It’s no secret that tech stocks were the high fliers during 2020. While other stocks treaded water, trying to make it back from a market crash, these stocks thrived. The work-from-home economy boomed and continues to remain strong today. The future is here, and these tech stocks were some of the first to take advantage.

So, let’s look at three stocks that did well this year, and should continue to be a great bet years from now.

Shopify

Shopify (TSX:SHOP)(NYSE:SHOP) continued to surpass everyone’s expectations this year. Many analysts believed the stock would fall to prices not seen in years when a market crash hit. In fact, the company soared, with record numbers of merchants signing on to the service during the pandemic.

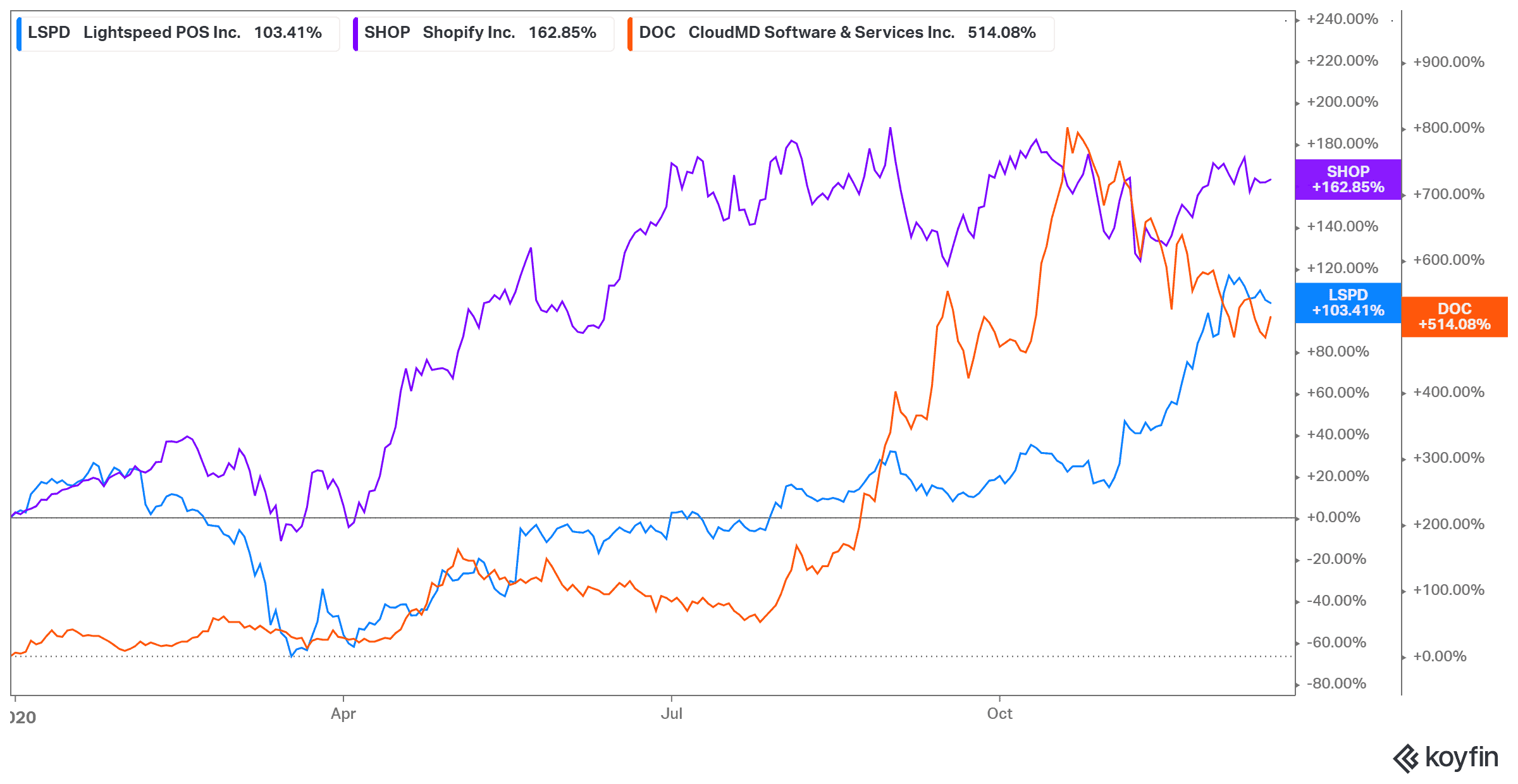

Revenue increased an incredible 96% year over year during Shopify’s latest earnings report. Meanwhile, shares continue to trade well into four digits. In the last year alone, shares have grown by 163% as of writing. But over the last five years, the company has grown by 3,785%! That’s a compound annual growth rate (CAGR) of 757%! While another market crash could see shares falter slightly, see this as an opportunity to pick up this tech stock and hold onto it for decades.

Lightspeed

Another up-and-comer tech stock many have been keeping their eye on is Lightspeed POS (TSX:LSPD)(NYSE:LSPD). The company also brought on new merchants, bringing with it recurring revenue that should last Lightspeed years. Now that it’s on the New York Stock Exchange, many believe there’s no turning back from its share price trading at all-time highs.

And revenue continues to grow for this company. Most recently, revenue was up 62% year over year, and the acquisition of ShopKeep was announced to help the company grow within the United States. Shares soared by 103% this year, and 287% since it came on the market. But many economists believe this stock is still only in the beginning phase.

CloudMD

While you may feel you missed your chance picking up those other tech stocks, CloudMD Software & Services (TSXV:DOC) still has a cheap share price anyone can afford. The virtual healthcare provider has been making acquisitions all over the place. While this means its years from turning a profit, it also means by holding onto it you could see massive returns in the meantime.

The company recently reported record revenue growth of 55% year over year, with several new acquisitions hoping to bring in even more next year. Shares are up 160% this year, and expected to continue growing as the company brings on healthcare providers in every field. So, if you’re looking to just buy a small stake in something, CloudMD is a great option.

Bottom line

The pandemic changed the world in more ways than one. The tech sector was one of the biggest areas where we saw this happen. Even when the pandemic is over, we’ll be in a new world where these tech stocks will continue to thrive. Now is a great time to add these defensive players to your portfolio and see them grow for decades to come.