On Thursday, the shares of Cenovus Energy (TSX:CVE)(NYSE:CVE) fell by 4.1%, as it released its third quarter of 2020 results. The Canadian integrated oil and natural gas firm missed Bay Street analysts’ consensus estimates by a wide margin, triggering a sell-off in its stock. Let’s look at its key financials and find out what might have hurt investors’ sentiments and whether or not its stock is worth holding.

Cenovus Energy’s Q3 earnings highlights

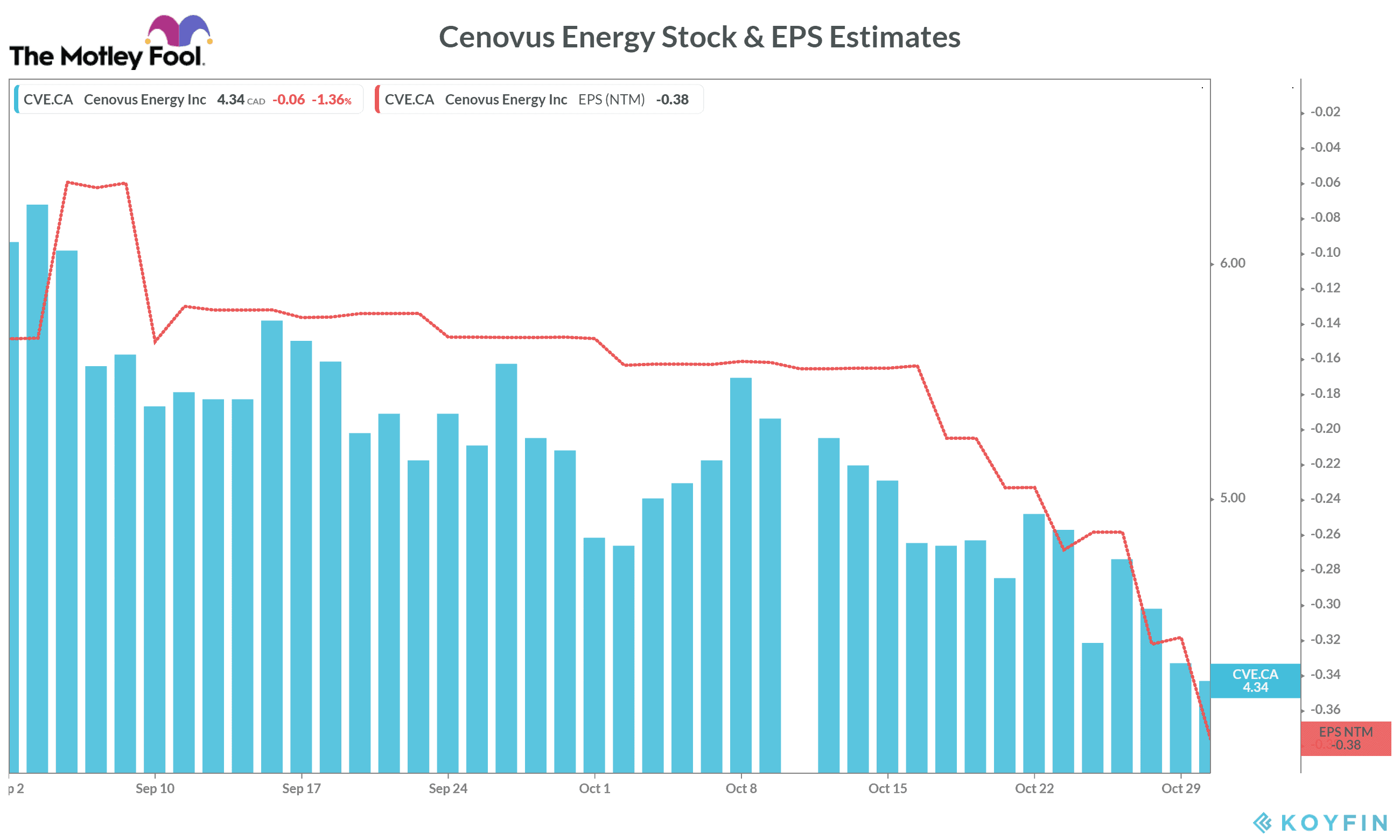

In Q3 of 2020, Cenovus Energy reported an adjusted net loss of $0.37 per share — down 8.8% from a loss of $0.34 in the previous quarter. It was also much worse than the loss of $0.23 per share in the third quarter of 2019 and analysts’ estimate of $0.07 loss per share. With this, the company’s earnings marked the third consecutive quarter of a negative year-over-year ( YoY) trend.

By comparison, its peer Whitecap Resources reported a 70% YoY decline in its Q3 EPS, but it remained in the positive territory with earnings of $0.03 per share.

Going through tough times

Despite the ongoing challenges due to the pandemic, Cenovus Energy tried to increase production and executed plan turnarounds at two of its oil sand facilities. As a result, its revenue improved to $3.7 billion in Q3 from $ 2.2 billion in the second quarter. While it was 23% lower on a YoY basis, the company beat analysts’ consensus estimate of $3.3 billion.

Note that it was the third consecutive quarter when Cenovus Energy posted a YoY decline in its revenue. In comparison, Whitecap Resources’s revenue fell at a higher rate of 36.5% YoY.

Continued losses

The COVID-19 has made it difficult for energy companies to grow by hurting overall energy demand globally. But the trend in Cenovus Energy’s financials was negative even before that, as Q3 2020 was the fourth consecutive quarter when it reported a net loss. Therefore, the company can’t completely blame the pandemic for hurting its financials growth.

In Q3, its adjusted net loss more than doubled to $452 million from $164 million loss in the same quarter of 2019. It was also higher than a net loss of $414 million in the previous quarter. This could be one of the key reasons why its stock fell sharply on the day of its earnings event.

Is Cenovus Energy stock worth holding?

Cenovus Energy stock has lost 67% in 2020 so far compared to an 8.2% drop in the TSX Composite Index — with no near-term recovery in sight. In fact, the second wave of the pandemic could make the overall environment more challenging for energy companies by further hurting the energy demand.

Also, Cenovus Energy doesn’t provide any dividend yield at the moment unlike many other energy firms such as TC Energy. Considering mounting energy sector challenges due to the prolonged pandemic, as mentioned above, and weak economic environment, I don’t see many reasons to hold Cenovus Energy stock.

Another reason behind my argument is that you might be losing many great opportunities to build wealth by locking your money in stocks like Cenovus Energy right now. Instead, you can invest the same money in some other great undervalued stocks right now.