The shares of Air Canada (TSX:AC) — the largest Canadian airline — saw a massive recovery in November 2020. Its stock rose by more than 60% during the month after losing 16.3% in the previous couple of months combined.

COVID-19 woes

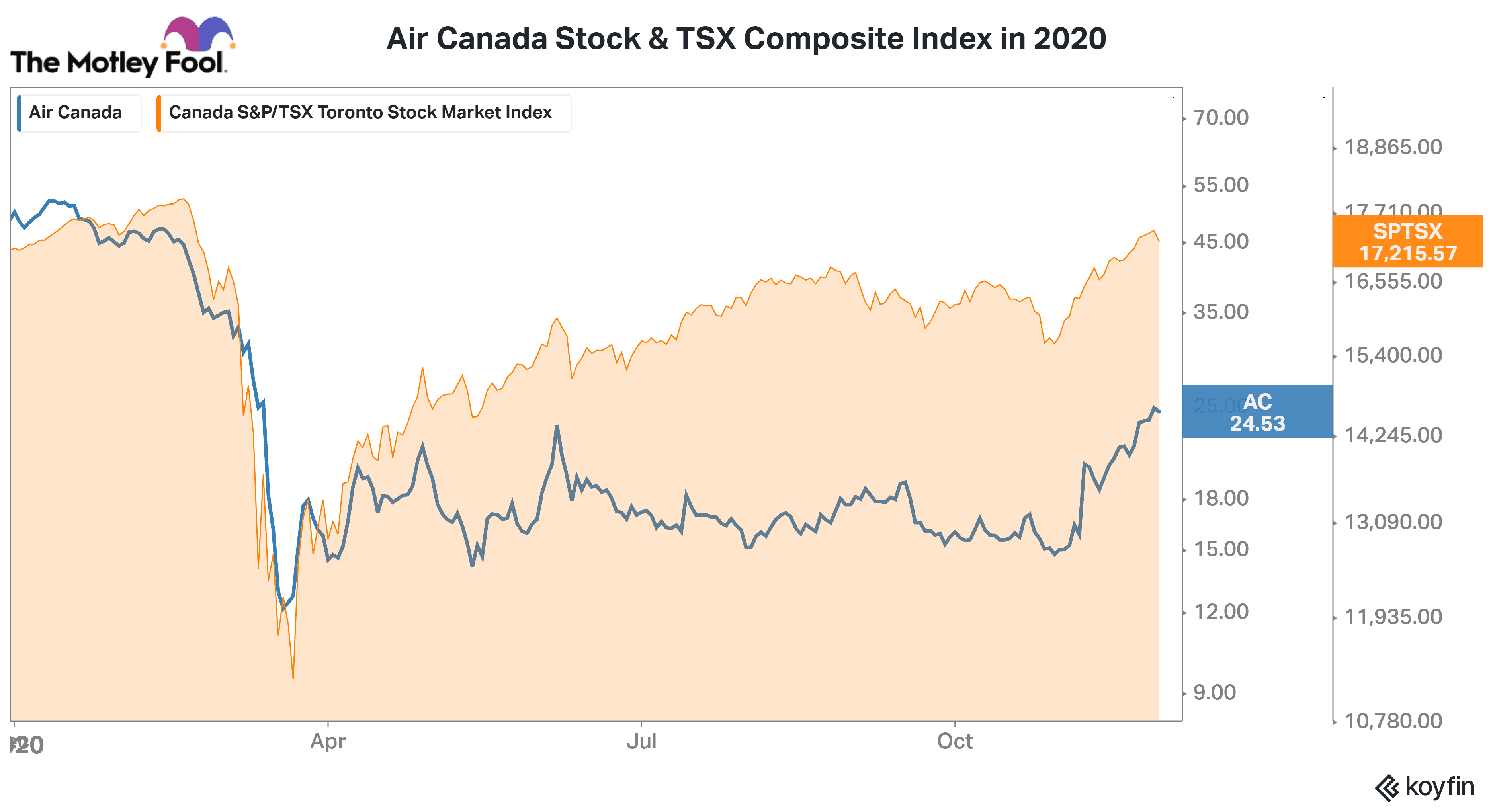

The year 2020 started on a terrible note for Air Canada’s investors, as its stock tanked by 67.5% from $48.51 to $15.75 in the first quarter. While the stock saw a minor recovery of 7.6% in the second quarter, it again turned negative in the third quarter — erasing all its Q2 gains. Worries about COVID-19’s negative impact on the airline’s business badly hurt investors’ sentiments.

Air Canada reported a 16.4% YoY (year-over-year) drop in its total revenue in the first quarter. The pandemic’s real impact was seen in the second quarter, as its sales tumbled 89% YoY to just $527 million — even much lower compared to its Q1 revenue of $3.7 billion. The pandemic-driven shutdowns have wreaked havoc on the airline business across the world.

The negative trend in Air Canada’s revenue continued in the third quarter as well. Its revenue fell by 86% YoY in Q3 and missed Bay Street’s estimates by 28%.

Why Air Canada stock rallied in November

In early November, multiple pharmaceutical companies released the positive outcome of their ongoing COVID-19 vaccine trials. These positive developments boosted investors’ hopes that a vaccine might hit the market soon — leading to a broader market rally.

As of November 27th’s closing price, the S&P/TSX Composite Index had risen by 11.7% for the month. During the same period, Air Canada stock rose by 68.8% — outperforming the broader market by a wide margin. The airline industry cheered more than any other industry in November, hoping that the availability of an effective COVID-19 vaccine could put an end to the industry’s woes.

Is it overconfidence?

In my recent article, I’d argued that Air Canada investors seemingly have become overconfident. While vaccine-related positive developments are certainly great news for the airline industry, airline companies’ financial troubles might continue for years.

For example, Air Canada has reported adjusted net losses in the last three quarters in a row. It wouldn’t be easy for the company to turn profitable in the next few quarters at least.

Another concern

Also, many experts have raised concerns about the demand for business travel in the post-COVID world. Even if the vaccine availability allows countries to lift the ban from international travel in the coming months, business travel might not come back to its normal level anytime soon.

Many companies promoted remote work during the pandemic and allowed their employees to work from home. This work culture forced such companies to improve their infrastructure to allow their employees to work remotely in an efficient manner. I believe these moves might drastically reduce their needs for business travel, even after the pandemic subsides completely.

Foolish takeaway

Overall, Air Canada stock has pleased its investors in November with a massive recovery. However, it’s too soon to say whether the stock could sustain these gains. That’s why you might want to lock in some profits — especially if you bought the stock around September or October with a short-term goal.