Canadian Imperial Bank of Commerce (TSX:CM)(NYSE:CM) is one of the largest Canadian commercial banks based on total assets. Currently, the bank has total assets of about $652 billion. The banking giant will release its fourth quarter of fiscal 2020 results on December 3 before the market opening bell.

Let’s find out what to expect from its upcoming earnings event and review the existing trend is in its recent financials.

Expectations from CIBC’s upcoming earnings

The existing trend in Canadian Imperial Bank of Commerce’s earnings is negative as it has reported a drop in its adjusted net profits in three out of the last four quarters. In the third quarter of fiscal 2020, the banking giant registered a 12.6% YoY (year-over-year) drop in its adjusted earnings to $2.71 per share.

However, it was far better as compared to Bay Street’s estimate of $2.15 per share as well as from its adjusted earnings of $0.94 in the previous quarter. In Q4, the Toronto-based bank is expected to report an 11.3% YoY fall in its earnings to $2.52 per share.

During the July 2020 quarter, CIBC’s net profit fell to $1.2 billion from $1.4 billion in the same quarter of fiscal 2019. Nonetheless, it showed a massive improvement over the previous quarter net profit of $419 million as Q2 was its worst affected quarter during the ongoing COVID-19 crisis.

Analysts predict a contraction in CIBC’s Q4 net profit margin to 24.2% — lower than 25.7% the previous quarter and 26.6% a year ago.

Could the positive digital trends continue?

During its third-quarter earnings event, Canadian Imperial Bank’s management highlighted significant improvements in its digital platform. Due to the bank’s efforts, its digital traffic and digital registrations rose by 18.6% and 44.5%, respectively. Similarly, e-deposits with the bank rose by 26.4%.

Its digital engagement with digital banking sessions also significantly improved in the last quarter. Seemingly, the bank’s years of investment in developing a secure and user-friendly digital banking platform paid off well in the recent quarters due to the pandemic related restrictions.

It would be interesting to see whether the Canadian Imperial Bank of Commerce’s digital platform continues to attract similar interest in the coming quarters. It would be one of the key factors to watch during its fourth-quarter earnings event next week.

Eyes on non-interest income

The pandemic has badly hurt CIBC’s core banking operations lately. A sharp rise in its wealth management and capital markets segment volume has helped the bank remain financially strong — during this bad phase — by increasing its non-interest income.

That’s why investors should keep a close eye on the consistency in its non-interest income trend in the fourth quarter. A significant drop in its capital markets and wealth management profit and volume could hurt investors’ sentiments and drive its stock lower.

Foolish takeaway

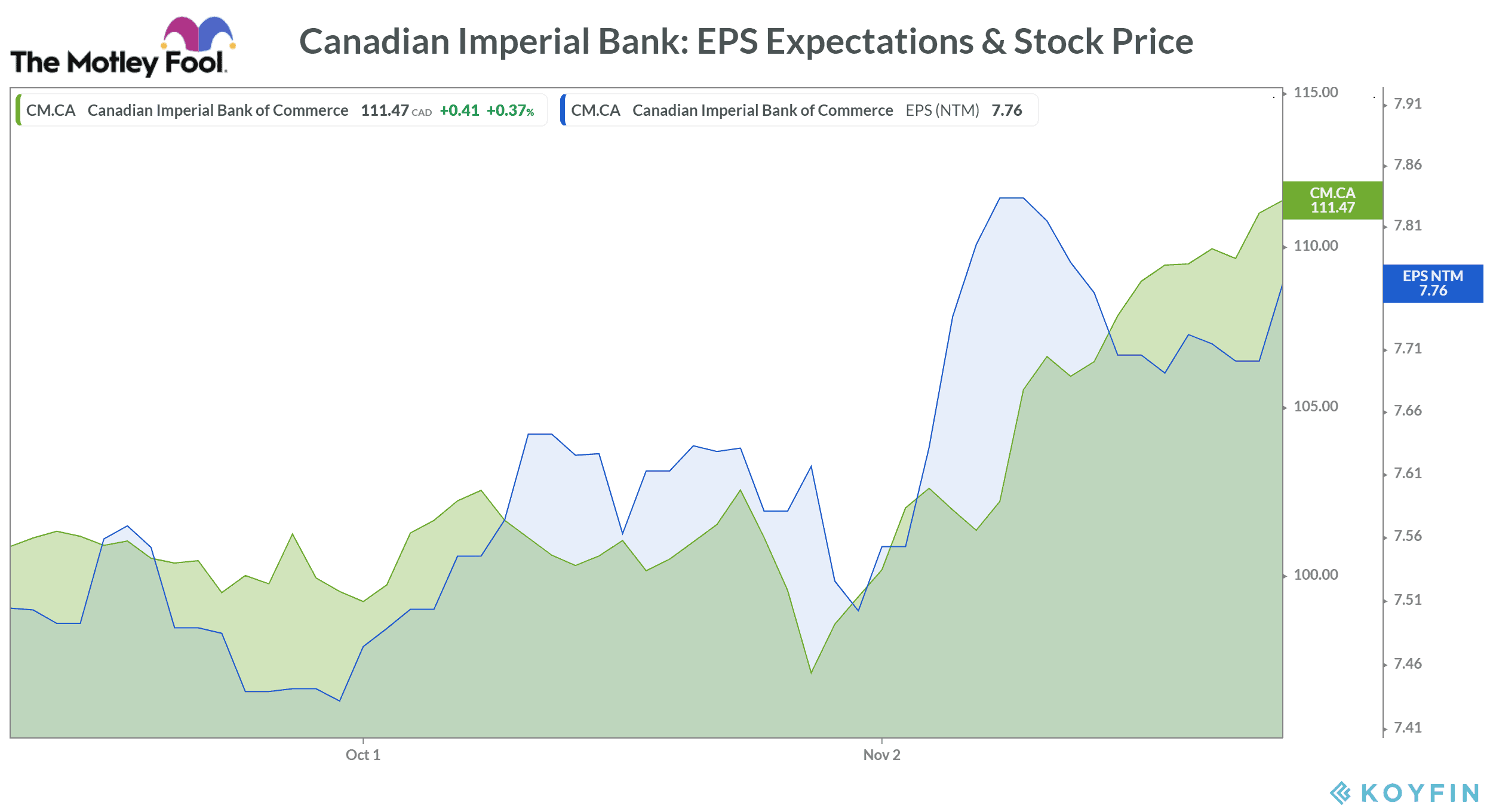

In November thus far, CIBC stock has risen sharply by 12.1% against a 3.9% rise in the S&P/TSX Composite Index. However, it would be important for the bank to register some improvements in its core banking operations in the fourth quarter to maintain these solid gains.