Air Canada posted its third consecutive quarterly loss on Monday, as the COVID-19 pandemic crippled air travel forcing Canada’s largest airline to cut the majority of its flights.

International air travel remains severely affected around the world due to border restrictions imposed by many countries.

As a result, carriers, including Air Canada, have cut thousands of jobs to cut costs and asked for government help to keep their operations afloat.

Air Canada Q3 results are as gloomy as can be expected

Air Canada reported a third-quarter net loss of $685 million on Monday, compared to a gain of $636 million at the same time last year.

The airline says the loss was $2.31 per diluted share, compared with earnings of $2.35 per diluted share in the third quarter of 2019.

Operating revenue for the quarter plunged about 86% to $757 million, down from $5.53 billion reported in the same quarter last year. Small consolation, its freight transportation revenues jumped 52% to $269 million.

Analysts on average expected Air Canada to lose $2.60 per share in the third quarter on revenue of $1.06 billion, according to IBES data from Refinitiv.

The airline says net cash burn for the quarter totalled $818 million, or about $9 million, significantly better than its forecast, which was between $1.35 and $1.6 billion or between $15 and $17 million a day.

Air Canada says the total number of passengers carried during the quarter decreased by 88% compared to a year ago.

The carrier expects to reduce its capacity in the fourth quarter by approximately 75% from the fourth quarter of 2019.

The airline cancels 12 Airbus A220 and 10 737 MAX orders

Still deprived of 86% of its revenue, Air Canada cancelled 12 orders for A220 aircraft manufactured in Mirabel but is suspending cancellations of regional flights pending the outcome of its discussions with Ottawa.

Cancellations represent nearly a quarter from 45 A220-300s ordered by Air Canada, which also eliminates 10 Boeing 737 MAX 8 aircraft from its book. Deliveries scheduled for 2021 and 2022 are also postponed.

A total of 95 domestic, transborder and international lines, as well as nine Canadian stopovers that the carrier claims to have identified as needing to be closed to preserve its liquidity, will also be maintained “…given the public statements made by the Honourable Marc Garneau, Canada’s Minister of Transport, on November 8, 2020, regarding commencing immediate discussions with major airlines on aviation industry sector-specific support”.

Marc Garneau said in a statement: “We are ready to establish a process with major airlines regarding financial assistance which could include loans and potentially other support to secure important results for Canadians. We anticipate beginning discussions with them this week.”

New federal support for the airline industry will depend on carriers reimbursing passengers whose flights have been cancelled.

Why Air Canada stock is soaring

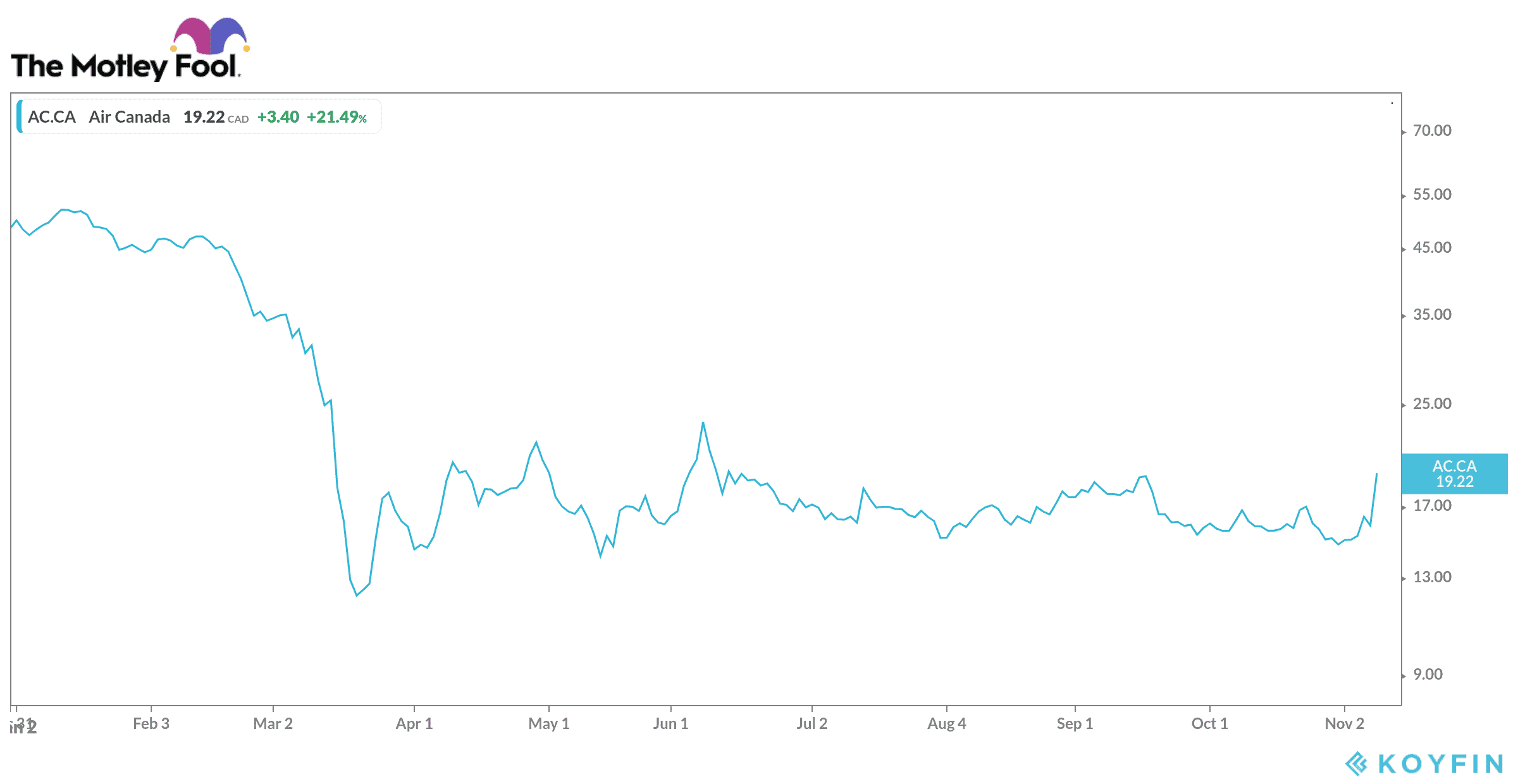

Air Canada stock soared by 25% to $19.70 shortly after the opening bell on Monday. The big surge in price is due to an announcement by Pfizer that its COVID-19 vaccine may be 90% effective. Airlines and other cyclical stocks soared after the news. An effective vaccine will be beneficial for Air Canada as passengers will want to travel again. Having lost almost two-thirds of their value year-to-date, Air Canada shares are cheap.