When it comes to protecting your portfolio, you want to look for top stocks that will do well a decade from now. That makes it obvious that you should see what stocks have done well over the last decade. While there are certainly new areas arising that present strong future options, looking back certainly has its benefits.

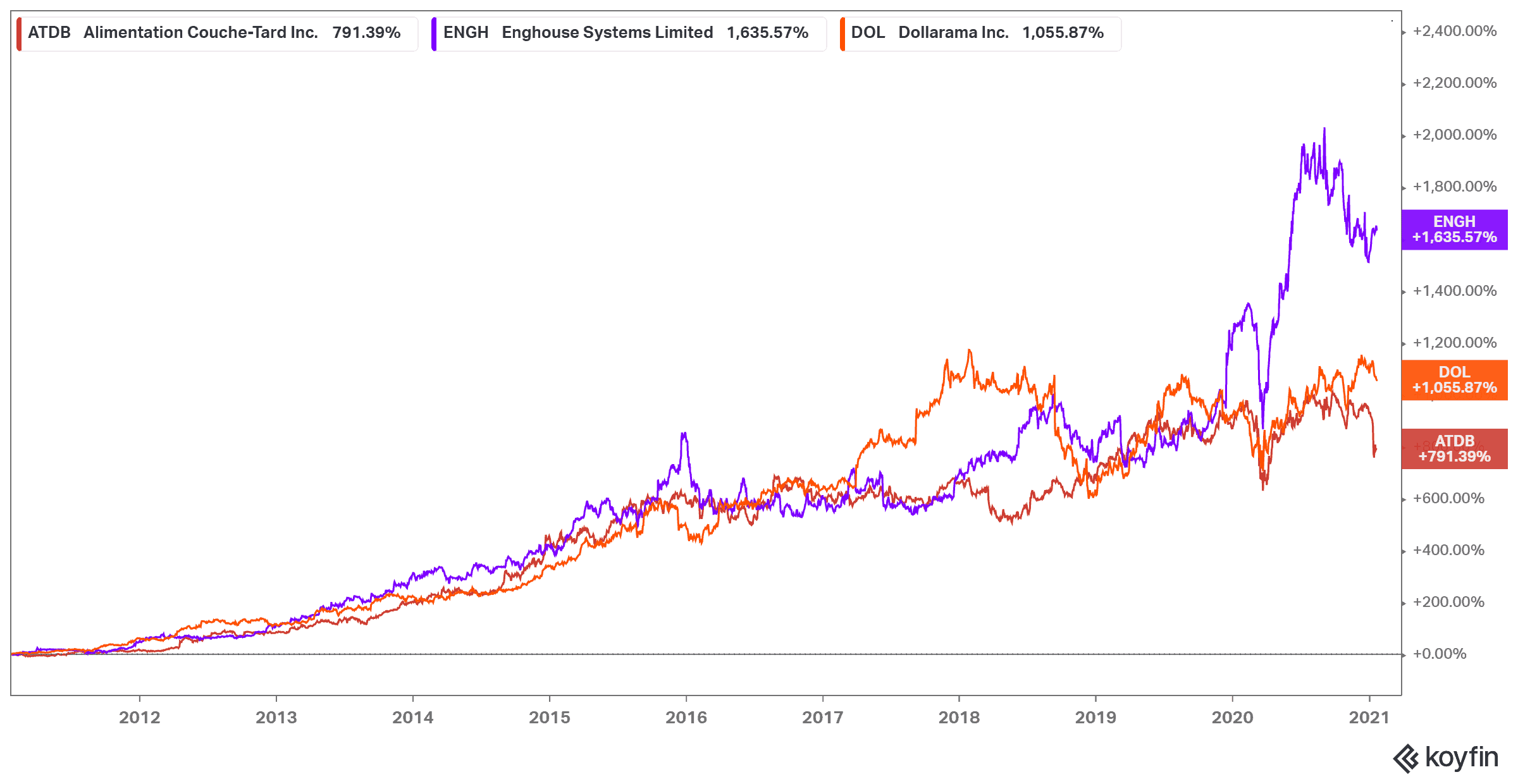

These top stocks have the history to prove each can do well, but the future potential to continue soaring. That’s why today I’m going to look at Dollarama (TSX:DOL), Enghouse Systems (TSX:ENGH), and Alimentation Couche-Tard (TSX:ATD.B) to see why these soared in the last decade, and what’s to come.

Dollarama

A decade ago, Dollarama would have been an absolute bargain. For those who foresaw the unique situation of the discount retailer, they would be rolling in it right now. The company has managed to appeal to the love consumers have for a discount, while also sticking to a bottom line and expanding throughout the country and recently beyond.

The company hasn’t been without trials, of course. After a huge run, shares dropped as sales dropped, as investors worried the expansion happened too fast. But the company has made a comeback as of late, capping the cost of items to the delight of consumers and expanding its Latin America project of Dollar City. In fact, the company is now back trading near all-time highs. To date, if you had invested $10,000 in Dollarama back in 2011, you would now have $106,470.59.

Enghouse Systems

It doesn’t take a genius to figure out why Enghouse has done so well. Management are expert tech executives that snatch up software companies around the world and consolidate them under the Enghouse umbrella. Multiple acquisitions occur every year. Then, of course, the pandemic happened, and a company like Enghouse became basically invaluable almost overnight.

Its diverse range of products, features, and software has something for practically every industry out there. Revenue started at a year-over-year increase of around 19% back in January 2020, but today, that’s soared to a 31% year-over-year increase as of the latest earnings report. Shares are up a whopping 1,637% as of writing, with a $10,000 investment in 2011 worth $158,925 today.

Alimentation Couche-Tard

Finally, Alimentation has the similarities of Enghouse but in a completely different industry. The company has been growing through acquisition for years, becoming the king of acquiring. While there have been too many to count in the last decade, there are some to note. That includes the $2.8 billion acquisition of Statoil Fuel and Retail, and, of course, all Esso retail locations — not to mention its expansion into the United States.

The company is now nearing almost 10,000 retail locations across North America, and there are its locations in Europe. And it looks like its rebranding of Circle K has been bringing in even more revenue. With the pandemic, that revenue has sunk, but that creates a fantastic buying opportunity. While shares are down 15% in the last year, those shares are still up 791% over the last decade. A $10,000 investment back in 2011 would be worth $83,146 today.