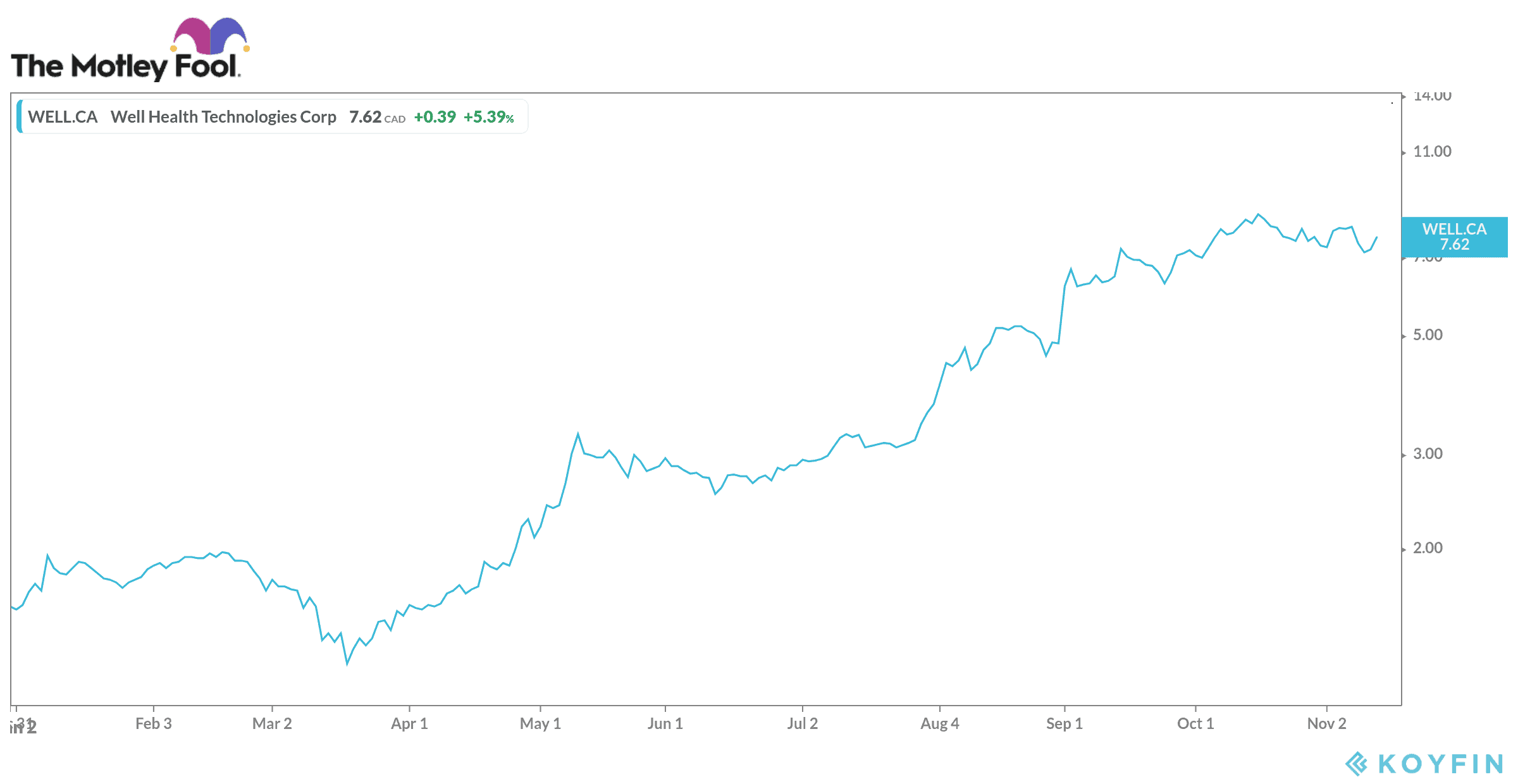

WELL Health Technologies (TSX:WELL) is an omnichannel digital health company that operates primary healthcare facilities and is the third-largest provider of digital electronic medical records (EMRs) in Canada in addition to being a national provider of telehealth services. The healthcare company owns and operates 20 medical clinics, provides digital EMR software and services to over 1,900 medical clinics across Canada, and is a majority owner of SleepWorks Medical. WELL Health stock price is about five times higher than at the start of the year.

WELL Health is led by Chairman and CEO Hamed Shahbazi, who sold his previous company, TIO Networks, to PayPal for more than $300 million.

The company is an M&A compounder, which can generate value in the massive healthcare market that is ripe for digital transformation. WELL has invested in a number of other technology assets.

The leadership has demonstrated an exceptional ability to execute disciplined accretive M&A and acquire valuable technology that can scale. Secular changes accelerated by the pandemic are strong favourable winds supporting WELL’s strategy to leverage technology and increase healthcare efficiency, thereby improving patient outcomes and generating shareholder value.

WELL Health stock soars on solid Q3 results

WELL Health stock soared by 7% shortly after the opening bell Thursday, as investors reacted positively to the company’s results in the third quarter of 2020.

WELL achieved record quarterly revenue of $12,245,735 and gross profit of $5,045,440, representing 50% and 75% year-over-year growth, respectively. WELL achieved digital services revenue of $2,484,862 in the third quarter, up 149% year over year. Combined with recently completed and announced acquisitions, WELL currently has an annualized revenue run-rate of approximately $68 million and is growing fast.

WELL’s positive Q3 results were driven by a significant increase in its clinical patient services revenue from Q2 2020 to Q3 2020 due to a return to physical clinic visits after lockdowns related to COVID-19. Meanwhile, the company’s virtual care revenue continued to grow in the quarter.

During the third quarter, WELL completed the acquisition of the Services division of Cycura Inc. and announced its entry into the U.S. market with a majority stake in Circle Medical Inc. After the end of the quarter, WELL completed the acquisition of DoctorCare Inc.; a controlling interest in Easy Allied Health Inc.; and its 100% acquisition of Insig Corporation, a leader in telehealth services in Canada — thereby significantly diversifying its activities into several growth-oriented business units.

Additionally, in the third quarter, the company launched its apps.health marketplace for healthcare professionals to navigate and interact with integrated EMR applications designed by third-party application developers. This market now offers 26 applications related to clinical efficiency and improved patient care.

WELL has a healthy balance sheet, with more than $100 million in cash and no debt following completion of $23 million private placement led by Sir Li Ka-shing in September and a recently completed $80.5 million bought deal financing closed on October 22, 2020.

WELL Health has plenty of upside

The company’s outlook for the fourth quarter of 2020 is enhanced with recent acquisitions of Cycura, Easy Allied, DoctorCare, INSIG, and the impending closing of the Circle Medical transaction. So far, in the fourth quarter of 2020, WELL has experienced steady growth in its patient service revenue with an increase of both in-clinic patient visits and virtual care consultations.

WELL’s objectives for the foreseeable future are as follows: it will achieve organic revenue growth from its operating activities; it will continue to follow a disciplined strategy for acquiring and allocating capital; and it will increase its market share and publicize its digital health initiatives.

Revenue is expected to increase by 37.2%, while earnings are expected to grow at a rate of 12.5% for fiscal 2020. WELL Health stock still has plenty of upside.