Tech stocks are really having their moment these days. This is being driven by one main theme. And the value and worth of this sector has rarely been more obvious. Technology has been a saviour of sorts in this pandemic. Tech stocks are therefore soaring. If you’re looking for stocks to buy for your RRSP, read on. In fact, all investors who want to make money should read this article. The two tech stocks I will highlight are CGI (TSX: GIB.A)(NYSE:GIB) and BlackBerry (TSX:BB)(NYSE:BB).

But first, let’s review the RRSP and the TFSA.

RRSP vs. TFSA: What’s the difference?

The Registered Retirement Savings Plan (RRSP) is a key savings tool. Tax-free income and capital gains help investors save for retirement more rapidly. But there are other tools to help us. For example, the Tax-Free Savings Account (TFSA) also shelters our investments from taxes. And it’s another very useful took in our savings and retirement strategy. Both are great places for tech stocks that are expected to generate massive capital gains. Let’s review each really quickly.

The RRSP, like the TFSA, allows your savings to grow tax-free. There’s a major advantage to the RRSP. Contributions made to your RRSP are tax deductible. This is a huge benefit. Come tax time, this benefit always becomes crystal clear. The juicy tax refund resulting from our RRSP contribution is a clear advantage. In fact, I would recommend investing this refund into your TFSA.

The TFSA is another tax-sheltered savings vehicle. It’s less strict in terms of withdrawals. And it has a cumulative contribution limit of $75,500 today. The TFSA is all about tax-free income and capital gains. Withdrawals can be made at any time at zero tax. Withdrawals from the RRSP are not as easy and come with strict rules. And they will be taxed.

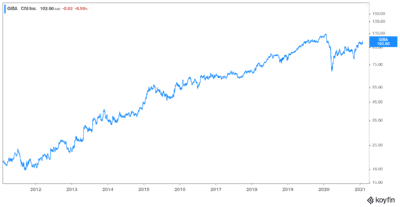

RRSP tech stock #1: CGI stock

So, let’s move on to the tech stocks to buy for your RRSP. CGI stock is one of Canada’s leading technology stocks. Since 1976, it has grown into one of the largest IT and business consulting services firms in the world. And its growth shows no signs of stopping. This company is on a quest to consolidate the end-to-end IT services industry. It continues to acquire and grow. Today, CGI generates over $12 billion in annual revenue. And its market cap stands at $23 billion.

In this pandemic, business remained quite resilient for CGI. As a recovery takes shape, the digitization trend is escalating. This digital transformation is happening across the globe. And CGI is right there, front and centre. As a result, CGI is the most profitable it’s ever been. And its plans to double in size in the five to seven years remains achievable. This will be achieved through organic growth and acquisitions. CGI will continue to consolidate this fragmented industry. And CGI stock will continue to generate shareholder value.

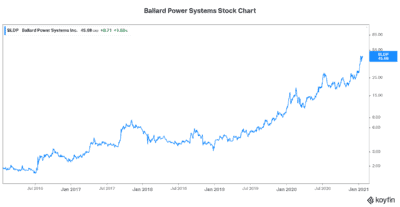

RRSP tech stock #2: BlackBerry stock

Connected cars and cybersecurity are clear growth areas in the tech world. And BlackBerry is at the forefront of both industries. Recent market action aside, BlackBerry stock remains one of my best tech stock ideas.

Demand growth for cybersecurity will grow at a healthy clip as remote working increases. Many estimate that the global cybersecurity market will grow from $149 billion in 2019 to $210 billion in 2023. BlackBerry is a trusted provider of cybersecurity.

The future for connected cars is bright. The global market size is widely expected to increase threefold in the next five years. The market was worth more than $60 billion in 2020. By 2025, many estimate it will be more than $180 billion. And now, BlackBerry and Google Web Services have partnered. They will provide a top-tier vehicle software solution. This solution will apply to every vehicle and every platform. It will transform the automobile software industry.

Motley Fool: The bottom line

RRSP investors and TFSA investors would benefit from buying the two tech stocks discussed in this article. For example, CGI stock has stability on its side. This stability is back by steady growth. Also, BlackBerry has massive growth on its side. These CGI and BlackBerry stocks should provide RRSP and TFSA investors with tax-free capital gains for years to come.