Are you finished your holiday shopping yet? Don’t worry, neither has most of the country. In the past, most people tend to be last minute when it comes to holiday shopping, yet this year, it’s true: things are different.

In fact, Canada Post urged Canadians back in October to get their holiday shopping done sooner as opposed to later. The business has already been swamped with an increase in e-commerce demand, and that’s with the holidays taken into consideration.

It’s true that most Canadians believed they would do a lot more online shopping, and it’s why many companies started offering earlier deals, extending Black Friday to a week in some cases. So, what will the Santa Claus Rally look like this year? And what are some stocks to invest in to take advantage?

Santa Claus what?

The Santa Claus Rally usually happens in the last few weeks of December and into January. It comes as consumers look to get their last-minute shopping done for the holidays but also as Boxing Day promises even more deals. But the stock market sees a jump for a number of pretty fluid reasons. It could be that people have their holiday bonus to invest. It could be investors settling their books before taking time off. Or it could be just general optimism about the new year.

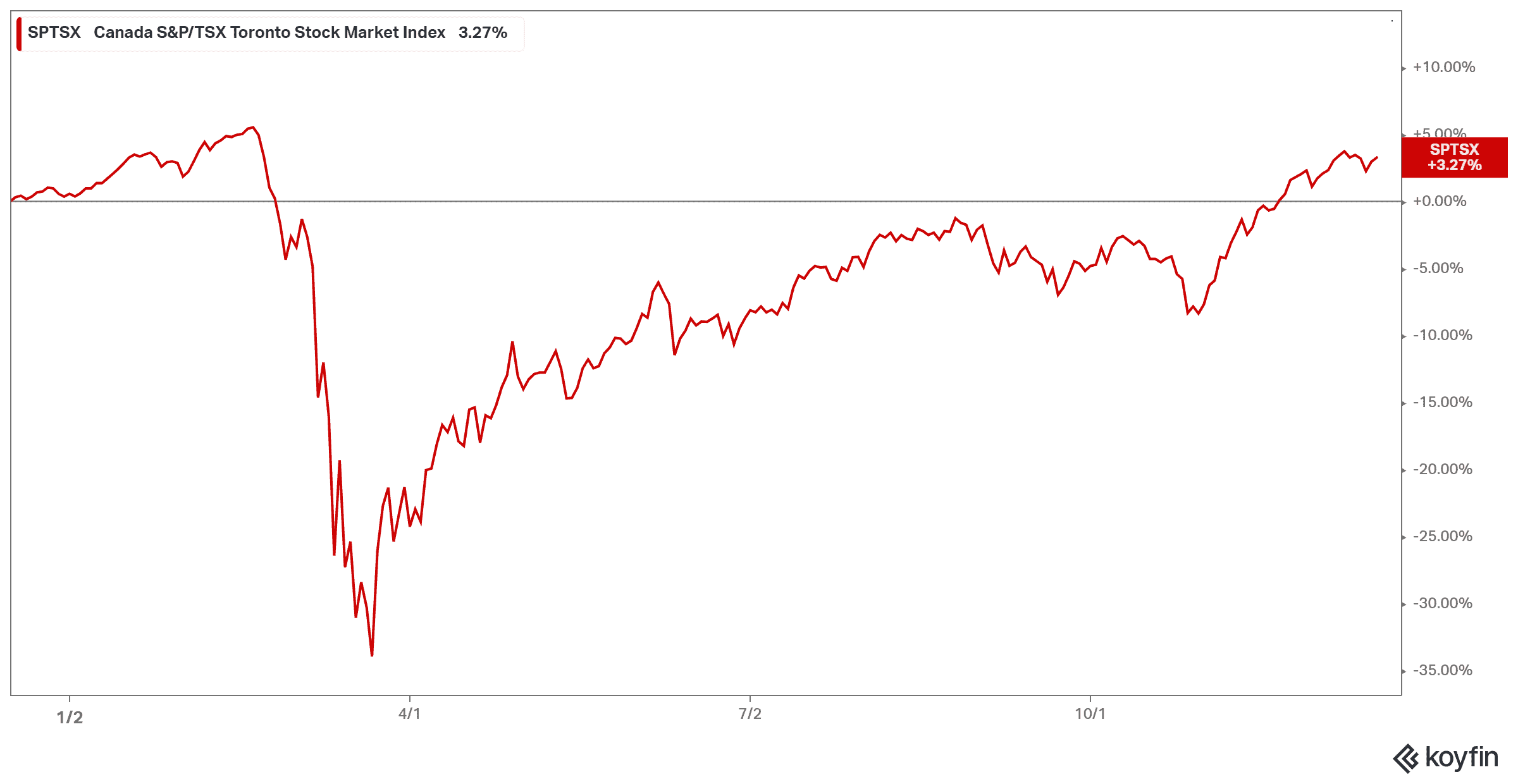

Whatever the case, it exists. You can see the general trend to go up at the last few weeks of the year. Even now, in a world of such volatility, we see stocks continue to rise, as the year comes to an end. If there was any time for optimism about a new year, it’s now.

Stocks to consider

If you want to take advantage of the Santa Claus rally in the last few weeks of the year, you can enter the new year on a high note. I would consider strong stocks to see you throughout this year and potential future market crashes. Again, we’re in a volatile world that has a lot of debt to pay down. So, arming yourself while you have cash at the end of the year is never a bad thing.

The banking industry is a great place to start. Canadian Imperial Bank of Commerce (TSX:CM)(NYSE:CM) in particular is great, as it offers the highest dividend yield of the Big Six banks. But it’s also expanding into the U.S., meaning you are likely to see a strong increase in revenue as the U.S. and Canada rebounds. Banks are also the ones that will likely be on the rebound first after a market downturn, making this a great option to consider.

Another strong choice is the shipping industry. Cargojet (TSX:CJT) saw a huge boost from e-commerce sales, and this will likely continue for years to come, as it continues its partnership with Amazon. In fact, Amazon will likely see a huge increase over the holidays, and Cargojet will definitely see an increase from this as well. As e-commerce continues to grow both during and after the pandemic, Cargojet will remain a solid investment choice.

But then there’s healthcare, and CloudMD Software & Services (TSXV:DOC) is a great option to support during the new world. The company’s virtual healthcare services will continue to be a necessity now and years from now. It continues to acquire more virtual healthcare services, creating a diverse range of services for patients to use. The company remains cheap, but likely won’t be by the end of next year. So, now is a great chance to pick it up.