Canadian National Railway (TSX:CNR)(NYSE:CNI) is a dividend-growth stock. The 7% increase in its dividend today makes it so. These stocks are essential to any portfolio. They keep the income coming. And they more than keep up with inflation. But this is a very unique time. The stock market is very richly valued, and this may have created a sort of paralysis in some investors. I know it has for me. I have a list of stocks I’m waiting to buy after a “market correction.” This list is quite long, and I’m watching all the stocks on my list go higher from the sidelines.

So, today, I would like to recommend CN Rail stock as a top TSX dividend stock to buy now. It’s a long-term buy. With this stock, I must admit, we shouldn’t get too hung up on timing the market. As long as we have our long-term goal, we should be in good hands.

CNR stock to benefit from recovering businesses

Canadian National Railway reported its fourth-quarter and year-end 2020 results yesterday. There were glimmers of hope. There were also clear areas of solid momentum. All told, CN Rail reported a 7% drop in revenue in 2020. The company also reported free cash flow of more than $3.2 billion. Given the year we have just had, I would say that these results are outstanding. They are a testament to CN Rail’s resiliency.

Following up on 2020, CN Rail management is very confident with regard to the recovery in 2021. We should naturally expect this recovery to be back-end loaded, meaning that we should expect a very robust second half of the year. The first half will have its struggles related to the pandemic.

CN Rail is in the position to invest in its long-term growth

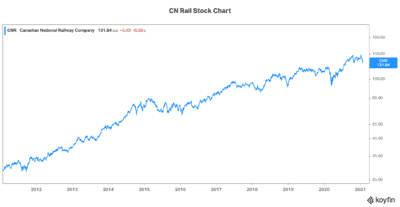

But clearly, the market is looking past the pandemic. It’s rallying on the hope of the vaccine and on the stimulus that has been injected into the economy. And so is CN Rail stock. While it’s lower today, the long-term direction is surely higher. The level of free cash flow that this company has generated even in bad years is a clue. Take a look at the following stock chart. We can see the long-term upward momentum.

In my view, CNR will continue to dominate the railway industry. It will also increasingly expand into related areas of the overall supply chain. Propane is booming, and CN Rail’s presence there is strong and growing.

Management also floating the idea that they’re looking at related acquisitions. For example, a technology acquisition might make sense. This would strengthen CNR’s digital strategy. It could transform CN’s railway business. Maybe there are some opportunities for partnerships with different ports. The Vancouver and Prince Rupert ports’ volumes are both up 17%. Lastly, intermodal opportunities are still out there. This growing part of the supply chain is fragmented. It’s ripe for consolidation. CN Rail could easily further its involvement in this part of the supply chain.

Motley Fool: The bottom line

The bottom line is that CN Rail stock is a top dividend-growth stock to buy today. It has all the qualities of a company that is set up to continue to thrive in good times and bad times. CN Rail provides an essential service for Canadians. The economy and our lives as we know them depend on it.