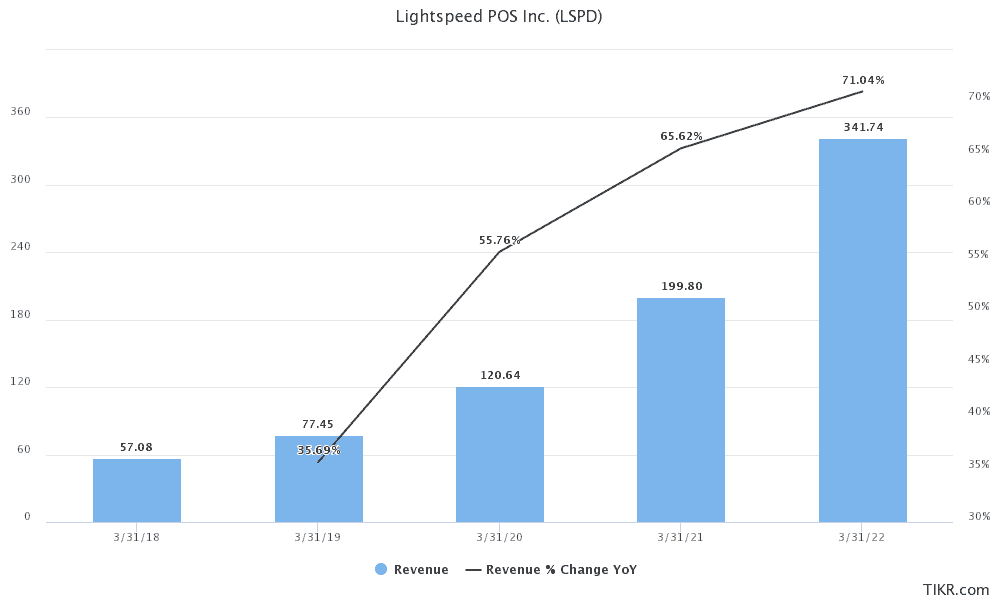

Lightspeed POS (TSX:LSPD)(NYSE:LSPD) is one top TSX tech stock that is expected to report strong growth rates in 2021. Analysts forecast LSPD will grow sales by over 65% in fiscal year 2021 which ends in March this year. Revenue could grow at a much faster annual pace in fiscal 2022 – think of a 71% year-over-year increase to US$342 million by March 2022!

Lightspeed offers cloud-based omnichannel commerce-enabling solutions targeting small and medium-sized businesses (SMBs) mainly in the retail and hospitality sector worldwide. Its target market comprises over 47 million retail and restaurant customers. The company’s total addressable market extends to over 226 million SMBs worldwide translating to an over US$623 billion market today. But this market is highly fragmented, and Lightspeed’s brilliant leadership is consolidating it fast.

Investors love the evolving story and have rewarded the stock with a 460% rally over the past nine months. The market’s expectations on the TSX tech stock seem increasingly bullish. At the time of writing, LSPD stock’s 12 months forward enterprise-value-to-revenue multiple has stretched to nearly 29 times, up from 17 times by September last year (just under four months ago.) Strong sales growth should back up Lightspeed stock’s bullish valuation again this year.

Here’s my take on how Lightspeed POS could sustain its rapid growth trajectory throughout 2021.

3 ways Lightspeed will grow its revenues in 2021

The company follows an acquisitions-led growth strategy. It’s currently consolidating two recent acquisitions concluded in November and December of 2020. I expect organic growth to complement acquisitions in 2021 through increased market adoption, and new product launches.

Growth through acquisitions

Lightspeed’s commitment to an acquisitions growth strategy is unquestionable. Since going public in 2019, the company closed three acquisition transactions in that year, made three successful deals in 2020. It’s only natural to expect another three transactions or more in 2021.

Consolidation is necessary given the company’s fragmented target market with over 190 direct competitors globally. Through acquisitions, the company has grown its customer count from around 77,000 customer locations in September 2020 to over 110,000 locations at year-end last year.

The significant rally in LSPD’s stock price over the past nine months gives management a great currency to transact with during 2021. Perhaps there could be some little cash drag given that two recent acquisitions were a combination of cash and equity. It would be interesting to see how much cash the company had on its books by end of 2020 to fund new transactions. However, it could still raise new equity from a bullish public market any day.

Lightspeed will report fiscal 3Q 2021 earnings on February 4.

Organic sales growth from the existing product portfolio

Lightspeed’s target SMB market segment is a critical backbone of the world’s economy. This segment usually grows at a healthy pace during economic recoveries as new businesses sprout. I would expect strong demand for the company’s future-proof and modern commerce platform which enables e-commerce integration, affords customers access to easy credit (through Lightspeed Capital) while offering payment processing capabilities.

The acquisitions of Shopkeep and Upserve provided over 27,000 new customer points for cross-selling opportunities in December. The recently acquired customer book brings new prospects for the company’s payments, credit, and e-commerce, and other product offerings.

I would expect new customer wins during the second wave of the COVID-19 pandemic, demand growth during a post-pandemic recovery, customer package upgrades from existing clients, and cross-selling opportunities to drive strong sales growth in 2021.

It wouldn’t be surprising if the company reports a further increase in average revenue per customer in February’s earnings release.

New product launches

Lightspeed was impressively innovative during the coronavirus pandemic. It launched new product solutions just in time for retailers and restaurants to adopt e-commerce and survive the crisis. Life-saving innovations such as check-out enhancements, Order-Ahead, and e-Commerce for Restaurants preserved a hospitality industry devastated by lockdowns and social distancing protocols.

Given the historically high rate of new product launches, investors should expect new product announcements this year to drive revenue growth and retain customers in 2021.