While you might already be familiar with Artificial Intelligence (AI), it’s far more than using “Hey Google” now and again. AI is really about learning. A computer takes in data and can learn and adapt to pretty much anything. From driving a car to training employees, AI can do it all. It’s the present, and will be here far, far into the future.

So that’s why you want to pay close attention to AI stocks, especially now. There’s a market downturn, sure, but tech stocks have been booming. AI stocks, obviously in tech, have been doing well also. But these are get-rich-quick schemes. AI stocks provide an opportunity for huge returns over decades.

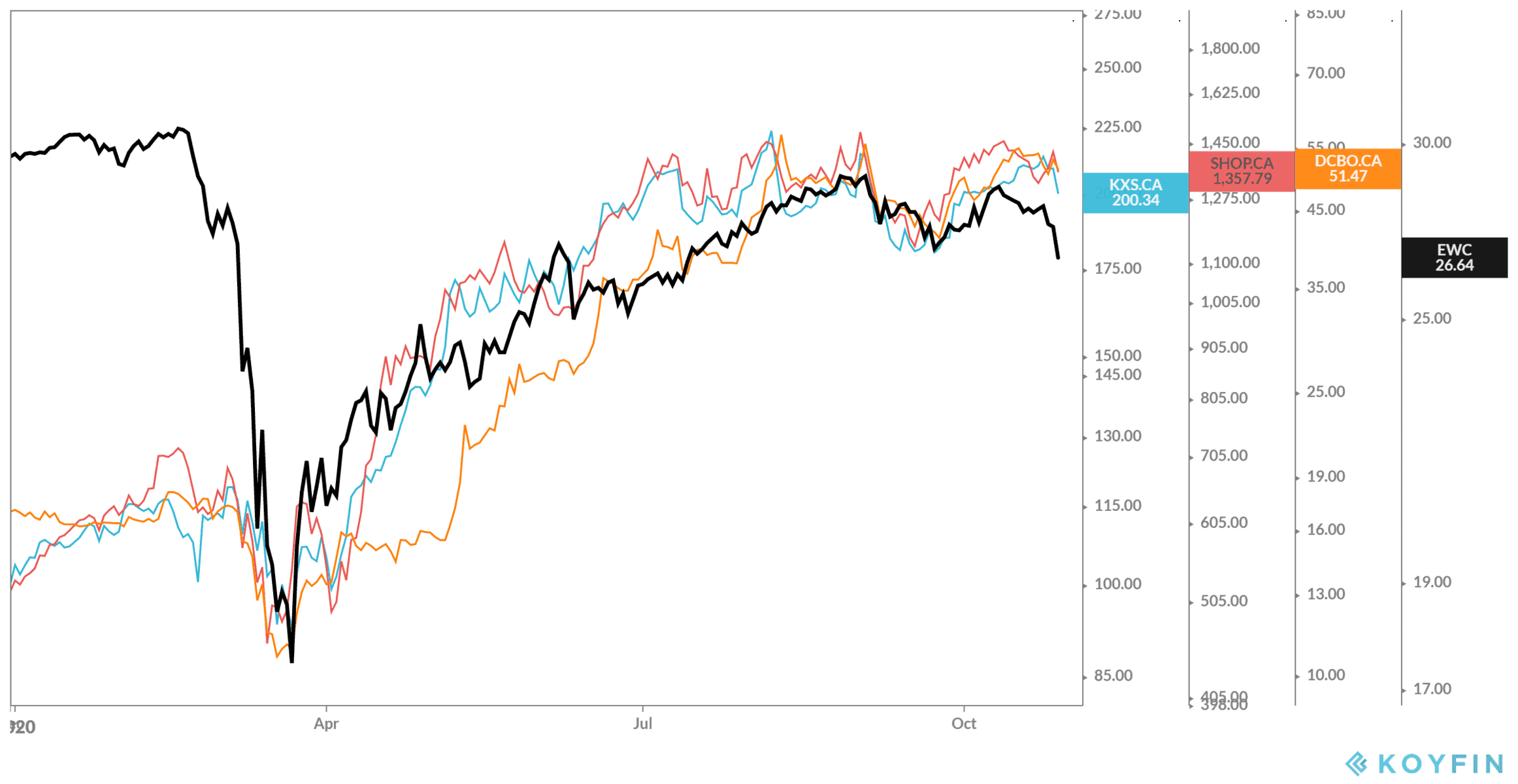

If there are three Canadian AI stocks I would consider today, they would be Shopify Inc. (TSX:SHOP)(NYSE:SHOP), Kinaxis Inc. (TSX:KXS) and Docebo Inc. (TSX:DCBO).

Shopify

Shopify is an easy choice among AI stocks. Shopify uses AI in a number of ways, for both clients and customers. Shopify’s algorithms means AI is used to help clients find customers, better perform, and even offer ways to improve based on what’s worked for similar clients. Meanwhile, Shopify is able to recommend shops to customers. It even helps detect and prevent fraud!

Of course, Shopify isn’t new, and its shares are through the roof. If you bought Shopify five years ago, you would have returns of 3,220% as of writing. But that’s not likely to go anywhere, as investors are still hot for Shopify. It’s more likely the share price will stabilize, but not drop. So you can continue to see those record-breaking revenues of 60% during the last quarter continue for quite some time.

Docebo

For a cheaper – but no less exciting – option, consider Docebo. Docebo is a learning management system that is provided to businesses. This system uses AI to help businesses create the perfect training system for employees no matter where they are in the world. This has obviously been beneficial in a pandemic-ridden society. But beyond that, businesses in the future can use this system to choose employees anywhere on the planet!

And Docebo has seen more and more revenue flood in as clients sign on. Year-over-year revenue came in at 46.5% during the last quarter, and earnings are around the corner on November 12. Meanwhile, returns are up 276% as of writing, and aren’t likely to come down anytime soon.

Kinaxis

Finally, Kinaxis provides the boring work that no one wants to do, but better. It’s a supply chain management system, using AI to provide the most efficient way for its clients to get product from one end to another. It has enterprise clients around the world, with no single client taking up more than 10% of its portfolio. As well, each signs up for contracts usually on a yearly basis, or longer. So recurring revenue remains strong for this AI stock.

Its latest revenue came in at a solid 33.4% year over year, reaching higher and higher quarter to quarter. Meanwhile, shares are up 387% in the last five years, with a compound annual growth rate (CAGR) of 37% in that same period. This stock is likely the most stable of these three, so if there’s one you’re going to buy, I would highly recommend Kinaxis before earnings come out November 4.