Lately, hedge fund managers have been all over the news. After losing more than $20 billion betting against GameStop, they’ve earned the spotlight in the worst possible way.

But before you declare hedge fund managers done and over with, I’d remind you that they’re still rich. Very rich. Most of the big players in the space are billionaires, some of them among the richest people in the world. It’s this fact that has led to such public glee over the Gamestop phenomenon. Sure, the WallStreetBets posters buying the stock are just traders hoping to make a buck, but at least they’re beating the hedge fund billionaires at their own game.

Indeed, they are.

And you can too — in a certain sense. While you may never be able to beat hedge funds in a short squeeze, you can outperform their annual stock market gains. And the way you do it is ridiculously easy.

Buy index funds

Index funds are highly diversified, low-risk investments that aim to replicate the average returns of a broad market index. Over a long time, they outperform the vast majority of hedge funds. By buying index funds, you will beat the average hedge fund manager in terms of percentage gains. You won’t become a billionaire, because you won’t collect management fees. But you will be able to say that you got better returns than many a wealthy investor.

Warren Buffett’s bet with hedge funds

You might think it’s bizarre that something as simple as an index fund could beat hedge funds. After all, these hedge fund managers are billionaires — how did they get there if their investments are underperforming?

It comes down to fees. Most hedge funds charge two fees: a fee for assets under management and one for performance. Often, the fee will be something like 2% on all assets and 20% on returns in excess of a benchmark. The really big money comes from beating the benchmark. But if you have $1 billion under management and charge 2% on AUM, you’ll still get $20 million … even if you underperform. And some of these fund managers have a lot more than $1 billion under management.

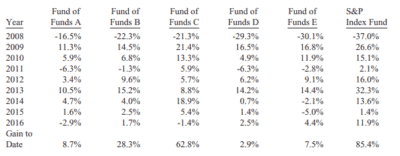

As for proof that index funds outperform hedge funds, I’ll simply reference Warren Buffett’s famous 2005 hedge fund bet. He wagered $500,000 that the S&P 500 would outperform five funds of hedge funds over a 10-year period. A “fund of funds” is a vehicle that invests in other funds — so this bet was based on a pretty broad swath of the hedge fund industry. In the end, the S&P 500 won out over every single fund!

Two index funds worth considering

If you’re interested in beating hedge fund managers by buying index funds, there are two options worth considering.

First, you have U.S. index funds like Vanguard S&P 500 Index Fund. It was this type of fund that Buffett’s winning bet was based on, making it a solid bet.

Second, if you’re a Canadian investor, you can consider Canadian index funds like iShares S&P/TSX 60 Index Fund (TSX:XIU). Canadian markets generally earn lower returns than American markets — although, even with Canadian stocks, you’d have beaten “fund of funds D” in Buffett’s data table above.

Regardless, there’s a good reason to hold both Canadian and American funds: geographic diversification. The more stock markets you invest in, the lower your unsystematic risk, and therefore, the lower your total risk. Also, if you’re a dividend investor, you might like the higher yield you get with XIU compared to American funds like VOO. Not only is it higher pre-tax, but you may no U.S. withholding tax on Canadian dividends, so the amount you receive is much higher.