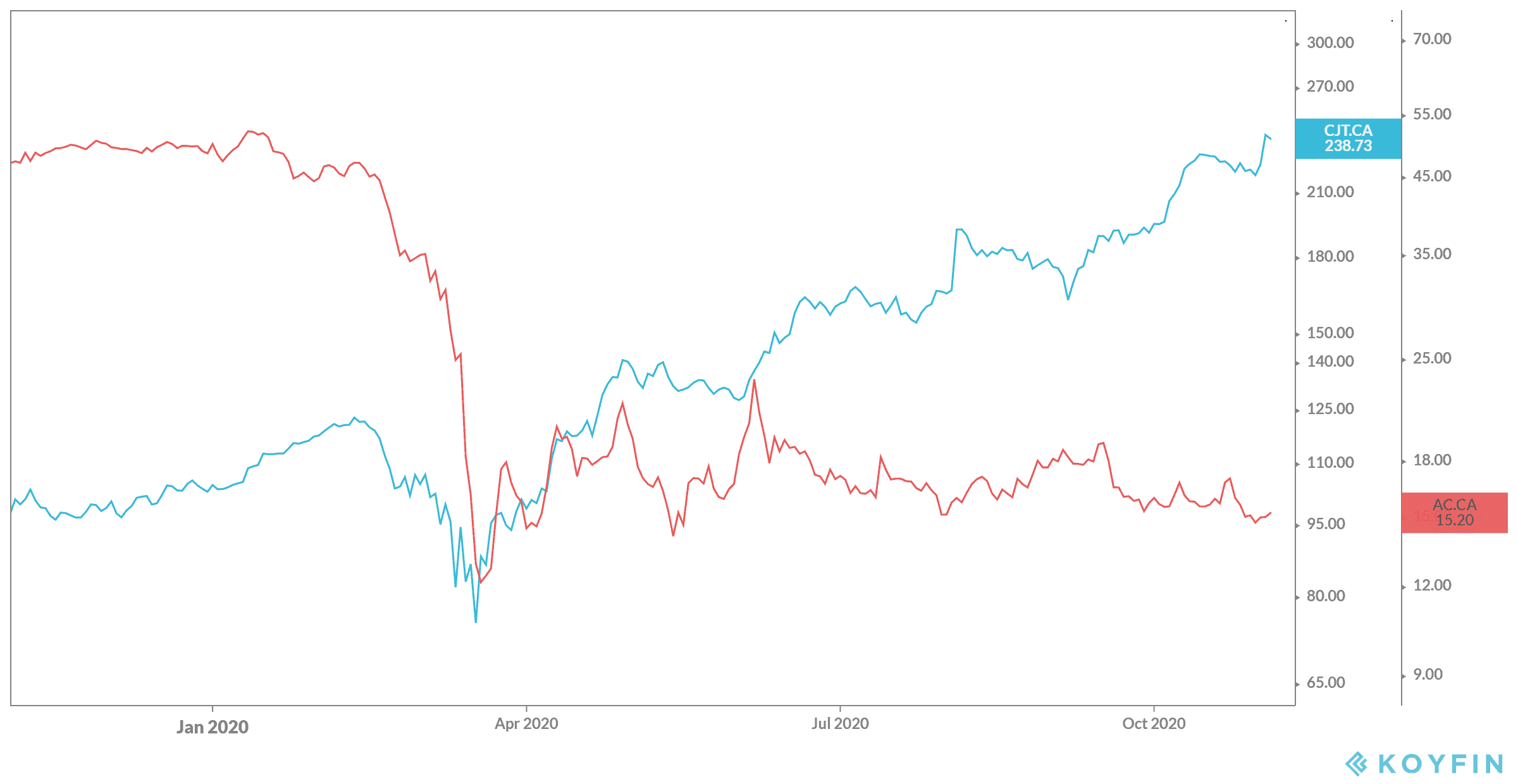

Air Canada (TSX:AC) has had a heck of a year. After shares reached all-time highs at the beginning of the year, the pandemic hits. That’s when the company went into free-fall. With planes on the ground, the company lost all the work it took years of recovery to reach. Now, the company lost $14.5 billion in market value as of writing.

Yet there are those who think now is a great time to invest. I get it! The stock is at lows not seen in years, and it won’t stay like that forever. The company did a huge overhaul about a decade ago, and this that has investors thinking it might be time to buy up the company.

Air Canada stock soared in the past few years after reinvesting in the business. The company made cuts and invested in a fleet of fuel-efficient airplanes to bring gas costs lower. Meanwhile, its expanded beyond a business airline to provide lower cost flights as well.

Then there’s a bailout to consider. Last month, the government announced it would start talking about bailing out the airline industry. Right now, Air Canada makes up well over half of Canada’s airline industry, and needs that cash stat. It already had huge debts from its reinvestment. Granted, those debts would be paid down the line from cuts, but the pandemic sent those even lower.

Yet I’m not sure whether I would invest in this company until I see debt start to drop. I personally am going to wait until a bailout is a certainty before investing in Air Canada. Meanwhile, there’s another stock I would happily buy more of.

Cargojet

Cargojet Inc. (TSX:CJT) reached all-time highs recently as the company announced even more soaring revenue during its latest earnings report. The company ships cargo through its airline, and saw an enormous jump during the pandemic thanks to the rise in e-commerce use.

This was likely to happen years from now, but the pandemic sped up the process. The company saw revenue year-over-year increase by 21% during the last two quarters. Adjusted EBITDA was also up by 31%, with debt been chipped down quarter after quarter.

The company has years ahead of it for strong performances. That’s thanks to its partnership with Amazon made last year. The company has a 9.9% stake in the company, and that’s likely to increase to 14.9% should Amazon provide $600 million worth of business in the next few years. That’s looking even more likely now with e-commerce booming.

Investors have already been treated to an annual return of 145% as of writing, with a five year compound annual growth rate of 60%! With even more movement likely over the next few years as Amazon deepens its partnership, investors should look forward to shares soaring ever higher.

Bottom line

It’s a bit of a toss-up when considering Air Canada stock these days. Rather than risk it, I would wait for some positive movement. Instead, consider investing in Cargojet after a dip and holding onto it for a few years at least. You should see some huge moves in that time.