Lightspeed POS (TSX:LSPD)(NYSE:LSPD) stock started trading on the Toronto Stock Exchange in March 2019 at $18.9. In 18 months, the stock surged to $45. This journey from $18 to $45 had its ups and downs, with the stock dropping to $12 in the March sell-off. And now, it is in the uptrend above $50. Should you buy the stock at $50?

What is driving Lightspeed’s stock price rally?

For a high-growth stock like Lightspeed, which doesn’t have historic data to prove its sustainability and only losses on its income statement, the stock’s rally depends on the revenue-growth rate. There are two ways to boost revenue: organically and through acquisitions.

Lightspeed earns revenue when the retail and hospitality industry subscribes to its omnichannel platform. The subscription amount depends on the size of the client, the number of locations, and the types of services they use. The company is increasing its revenue organically in three ways:

- First, it is broadening its customer base beyond retail and hospitality to include golf clubs. It is also acquiring new customers in these three verticals.

- Second, it is retaining its existing customers and cross-selling products.

- Lastly, it is adding more services to its offerings to increase cross-selling opportunities. For instance, it has added curbside pickup, appointment booking, and online store themes to its e-commerce platform.

Adding new services helps Lightspeed attract new customers and retain them by adding more value. Like the Shopify flywheel model, Lightspeed benefits when its merchants benefit.

Growing through acquisitions

A faster way to boost growth is through acquisitions. Lightspeed is firing all cylinders. Since going public, it has acquired four companies to expand its geographical reach and product offerings. For instance, it expanded its offerings to golf clubs with the acquisition of Chronogolf.

The latest addition to its acquisitions is ShopKeep, which it is acquiring for $440 million ($145.2 million in cash and the rest in shares). This latest acquisition will expand its geography, as ShopKeep serves 20,000 retail and hospitality locations across the United States. The addition of ShopKeep will increase Lightspeed’s gross transaction volume to $33 billion from $26 billion at present.

The organic and acquisition strategies have driven Lightspeed’s revenue up 35% and 55% in the last two fiscal years. The pandemic-accelerated organic growth and ShopKeep acquisition could drive Lightspeed’s revenue up more than 80% for fiscal 2021 ending March 31, 2021.

Should you buy Lightspeed stock at $50?

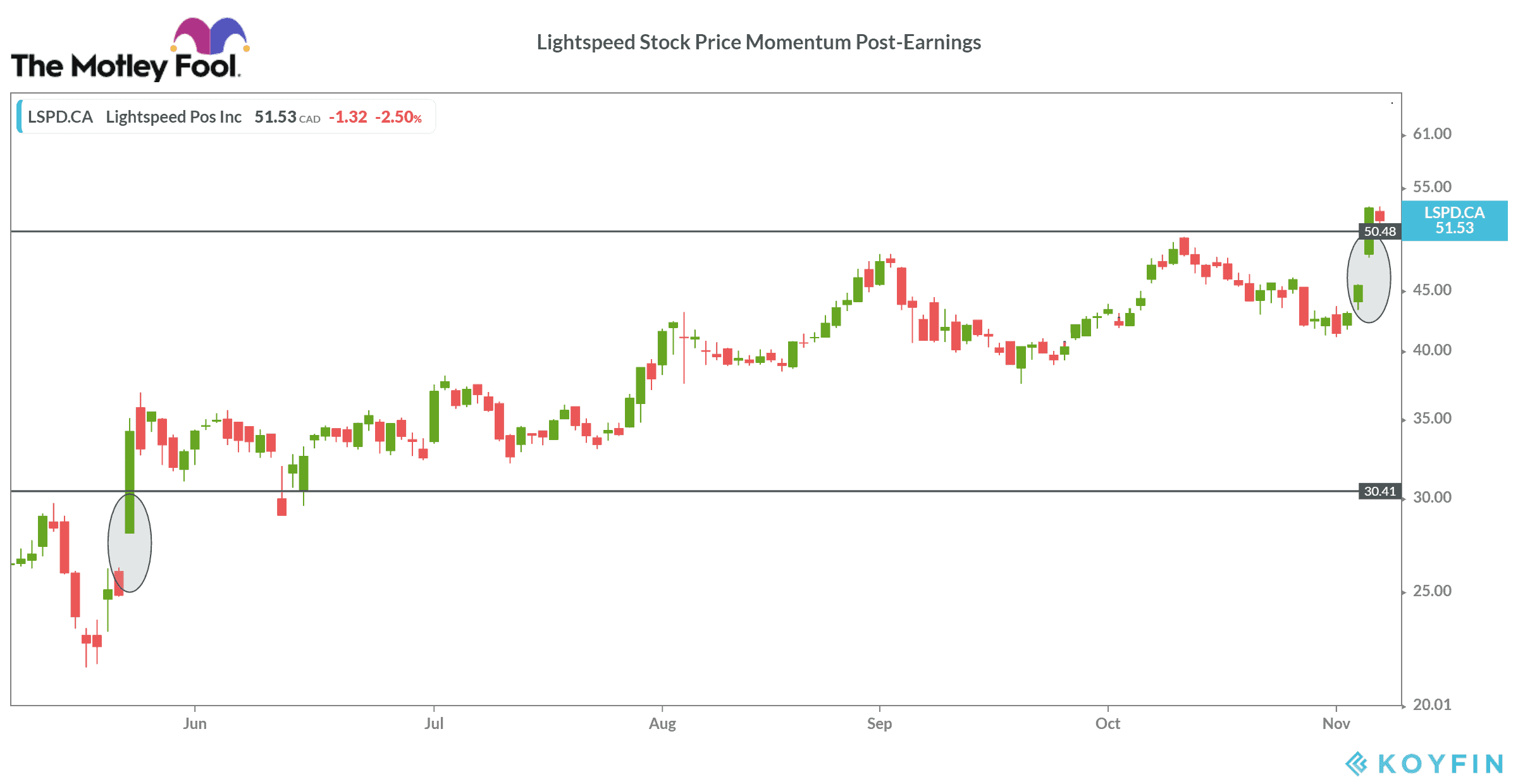

Like I said before, Lightspeed’s stock price growth depends on its revenue-growth rate. The stock jumped over 16% last week on robust earnings and acquisition news. Looking at the technical indicators, the stock is overbought, as there was a huge volume; over two million shares exchanged hands on November 5 as compared to the average volume of 636,000. And the stock opened at a spiked up rate of $48.27, 6% above the previous day close of $45.5.

Lightspeed stock showed a similar trend on May 21 when the company launched its fourth-quarter fiscal 2020 earnings. At that time, it reported its highest quarterly revenue growth of 70% year over year, which sent the stock up 37.8% in just one day from $24 to $34. Since then, the stock traded above $30, which is 10.9 times its sales per share.

At present, Lightspeed stock is trading at 21 times its sales per share. The stock could see some correction and fall below $50 for a brief period, but it has the potential to maintain the $50 price. For an 80% revenue growth, a 21 times price-to-sales ratio is an attractive price. Buy the stock when it falls below $50. If Lightspeed maintains its average revenue-growth rate of around 50%, its stock price could double in two to three years.