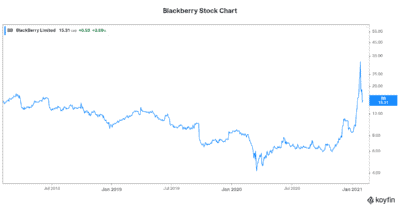

BlackBerry Ltd. (TSX:BB)(NYSE:BB) stock has been on a roller coaster ride. But before BlackBerry was in the news, I was writing to my readers about it. I was singing its praises. Investors did not appreciate the value of Blackberry stock. So now BlackBerry stock is trading at almost $15.00. That’s far lower from the Reddit induced rally to over $30. But it’s also a fry cry from the $6 to $7 that the stock was trading at earlier this year and in 2020. BlackBerry stock predictions are all over the place these days.

Let’s tackle this here. Let’s try to make some predictions as to where BlackBerry stock will go from here.

Long-term, BlackBerry stock will very likely be trading much higher

In my view, the long-term outlook for BlackBerry stock is extremely bright. What it does before it gets there is more uncertain. I don’t think any of us can accurately predict the short-term movements of any stock. So let’s keep that in mind. My only worry with regard to BlackBerry stock is simple. I don’t want to pay a premium. And I don’t want to get caught in a BlackBerry stock reddit squeeze.

BlackBerry stock at $15 today is more than double the level I was recommending it at. Fundamentals have driven some of this return. But not all of it. The stock was too cheap back then. But is it still too cheap today?

BlackBerry stock trades at seven times sales

Trading at seven times sales is by no means grossly undervalued. But it’s not grossly overvalued either. I mean, BlackBerry’s expected revenue growth rate will be much higher going forward. While revenue is still currently weak, the longer-term outlook looks really good.

For example, the cybersecurity business is getting a boost from the digitization across all industries. Many estimates are calling for a steady 9% compound annual growth rate (CAGR) in the next few years. This growth is supported by increasing remote workers. It’s also being supported by the digitization trend that is sweeping our society.

And the connected car industry’s growth rate is far higher. In this industry, many are estimating a 24% CGAR in the next five years. The big news in this segment is the BlackBerry IVY partnership. BlackBerry and Google Web Services have partnered to provide a top tier vehicle software solution. This solution applies to every vehicle and every platform. It will transform the automobile software industry. This is where we can get really excited about BlackBerry stock.

Catalysts for BlackBerry stock price

Today, BlackBerry is seeing significant order and backlog growth. And 83% of the company’s software revenue is recurring. In 2021, there will be many catalysts for BlackBerry. These catalysts will support the stock price.

For example, application providers will be able to get their hands on IVY in September 2021. Twenty car manufacturers will be targeted. And BlackBerry will make a public announcement whenever one signs up. Also, BlackBerry is now increasingly free cash flow positive. This is a big game changer for the company. Investors will value BlackBerry stock much more attractively because of it. Free cash flow in its latest quarter was $29 million.

Foolish bottom line

So the question in my mind is not whether BlackBerry stock is a buy. It’s whether the stock is a buy at $15.00. I’m personally inclined to wait it out a bit. I’m of the view that we can expect some stock market weakness in the coming months. I look at this combined with BlackBerry stock’s own journey down from its Reddit highs. This translates to a short-term action plan that consists of waiting. I would wait until the stock approaches $10. I would buy at that point.