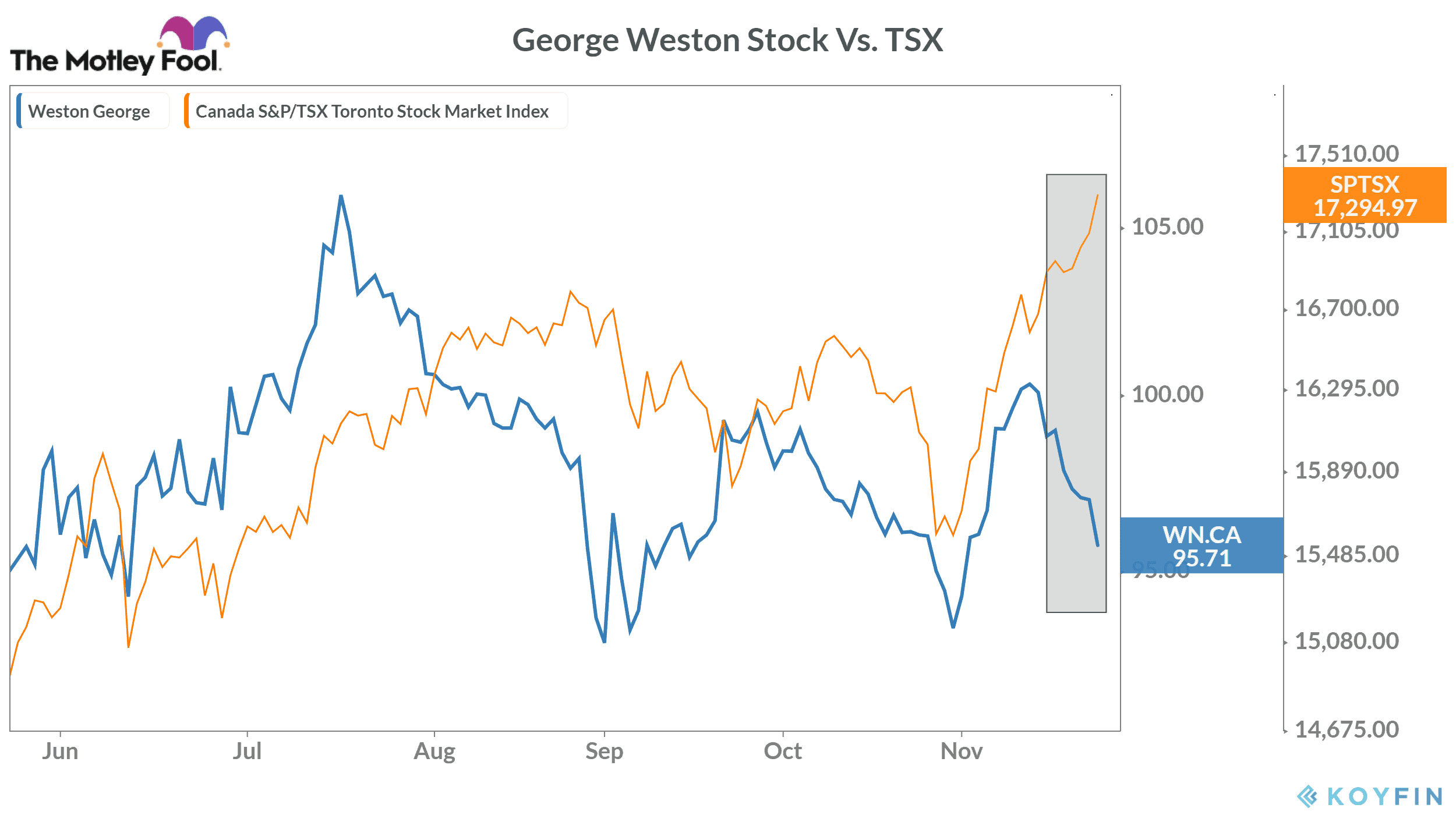

George Weston (TSX:WN) stock is continuing to trade on a negative note after reporting its slightly positive Q3 results last week. Since November 17 — the day of its earnings release — its stock has lost over 3%. In contrast, the broader market has traded with positive sentiments during this period. In the last 10 days, the S&P/TSX Composite Index has gone up by 3.8%.

As we know, if a stock with good fundamentals temporarily goes down, it could be a buying opportunity. Let’s find out whether this rule applies to George Weston stock after its recent decline.

George Weston’s key businesses

George Weston is a Toronto-based food processing and distribution group. Its primary subsidiaries include Weston Foods, Loblaw (TSX:L), and Choice Properties. In 2019, the food processing giant’s over 95% of total revenue came from Loblaw — the Canadian supermarket chain.

Despite having a presence in the United States, George Weston makes most of its profit from its home market. Last year, Canada accounted for about 98% of its total revenue, while the U.S. market accounted for the remaining 2%.

Recent earnings trend

The overall trend in George Weston’s recent earnings has been slightly negative in the last couple of quarters. While the group’s adjusted earnings saw a massive 45.3% YoY (year-over-year) drop in the second quarter, the trend slightly improved in the third quarter. In Q3 2020, its earnings fell by 7.5% YoY to $2.35 per share, but it still managed to beat analysts’ consensus estimates of $2.19 per share.

George Weston’s total revenue growth has been around 6.5% YoY in the last couple of quarters. It was much lower than 10.4% growth rate in the first quarter of 2020 but much better than its 2019 sales growth of 3.2%.

The COVID-19 impact

Notably, George Weston’s double-digit Q1 sales growth was mainly driven by a sudden but temporary surge in essential items’ demand around mid-March due to COVID-19. That’s why comparing its latest quarterly sales with the first quarter won’t be appropriate.

While the demand for essential items has gradually normalized, businesses — including George Weston — still have to bear higher costs related to COVID-19 measures. It’s one of the reasons why Bay Street expects the company’s 2020 net profit margin to be around 1.9% — lower from 2.2% in 2019.

Bottom line

Despite being the top Canadian food-processing company, George Weston hasn’t been a great investment in the last five years. Its stock has lost 10.7% against nearly 28% rise in the TSX Composite benchmark during this period. The company also doesn’t offer very attractive dividends, as its dividend yield currently stands at just 2.3%.

Higher costs related to its subsidiary Loblaw’s ongoing restructuring efforts could further affect the group’s overall financial performance in 2020 and 2021. While George Weston’s food-service business has seen improvements in the third quarter, higher overall restructuring costs and costs related to COVID-19 measures would make maintaining this positive trend a challenging task.

That’s why you may want to avoid buying George Weston stock right now, as it may go further down in the coming quarters.