Shopify (TSX:SHOP)(NYSE:SHOP) stock dipped another 11% this week after rallying 10.8% last week on the back of strong earnings and rising coronavirus cases. The stock is sensitive to COVID-19 updates, as it was the pandemic that pushed the stock up more than 160% in six months. This week the stock fell after the COVID-19 vaccine euphoria turned the tables.

At the start of this week, Pfizer and BioNTech, in a press release, stated that their COVID-19 vaccine was more than 90% effective in the interim study. Responding to the progress report, airline stocks, which were worst hit by the pandemic, soared 20-25%, and e-commerce and tech stocks, the key beneficiaries of the pandemic, fell 10-20%. This shows that investors rushed to cash out the pandemic rally and invest in the post-pandemic recovery.

Shopify investors: Divided, you fall and rise

Shopify has immense growth potential, with the e-commerce wave driving its revenue up more than 95% year over year (YoY). But investors are divided over the stock. Bulls believe the digital wave will push the stock to new highs. Bears believe that the stock is overpriced for the digital wave.

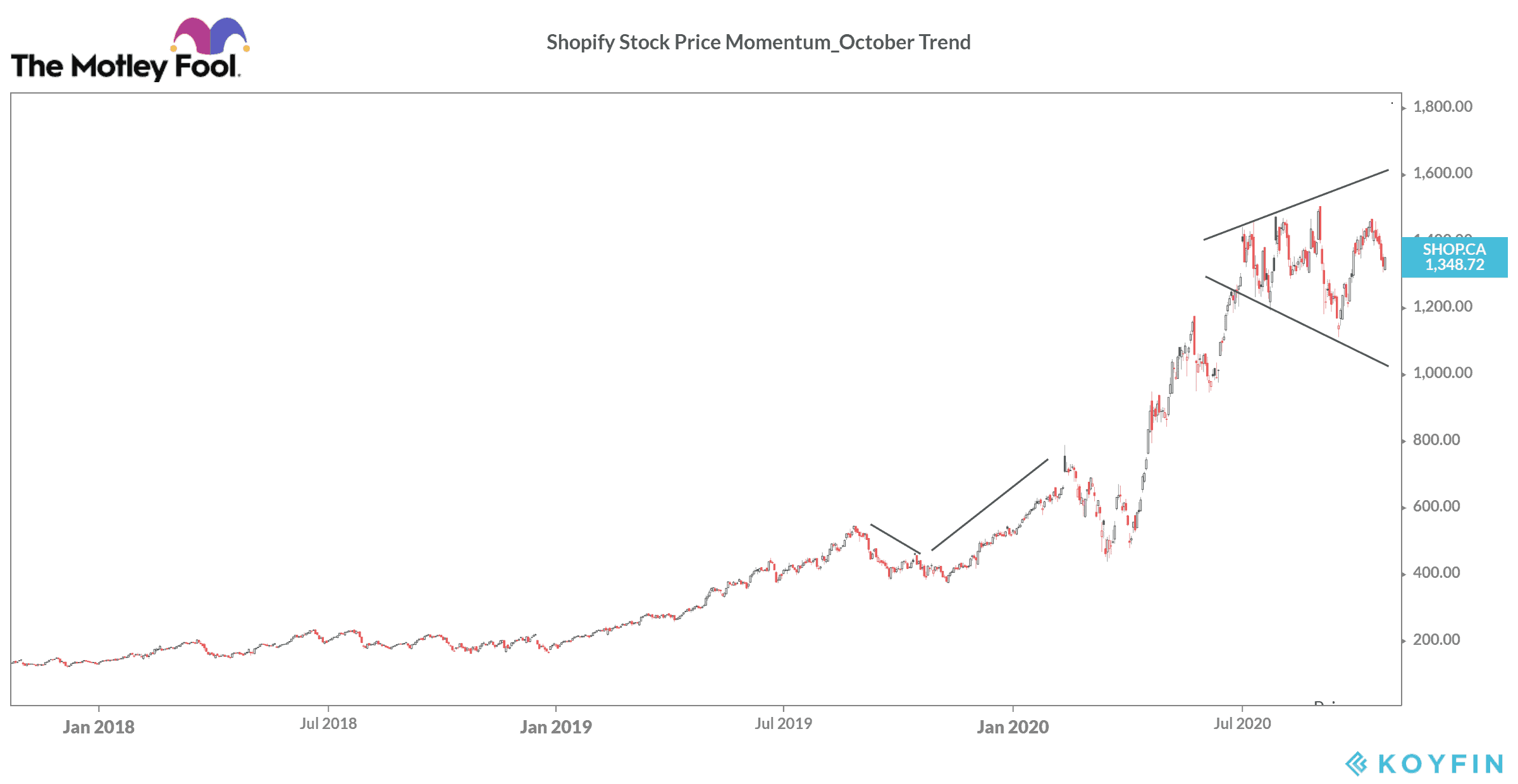

In my previous article, I’d explained how Shopify’s stock price momentum has formed a megaphone pattern. The stock price is moving at two extremes of $1,200 and $1,450. This is the play area for the traders. When bears are heavy, the stock goes downhill to around $1,200, like it is now.

As a fundamental investor, you should know that a vaccine won’t take away the e-commerce wave. When the lockdown opened, many retail stores opened but people still preferred buying online. The pandemic gave Shopify what it wanted. The population and retailers who preferred the old school way of shopping at the store accepted online shopping. Grocers and food companies are famous for having the largest chain of physical stores. Even they opened online stores on Shopify. The older generation who are not quite tech-savvy learned the tech.

The end outcome of this attitude shift was a 96% YoY revenue growth in the third quarter. The fourth quarter is anyway the seasonal attraction because of Cyber Monday and Black Friday sales. But this time, both Shopify and rival Amazon is expecting a better-than-seasonal growth as the new segment of the population will also shop online.

When everyone is shopping on Shopify, should you shop Shopify stock at $1,205?

Should you buy Shopify stock at $1,200?

The bears have created an opportunity to buy Shopify stock. Pandemic or no pandemic, Shopify stock has surged between November’s end and January. In the last two years, the stock has surged 21% and 54%, respectively, during this time of the year.

Positive momentum will likely float towards November end as holiday season sales kick in. The bull will overtake the bears and push the stock above $1,400, representing an upside of 17%. The stock can even make a new high of over $1,500, representing an upside of 25%. If you invest $2,000 in Shopify right now, it can grow to $2,500 in just two months. But you will have to keep a tab of the excitement around e-commerce. Sell the stock at $1,420 or $1,500.

An alternative way to invest in Shopify stock

If this looks like too much risk, you can gain exposure to Shopify stock price movement in a more controlled and less expensive environment. Buy iShares S&P/TSX Capped Information Technology Index ETF, which has 25% of its holdings invested in Shopify and another 7% in Kinaxis and Lightspeed POS. These two stocks are also moving on the e-commerce momentum.

The ETF can give you exposure to e-commerce stocks and other tech stocks for less than $40 a unit. And as far as price momentum goes, the ETF surged 9% last week and fell 6.7% this week when Shopify stock surged 10.8% and fell 11%.