Canadian savers use their TFSA to set aside cash for a number of financial goals. Retirement planning is one good use for the TFSA.

TFSA 101

The TFSA contribution limit is as high as $69,500 for Canadian residents who were at least 18 years old in 2009. That’s when the government launched the TFSA to give Canadians a savings new tool.

Previously, people used the RRSP as the main vehicle for self-directed retirement savings. The RRSP remains a very attractive savings option, but not everyone builds RRSP room. Those who have it might decide to save it for later.

Business owners, for example, often pay themselves with dividends, rather than taking a salary. This means they do not generate RRSP contribution space. In this case, the TFSA can be very helpful.

Younger investors who have income and build RRSP contribution space might decide to bank it for years when income is higher. RRSP contributions are used to reduce taxable income for the relevant year, so it makes sense to allocate the contributions when the investor is in a high marginal tax bracket.

The TFSA provides more flexibility than the RRSP. Funds can be removed easily without a withholding tax being applied, as happens with RRSP withdrawals. All interest, dividends and capital gains earned inside a TFSA are tax-free. This makes it effective for income generation. Dividends can also be reinvested in new shares to harness the power of compounding. The snowball effect has the potential to turn small initial investments into a significant retirement portfolio.

Best investments for a TFSA

Investors who hold top-quality dividend stocks and use the distributions to buy more shares typically do well over the long term. The best stocks to own might not be the most exciting ones in the stock market, but they make up for the lack of bling with their stellar returns.

In the current environment, it is a good idea to look for businesses that have strong track records of dividend growth and rising revenue.

Is Fortis stock a good buy today?

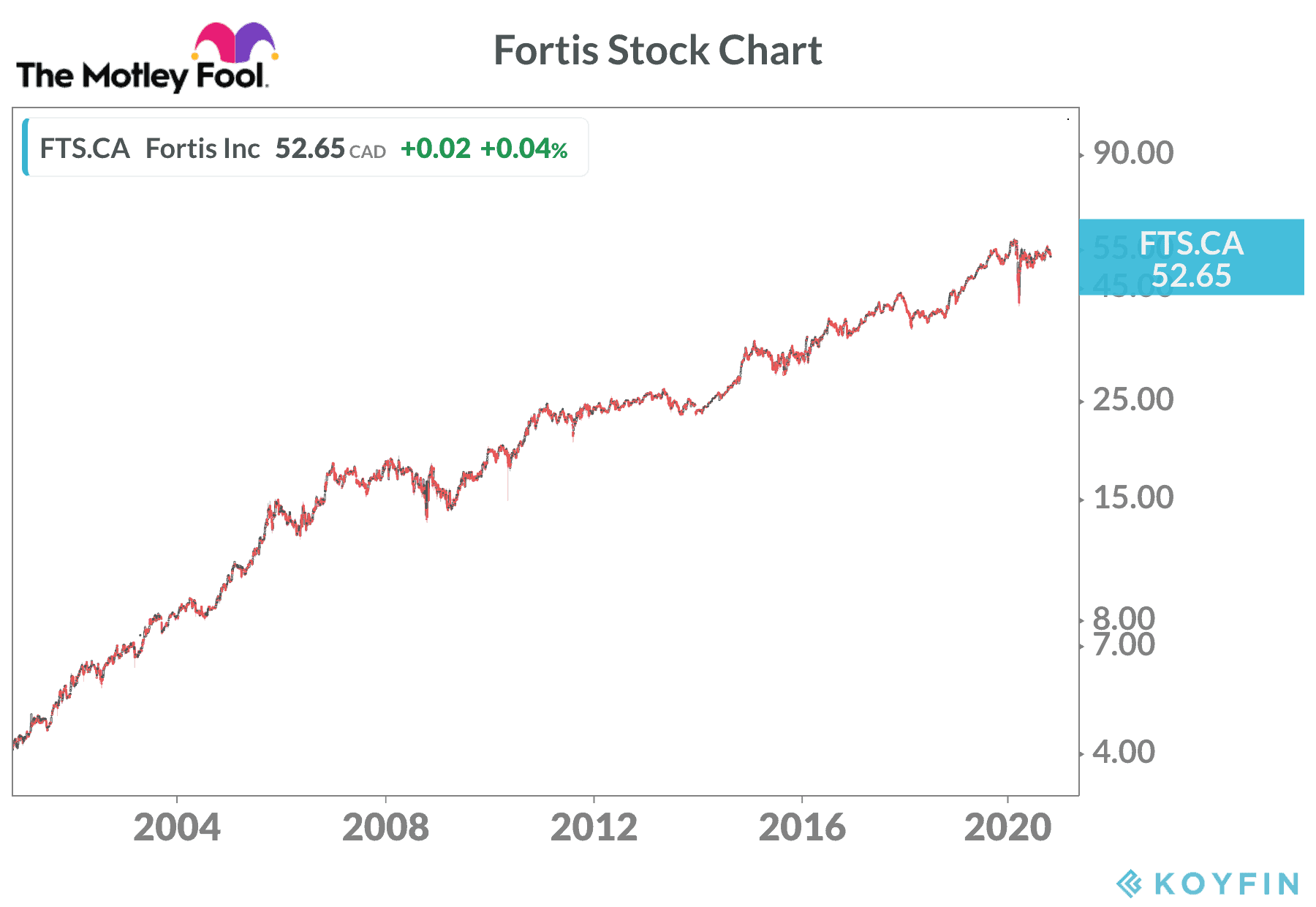

Fortis (TSX:FTS)(NYSE:FTS) owns more than $50 billion in utilities assets across a number of sectors. The businesses are located in Canada, the United States, and the Caribbean and include power generation, electricity transmission, and natural gas distribution.

These regulated sectors provide steady and predictable revenue streams in most economic conditions. People need to turn on the lights, cook food, and heat their homes regardless of the state of the global financial system. Geopolitical chaos and economic upheaval around the world have little impact on the operations.

Fortis grows through acquisitions and internal projects. The current capital plan is above $19 billion. As the new assets go into service, the rate base will expand. Fortis expects cash flow to increase enough to support average annual dividend hikes of 6% through 2025.

The current distribution provides a 3.9% dividend yield.

A $5,000 investment in Fortis just 25 years ago would be worth $100,000 today with the dividends reinvested.

The bottom line

Fortis should continue to be a solid anchor position for a balanced TFSA dividend portfolio. The TSX Index has a number of top stocks that appear oversold right now and provide attractive yields with strong upside potential.