It’s been one heck of a year, especially for the markets. After falling to lows not seen in years, many industries are still working back to pre-crash prices. For those already achieving those prices, many worry how long it will last. Another market crash is likely and could be the first of many. This comes down to a bleak economic outlook for this year and the next few years as the world recovers.

But that doesn’t mean your investments are out of luck. You can even look to the best-performing Canadian stocks for at least some guidance if not for an investment. These stocks soared in 2020 and could continue to do so through 2021 and beyond. Let’s take a look at the top three.

Shopify

Of course, there’s Shopify (TSX:SHOP)(NYSE:SHOP). Analysts warned investors that should a market crash occur, Shopify didn’t have what it takes to make it through an economic downturn. Boy, were those analysts wrong. The company continues to see revenue soar year over year, and though shares are exorbitantly priced, it continues to skyrocket.

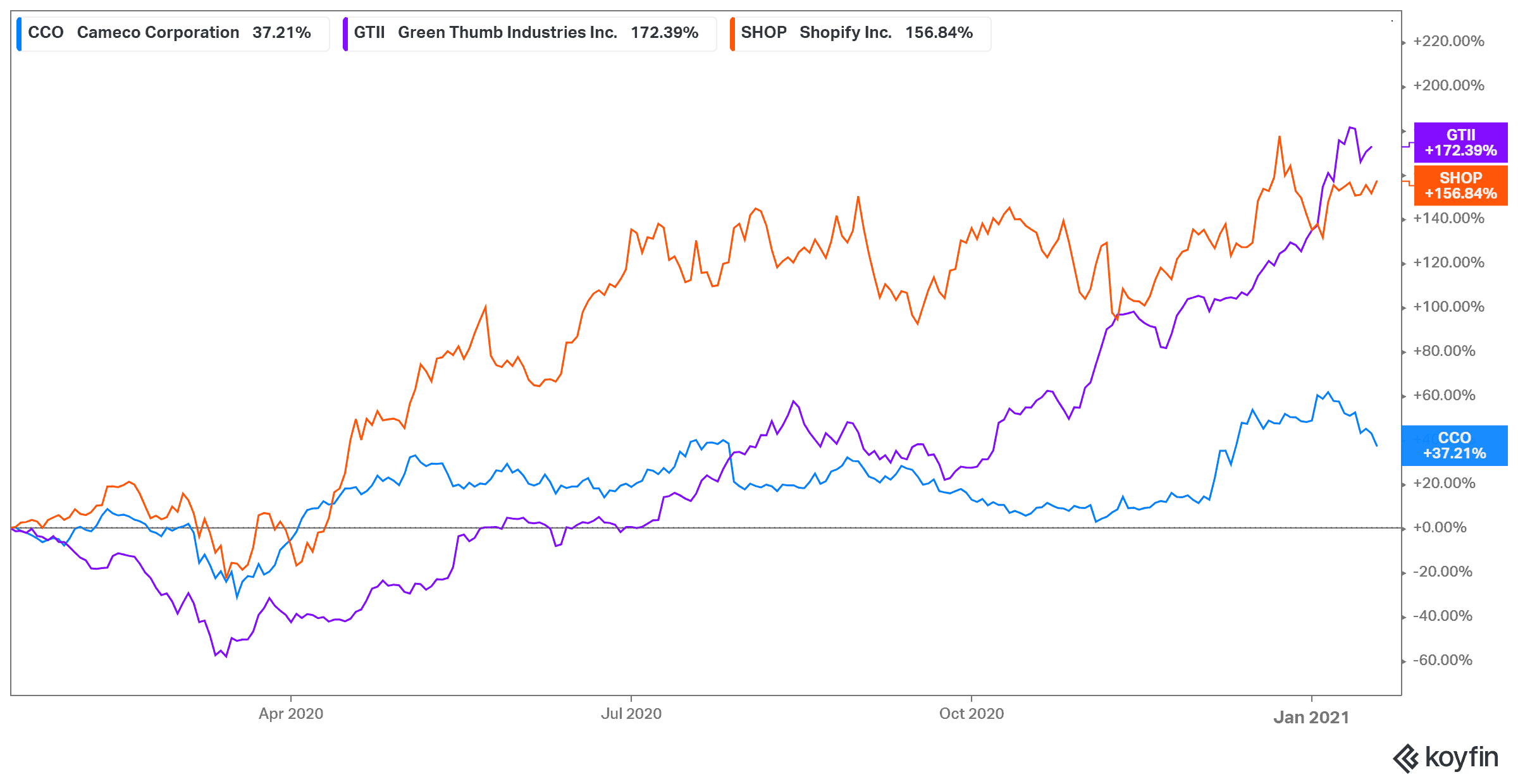

Shares are up 157% during the last year and over 5,000% in the last five years! While this has to slow down some time, investors are still reading with their finger on the Buy button for any sign of a dip. The rise in e-commerce from the work-from-home economy fueled the fire, bringing in even more subscription revenue. As the world continues to change, Shopify should continue to take advantage.

Green Thumb

It looks like the United States could be moving towards federal legalization of marijuana, and one company that could see a huge boost from that is Green Thumb Industries (CNSX:GTII). The cannabis company has shop set up across the U.S., selling recreational, medicinal, or CBD cannabis products.

Sales are expected to skyrocket in the coming years. In a market that is likely to see cannabis climb even higher in the next decade, Green Thumb could be a leader. Shares are already up 172% as of writing in the last year and 311% since it came on the market in 2018. So, if you want to bet that the U.S. will soon go green, Green Thumb is where you’ll want to be.

Cameco

This is where things get tricky. Cameco (TSX:CCO)(NYSE:CCJ) isn’t on the right side of history. Uranium mining and reactors continue to make people feel nervous. But no matter how you feel about it, the movement is towards more reactors. Around the world, countries are making more and more nuclear reactors, including China, Russia, and India. Once built, this will double the demand for uranium.

In fact, analysts predict a growth from US$35 per pound to US$65 per pound in the long term. So, if you’re looking for a solid long-term buy, consider Cameco. The stock is up 37% in the last year as of writing but still down 52% in the last decade. When there is that shift to nuclear, Cameco stands to be the world leader in uranium production, making it a bargain at today’s prices.