Canadians are using the TFSA to set cash aside for retirement as part of their overall financial-planning strategy.

TFSA basics

The government created the Tax-Free Savings Account (TFSA) to give Canadians an extra tool to save for future needs. In 2020, investors have as much as $69,500 in TFSA contribution room.

The TFSA helps young investors build savings for a number of goals. Some people want to create a fund for a house purchase. Others prefer to use the TFSA to start a personal retirement plan. In this case, the TFSA offers some attractive benefits.

All money earned on investment inside the TFSA remains beyond the reach of the CRA. This means the full value of dividends can be invested in new share to harness the power of compounding. It’s a snowball effect that can turn relatively small initial investments into large savings over time.

In the event you need to access the TFSA funds for an emergency, there is no penalty for taking out the cash. That isn’t the case with RRSP investments.

Once an investor reaches retirement, the TFSA money is removed tax-free. This is useful for OAS recipients, as the CRA does not count TFSA withdrawals as part of net world income used to determine the OAS clawback.

Best stocks for a TFSA

Top dividend stocks tend to be the best stocks to hold in a TFSA to build the portfolio over two or three decades. Look for companies the perform well in all economic conditions. In addition, they should demonstrated rising revenue and higher profits to support dividend increases.

The pandemic has pointed out the value in owning stocks that provide essential products and services. It has also driven down interest rates, which benefits companies that tap the capital markets to fund growth projects.

Fortis (TSX:FTS)(NYSE:FTS), for example, might be a good pick right now to start a TFSA retirement fund.

The company owns more than $50 billion in utility assets located in Canada, the United States, and the Caribbean. Business units include power generation, electricity transmission, and natural gas distribution. Most of the revenue comes from regulated assets, making cash flow predictable and reliable.

The era of low interest rates appears set to continue for some time. This reduces borrowing costs for utility companies, helping make developments more profitable. In the Q3 2020 earnings report, Fortis said is working on a capital program of $19.6 billion. This will boost the rate base from $30.2 billion in 2020 to $40.3 billion in 2025.

As a result, the board plans to raise the dividend by an average annual rate of 6% over that timeframe. Fortis increased the payout annually for the past 47 years, so the guidance should be solid.

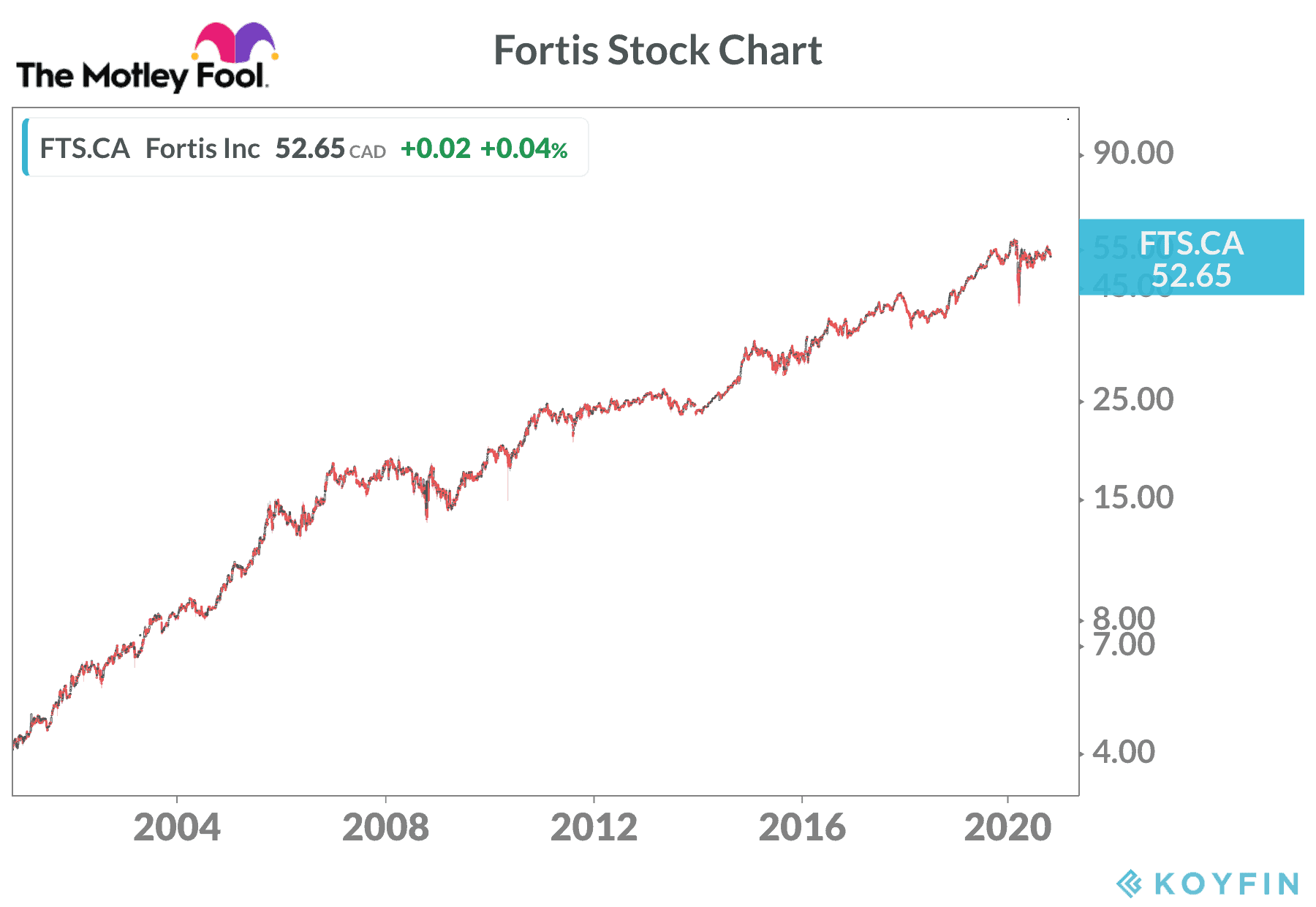

Long-term investors have done well with the stock. A $3,000 investment in Fortis 25 years ago would be worth $60,000 today with the dividends reinvested.

The bottom line on retirement investing

It takes patience and discipline, but investors can use the TFSA to harness the power of compounding to create a substantial savings fund for retirement. Fortis should be a good pick to start a diversified portfolio of top dividend stocks.