There is a lot of advice millennials should take from our baby boomer parents. However, when it comes to investing today, millennials don’t have to do exactly what they say or what they do. Sure, when you’re about to retire, things will change. But you’re not about to retire. Far from it. And that means you have a lot of time on your hands to see your stocks grow, so you can afford to take on at least a little risk from growth stocks.

But granted, choosing growth stocks is pretty darn hard. So, that’s where the best practice comes from investing in exchange-traded funds (ETFs), specifically all-in-one ETFs. These ETFs are basically balanced ETFs. They provide investors with a cheaper option to invest in stocks they’re interested in without paying the oftentimes higher price for those individual stocks and trying to rebalance them themselves.

But for millennials, it goes one step further. If you invest in all-in-one ETFs that narrow in on growth stocks, you can see enormous gains over a number of years. While there is likely to be more ups and downs than a more conservative all-in-one ETF, you have one thing on your side: time. That means as long as you continue to hold the ETF, there is an incredibly small chance that you’ll come out the other end in the red.

What to consider

When looking into growth stocks, you don’t have to think decades and decades. Instead, just think whether you are willing to own the ETF for the next decade or so. So, here are some options to look at if you’re willing to go this route.

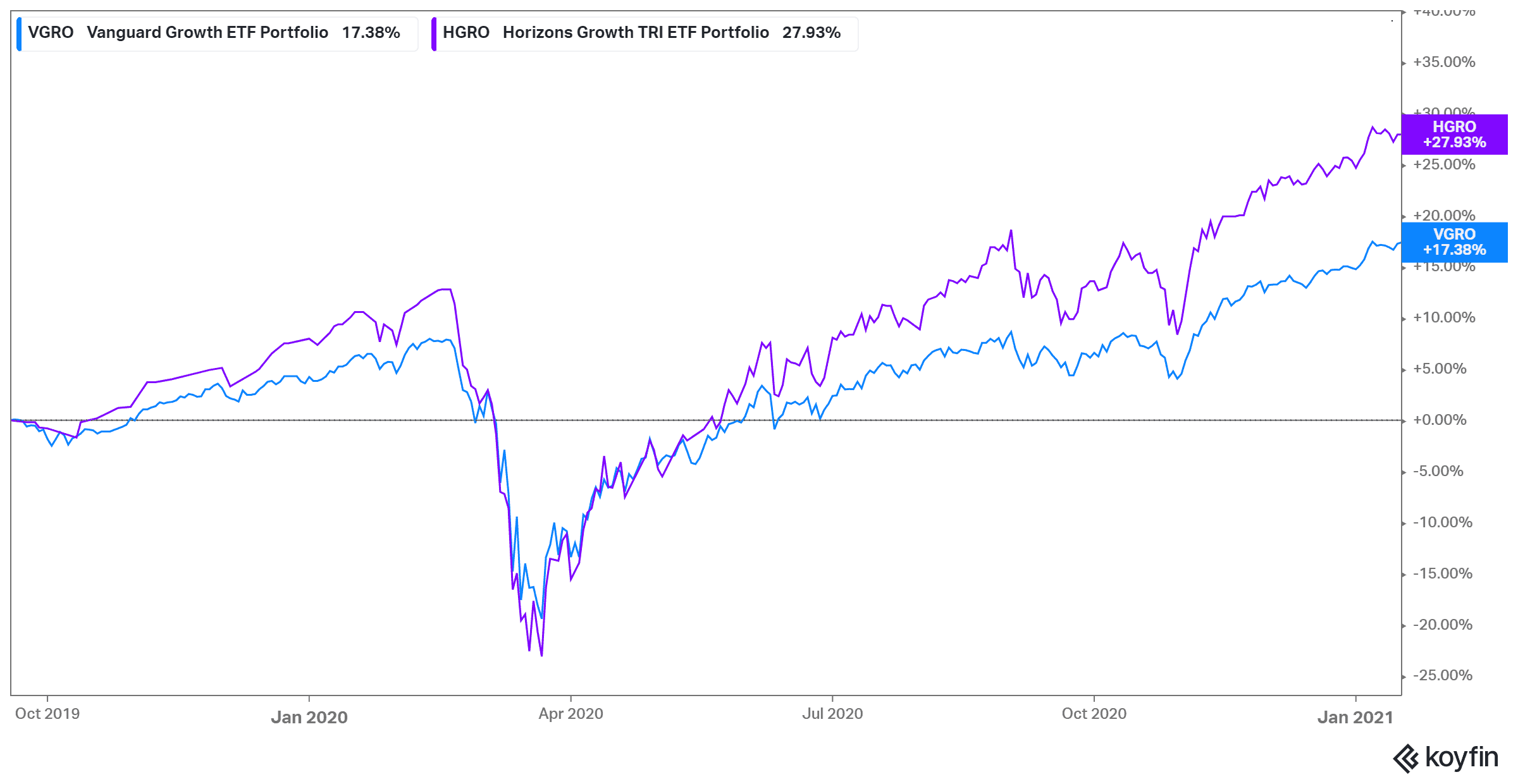

The Vanguard Growth ETF Portfolio (TSX:VGRO) is an excellent option during this time of economic weakness. The company has a wide range of equities, fixed income, and minerals under its portfolio. This diversity has kept it growing strong, even during the downturn and offers a quick fix to the current volatile climate. What this means is if there is another market crash, your cash will likely be quite safe. The stock is one of the newest from Vanguard, but even still, its shares are up 28% in the last year.

Another company with a slew of solid options is Horizons with its Horizons Growth TRI ETF Portfolio (TSX:HGRO). The company already has a number of heavy hitters under its belt, but this newest one has remained stable, even during the market crash of 2020. While other ETFs have around 30% invested in U.S. equities, Horizons Growth has over 50% as of writing. With a new administration in the White House, that could mean Horizons sees a boost in the coming months should there be an economic recovery.

Foolish takeaway

Growth stocks don’t have to be scary. In fact, they don’t even have to be risky or expensive. By investing in all-in-one ETFs with focus on growth, you have the time to see your shares rise. Meanwhile, you don’t have to pay the exorbitant price of trying to create your own balanced portfolio. Simply buying shares at $30 for Vanguard and $13 for Horizons means you get a cheap option to quell your worries and see your portfolio rise.