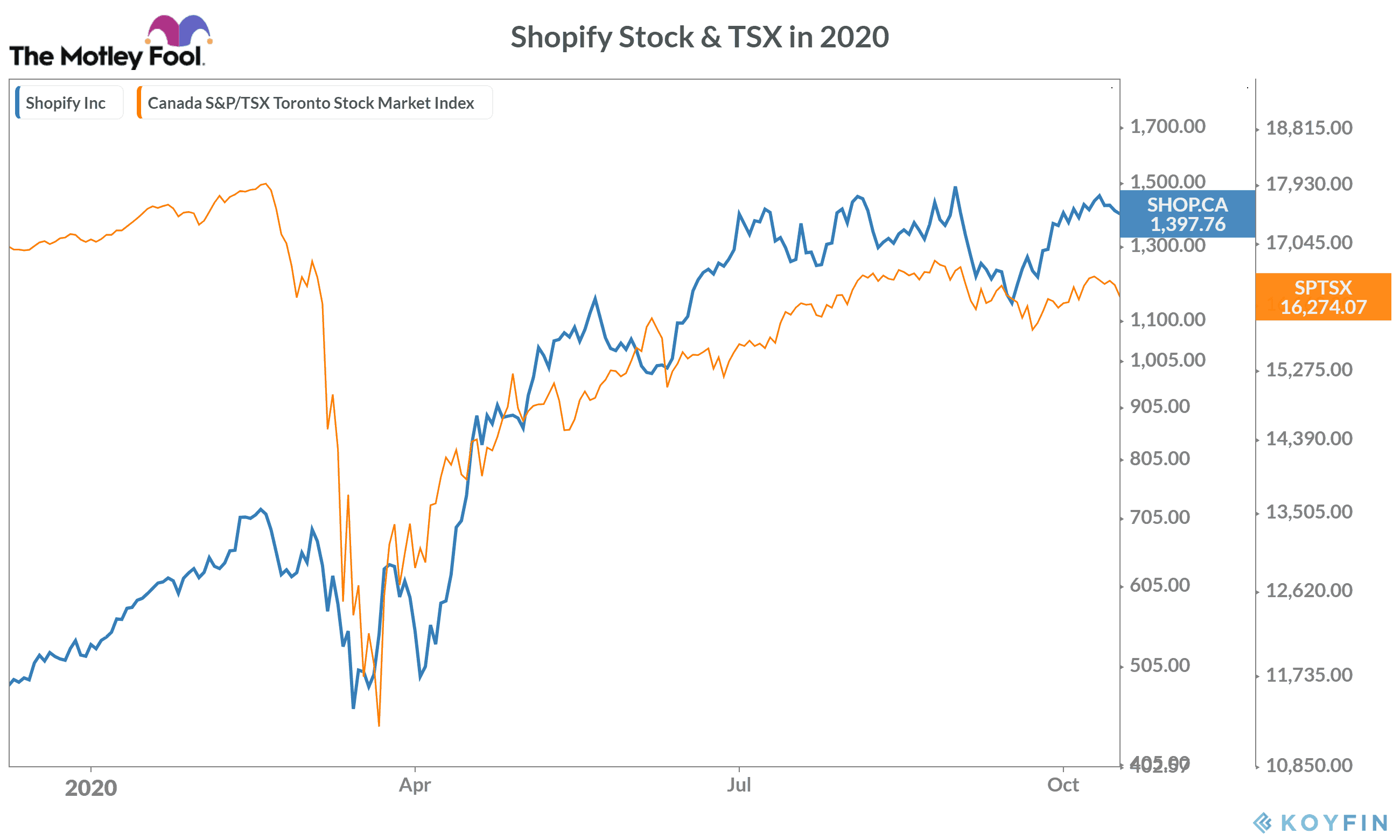

Shopify (TSX:SHOP)(NYSE:SHOP) — the popular Canadian e-commerce services provider — saw a sharp 5% drop in share prices on Thursday, despite reporting solid third-quarter results. The company continues to hugely benefit from a rise in e-commerce services demand amid the pandemic. Let’s take a closer look at its recent financials and find out why its stock fell, despite its impressive Q3 results.

Shopify’s Q3 earnings

In Q3, the company reported earnings per share of US$1.13 — up 7.6% from US$1.05 in the previous quarter. It showed a massive 528% year-over-year (YoY) increase from US$0.18 in the third quarter of 2019. Shopify’s Q3 earnings figure was also more than double compared to Wall Street’s consensus estimate of US$0.51 per share.

Interestingly, the company’s EPS rose at a comparatively higher pace in the previous quarter — by 650% on a YoY basis.

Astonishing revenue growth continued

Shopify continues to impress with its astonishing YoY revenue growth. In the third quarter, its revenue rose by 96.5% YoY to US$767 million. Its revenue figure also reflected 7.4% sequential growth and was much higher as compared to analysts’ consensus estimate of US$658 million.

It was the second quarter in a row when Shopify’s revenue rose sequentially with the help of continued strong performance in both of its segments — merchant solutions and subscription solutions. Now, let’s move on to look at its profitability.

Solid expansion in bottom-line margin

Shopify registered another solid quarter in terms of profitability, as its adjusted net profit rose by 8.8% sequentially to US$141 million. It was over 600% higher YoY from its net profit of US$20.05 in the same period of the last year.

To add optimism, the company reported a record 18.3% adjusted net profit margin in Q3 — much higher from just 5.1% a year ago and slightly better than 18.1% in the previous quarter.

What hurt Shopify’s stock movement then?

Looking at these amazing quarterly results, anyone would want to buy the company’s stock. In contrast, Shopify stock turned negative and lost about 5% for the day. Shopify management’s seemingly realistic comments about the fourth quarter could be the primary reason for these losses.

During its Q3 earnings conference call, Shopify’s CFO Amy Shapero — when talking about the subscription solutions — said that “while demand remains higher for subscriptions compared to pre-COVID levels, we do not expect a year-on-year MRR growth rate in Q4 to match what we saw in Q3.”

Will the stock fall further?

While the management’s realistic expectation for the next quarter might have hurt some investors’ sentiments, it wasn’t really a big surprise for many others. In fact, I’ve been arguing for months that the best period amid the pandemic might soon be over for Shopify.

Overall, if you bought Shopify stock with a long-term goal in mind, it would be wise to avoid the ongoing temporary drop in its stock, as the company may continue to grow faster in the long run. However, I don’t see many reasons to buy its stock at this price point right now, as it might fall further in the short term.