After the market crash in early 2020, there were several opportunities for investors to make money. Stocks with significant tailwinds from the pandemic saw massive rallies at first. However, that was soon followed by recovery rallies in a majority of TSX stocks.

2021 may not offer as many opportunities for investors, but those that do exist offer significant potential. While much of the market is focused on recovering from the pandemic, there are some industries, such as tech and renewable energy, that offer incredible long-term growth.

So while you may find some attractive stocks that are recovering from the pandemic, such as a stock like Corus Entertainment, the best long-term investments to make today will be in high-quality growth stocks.

Here are the three at the top of my buy list.

TSX real estate stock

The coronavirus pandemic impacted many industries. However, for some, the pandemic was a tailwind. That was the case for e-commerce stocks, which may have been the biggest beneficiaries of the pandemic.

E-commerce was always going to grow. The pandemic just gave it a major boost. This fundamental economic shift has created growth potential for tech stocks. However, it’s also created opportunities for industrial real estate stocks, such as Granite REIT.

In the past, retail companies haven’t needed as much warehouse space because their brick-and-mortar locations hold a fair amount of inventory at a time. As companies elect to close their brick-and mortar-stores and focus more on e-commerce, though, the need for warehouse space is increasingly being demanded.

That’s why Granite, a leading Canadian industrial REIT, is one of the top long-term TSX stocks you can buy today.

Consumer staple stock

In addition to Granite REIT, Alimentation Couche-Tard Inc (TSX:ATD.B) is also one of the TSX stocks at the top of my buy list.

Alimentation Couche-Tard is one of the top long-term companies you can own. The growth it’s accomplished over the years, both organic and by acquisition, has created a tonne of value for shareholders.

Plus, management has proven that it can repeat the process. And with so many stores now in its portfolio, the move to focus more on organic growth and brand loyalty is prudent.

Because it’s such a high-quality, long-term stock, the dropoff it’s had in the last few weeks has made it extremely attractive.

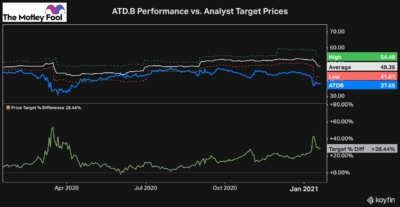

As you can see, Alimentation Couche-Tard has sold off quite considerably as of late. The TSX stock continues to trade below even the lowest of all analyst’s target prices.

At a current market price of $37.65, the stock currently trades down over 20% from its 52-week high. That’s an incredible discount for such a top growth stock and one that surely won’t last.

TSX retail stock

The last TSX stock at the top of my buy list is one of the best retail companies you can find, Dollarama Inc (TSX:DOL).

Dollarama is an exceptional business for several reasons. First of all, the company predominantly sells staples and household goods. This makes Dollarama highly recession-proof. However, because it offers consumers the ability to buy many household staples at cheaper prices than its big-box competitors, it actually means that Dollarama usually sees an increase in sales during periods of economic turmoil.

The other reason it’s such a high-quality TSX stock is the incredible merchandising the company has done over the years. With all the increased traffic from consumers looking to save money on essentials, Dollarama has had a major opportunity. And the company has capitalized on this opportunity, continuously improving its merchandise to rapidly grow its sales.

The sky’s the limit for Dollarama. It’s even invested in a dollar store chain in Latin America to help diversify its growth.

So if you’re looking for a high-quality TSX stock to buy and forget, Dollarama is one of the first stocks you consider.