This year Canadian growth stocks have been some of the worst performers on the TSX. There have, of course, been some growth stocks that exploded in value this year. However, those businesses have mostly been ones seeing a positive impact from the pandemic.

Meanwhile, other high-quality growth stocks in businesses that haven’t gotten a boost from the pandemic have mostly underperformed.

Growth stocks tend to always have more risk, which is why they offer more reward. So it makes sense that over the past nine months, as uncertainty has been at all-time highs, investors have generally avoided the riskier growth stocks.

Now, though, as optimism is rapidly coming back to markets, these stocks are starting to see huge increases in their share price.

This growth is set to continue in 2021 as the economy recovers from the coronavirus pandemic. So with so much potential for gains in the near-term, here are the three top growth stocks set to outperform in 2021.

One of the top Canadian growth stocks

The first stock to consider is one of the highest potential stocks on the TSX, Lightspeed POS Inc (TSX:LSPD)(NYSE:LSPD). Lightspeed is a software company that empowers businesses to grow and manage their operations digitally.

The company helps several businesses across various industries in over 100 countries to do things such as engage with consumers, collect payments, and manage inventory.

While Lightspeed has the ability to work with several companies, traditionally, it services mostly restaurants and retail, two of the hardest-hit businesses in the pandemic.

So the fact that it’s continued to perform at such a high level is extremely attractive going forward, especially as these restaurants and retail businesses start to recover.

Furthermore, the company has been making a string of acquisitions lately. This can not only help to strengthen its software, but also to grow the business even more rapidly, which is why it’s one of the top Canadian growth stocks you can buy today.

Rapidly growing TSX REIT

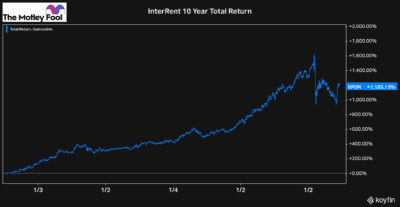

Another super high-quality Canadian growth stock you could consider is InterRent REIT (TSX:IIP.UN). If you just looked at the performance InterRent has put up for unitholders over the last decade, there’s no way you would think it was a real estate stock.

The company has been incredibly good at buying older buildings in need of repair. It then renovates them, increasing the value for unitholders and the amount it can charge on new leases. This strategy has been incredible and led to a tonne of growth for InterRent investors.

Over the last 10 years, InterRent untiholders have seen a total return of more than 1180%. Plus, prior to the pandemic and the Canadian growth stock’s subsequent fall, that return was roughly in the 1,600% range.

That’s incredible growth for any company, let alone a real estate investment trust. And the great news is, there’s no reason why InterRent can’t continue with this impressive growth as the economy recovers.

Resilient Canadian growth stock

Shaw Communications Inc (TSX:SJR.B)(NYSE:SJR) is another high-quality Canadian growth stock to consider buying today. While Shaw is the most stable stock of these three, it still offers investors considerable growth potential.

It’s a different type of growth stock suited for investors who don’t want to take as much risk. The stock will still be an excellent core portfolio stock; however, it also offers a lot more long-term growth potential than its industry peers.

Growth stocks don’t always have to be high risk and high reward, and Shaw is a perfect example. The company will see a major increase in its business from 5G technology. In addition, it’s been consistently trying to build out the wireless side of its business and still has a lot more room to grow.

However, Shaw also pays a 5.1% dividend and can be extremely resilient in a market crash. So it’s an ideal company for investors, especially in this still highly uncertain investing environment.

Bottom line

Heading into 2021, investors need to exercise a tonne of caution. There are still a lot of unknowns, so being selective and picking the right Canadian growth stocks will not only allow your portfolio to outperform, but will also protect you from making big mistakes.