Many technology stocks — that surged in the first half of 2020– are continuing to trade on a mixed note for the last few months. After massive gains in the second quarter, investors’ fears about these stocks trading with high valuations are one of the reasons hurting sentiments.

However, multiple other factors seem to be at play right now. Let’s take a closer look at such factors related to one such Canadian technology company and find out if it’s still a good buy.

Real Matters’ stock has turned mixed

Real Matters (TSX:REAL) is a Thornhill, Ontario based technology and network management firm with its primary focus on mortgage lending and insurance industries. The COVID-19 wrecked-havoc on markets worldwide earlier this year. However, the pandemic also sharply boosted the demand for some tech services.

A sudden surge in work from home culture acted as a key massive growth driver for tech firms’ sales. Real Matters also benefited from a surge in demand for its network management services. Its stock — that rose by 13.6% in the first quarter — extended these gains further by 89.1% in the second quarter. Interestingly, it was the sixth consecutive quarter when Real Matters stock ended a quarter in the positive territory after falling for the previous six quarters in a row.

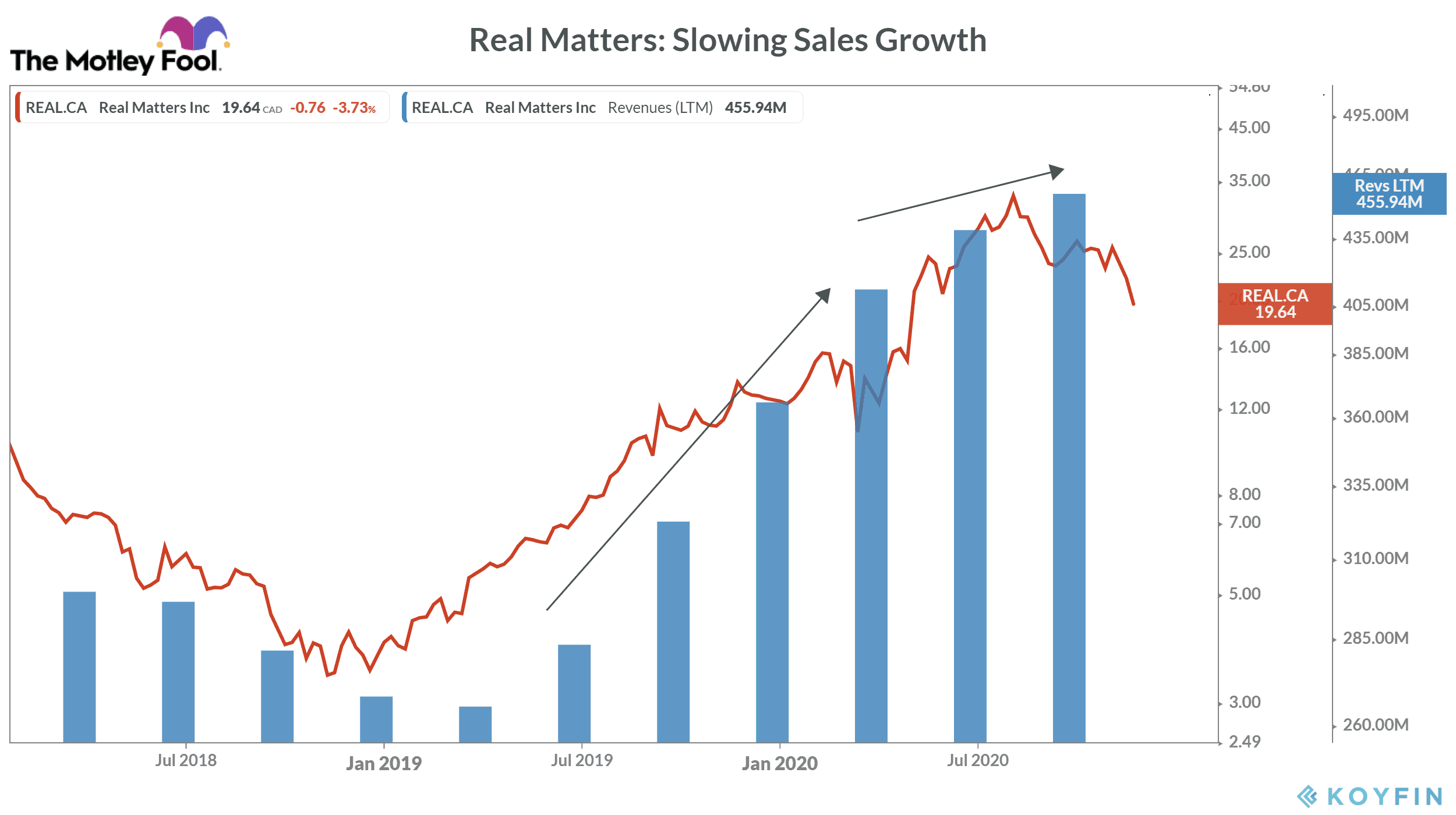

However, the second half of 2020 is not turning out to be good for its investors. In the last three months, the stock has lost nearly 31%. During the same period, the TSX Composite Index has gone up by 3.5% gains.

Why is the stock falling?

After crushing Bay Streets’ consensus estimates in a previous couple of quarters, Real Matters missed earnings expectations in the fourth quarter of fiscal 2020. The company reported adjusted earnings of $0.18 per share in the fourth quarter — up 63.6% year over year (YoY). But it missed analysts’ expectation of $0.19 per share.

While on the sales front, Real Matters beat Q4 expectations, its sales growth rate continued to decline for the fourth quarter in a row. In Q1 of fiscal 2020, the company’s total revenues inched up by 87.1% YoY. By the fourth quarter, this growth rate came down to just 36.7% YoY. It was also much worse than its revenue growth rate of 75.8% YoY in the fourth quarter of fiscal 2019.

More challenges ahead

Real Matters clearly saw a sharp rise in its sales in the first half of this year. However, this COVID-19 driven sudden sales surge was without question temporary. That’s why analysts expect its revenue to rise by only 31.4% in fiscal 2021 — much lower than 58.8% in fiscal 2020.

During its Q4 earnings conference call, Real Matters’ management acknowledged that the proportion of the company’s volumes — derived from home equity and default — could continue to fall further in the coming quarters.

This situation could create new challenges for Real Matters’ management as the company is already struggling with a consistently falling sales growth rate. These are some of the reasons I don’t consider Real Matters stock a good buy at the moment.