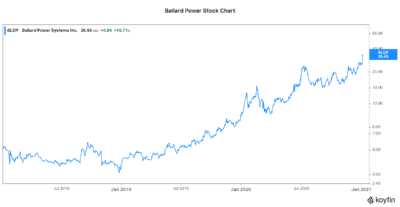

Ballard Power Systems (TSX:BLDP(NASDAQ:BLDP) stock has rallied over 20% so far in 2021. There have been only four trading days so far this year. So, this is a huge return. Will this momentum continue? What is even driving this momentum? And what do Ballard’s financials look like? Is there any support for Ballard stock’s movement?

Ballard Power stock is on fire, as fuel cells gain widespread acceptance

So, 2021 has already been exceptional for Ballard Power stock. But it pales in comparison to the stock’s returns over the last few years. The stock has risen almost 600% in the last three years. It has risen as Ballard and its fuel cells have made significant progress globally.

Many countries have mandated that vehicles be zero emission. The plans have different timelines. But countries around the world are targeting zero emissions, and they are legislating for this.

From China to Europe to California, the stakes are high. And fuel cells are making their mark. They’re proving to be the energy of choice in some areas. For example, fuel cells have a stellar track record with heavy-duty vehicles. That means buses, trucks, trains, and even boats. Eventually, airplanes might be added to this list. Imagine the market size of this. Imagine the growth trajectory. It’s huge.

Ballard Power takes hold of the rapidly growing fuel cell market

The future for fuel cells looks bright. ResearchandMarkets.com estimates that the global fuel cell industry will experience massive growth in the next five years. Their estimate stands at an average annual growth rate of 26%.

Ballard Power is at the forefront of the fuel cell market. For example, the company has the largest market share by far. It also has the expertise. And it has unrivalled relationships. The thing that I’m watching now is simple. How long will it take for Ballard to translate this into significant revenue growth? How long will it take for Ballard’s financials to catch up to expectations and valuations?

Ballard Power’s management realizes the importance of these questions. At some point, reality has to match expectations. Otherwise, the stock is setting up for a big free fall. According to Ballard, the time is fast approaching. In the next couple of years, Ballard’s record-high sales pipeline will translate to booming sales. And Ballard’s sales growth rate is expected to accelerate to 20-30%. The growth curve will be steep in 2023 to 2030. In my view, this inflection point will come as a surprise to many who have not been paying attention to this company.

Motley Fool: The bottom line

The bottom line here is quite simple. Ballard is on the cusp of a very lucrative emerging industry. It’s a fuel cell stock that has a bright future. It’s an industry that continues to gain momentum. This is supported by the fight for clean energy. The growth trajectory is strong and sustainable.

So, the next year or two are key for Ballard. The promise must translate to strong revenue growth in order to justify Ballard stock’s valuation. I believe this will happen and that Ballard Power stock will continue to outperform.