Metro (TSX:MRU) is a food and pharmacy leader in Québec and Ontario. The company’s sales and profits increased in the fourth quarter, as the COVID-19 pandemic continued to provide an unusual level of growth in the grocery industry. This stock is a good buy, as it is resilient to the pandemic.

Metro is seeing strong growth in sales and profits

The company, which includes the Metro grocery store chain and Jean Coutu drug stores, reported $4.14 billion in sales for the 12 weeks ended September 26, up 7.4% from the same period last year. Same-store sales — an important metric that tracks sales growth unaffected by new store openings — grew 10% in its grocery banners in the fourth quarter.

This trend is continuing. Metro reported on Wednesday that food same-store sales had increased 11% in the four weeks since the end of the fourth quarter. Pharmacy same-store sales rose 5.5% in the fourth quarter.

All of Canada’s largest grocers have seen increased sales this year, with public health restrictions deeply affecting the restaurant industry. Many Canadians have restricted outings and cook more for themselves at home.

Metro announced that its fourth-quarter profit was up 11.4% from a year ago. The company’s net income for the fourth quarter was $ 186.5 million, or $0.74 per share, compared to $167.4 million, or $0.66 per share, in the same period last year. On an adjusted basis, Metro says it earned $193.1 million, or $0.77 per share, for the quarter compared to adjusted earnings of $174 million, or $0.68 per share, a year ago.

Customers are also putting pressure on the e-commerce operations of retailers. Metro said its online food sales were up 160% from the fourth quarter of last year.

The Montreal-based retailer tries to meet the demand. Metro on Wednesday announced plans to more than double the number of stores offering online order pickup by the end of next year from 40 stores currently offering the service to more than 100. Metro will also open a dedicated store next summer exclusively for online customers in the Montreal area.

A labour dispute at the Jean Coutu distribution centre, which began on September 23 and is now resolved, will likely affect Jean Coutu’s sales in the first quarter, the company said.

For the full year 2020 ended September 26, Metro posted sales growth of 7.3% to nearly $18 billion. The company’s net income for the full year was $796.4 million, or $3.14 per share, compared to $714.4 million or $2.78 per share the previous year. On an adjusted basis, Metro earned $829.1 million or $3.27 per share, for the full year, compared to adjusted earnings of $731.6 million, or $2.84 per share, a year ago.

On Wednesday, Metro announced the renewal of its share-buyback program. As of November 25, the company has the option to repurchase up to seven million, or approximately 2.8%, of its outstanding shares in the coming year. In the past 12 months, the company has spent $240.8 million to buy back 4.26 million common shares.

Metro stock will continue to be a pandemic winner

The ongoing pandemic continues to impact Metro’s business. The company expects that in the short-term food revenues will continue to grow at higher than normal rates compared to last year as part of the sales of restaurants and food services will continue to move to the grocery store network.

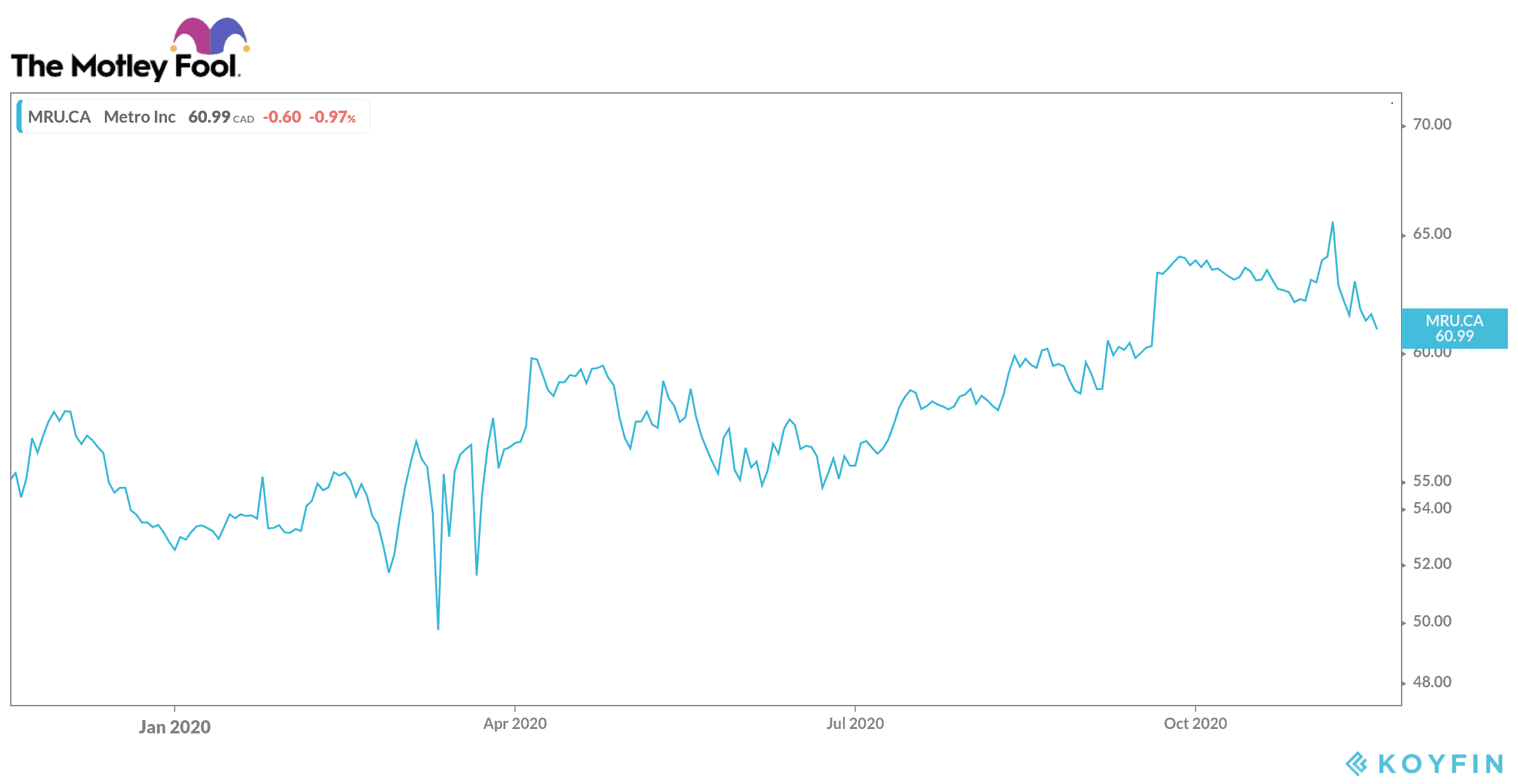

Metro is a great defensive stock that can give some protection to your portfolio in case of a market crash. The stock is up about 15% year to date.