Suncor Energy Inc. (TSX:SU)NYSE:SU) is Canada’s leading integrated oil and gas stock. It’s an operational leader in oil sands, exploration, and refining and marketing. It is this integrated businesses model that makes Suncor Energy stock so interesting.

Without further ado, let’s look into Suncor Energy stock more closely. Is this $34 billion company a buy today?

Oil prices rally — boosting the fortunes of Suncor Energy stock

Oil prices have been rallying lately for a number of reasons. For example, a general lack of investment is starting to affect supply. Also, hopes of a strong recovery this year is upping demand forecasts. When all is said and done, 2021 is increasingly looking like a perfect storm for oil and gas.

So oil has rallied to over $55. It’s higher versus one year ago. In fact, it’s much higher than most would have dared imagine, boosting Suncor Energy’s business recently. The company is returning to its roots – a stable oil and gas business. In normal times, this business model gives Suncor the kind of diversification that shields it from the hard times. But in 2020 this was not the case. In fact, Suncor was hit on both the upstream (production) side and the refining side. This is not a usual occurrence.

Normally, the nature of Suncor’s diversified business model means that it’s more stable. This is so because the refining side of the business provides a cushion in times of low oil prices. When oil prices fall, Suncor’s refineries should experience rising refining margins. This is because their input (crude oil) is now cheaper. Being involved in the entire chain of the oil business sure has its advantages. But as we know, in the latest crisis, this did not happen. The pandemic cut demand sharply even though oil prices were in the dumps. Going forward, we should see a return to normal as a recovery takes hold.

Cost reductions are the key theme at Suncor

Despite the faster-than-expected recovery of oil markets, the environment remains difficult. Thankfully, Suncor initiated ambitious cost reduction targets last year. And these efforts are bearing fruit. Costs are being taken out of Suncor’s business at a feverish pace, ultimately driving down to the bottom line. And much of these cost reductions are structural. This means that these costs will be taken out of the business for good.

The bottom line here is that costs are coming down quickly, setting Suncor up for good days ahead. Suncor is targeting incremental cash flow of $1 billion by 2023 and $2 billion by 2025. Suncor breaks even at $35 oil. Oil is currently at $55. This translates into massive cash flows for 2021 and beyond assuming oil prices hold firm.

Suncor stock remains grossly undervalued

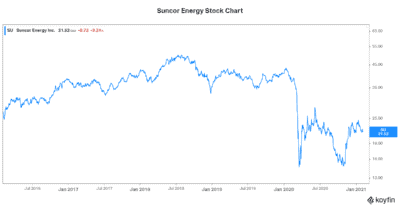

Since December 2019, Suncor stock has lost 50% of its value. We all know the culprits in this fall from grace – oil price weakness, and uncertainty related to the economic impact of the coronavirus. It all came to a head when Suncor instituted a 55% cut in its dividend. How far this energy giant had fallen. Years ago, Suncor was touted as a stable dividend stock. And it was in fact exactly that — the epitome of stability, dividend growth, and financial strength.

Today, Suncor Energy stock remains in the dumps. Suncor trades below book value. It’s posting net losses. And its revenues are more than 30% lower versus last year. But Suncor is intent on driving value going forward. Its share repurchase plans reflect management’s belief that the stock is undervalued. Its debt reduction plans reflect management’s desire to shore up Suncor’s financial standing. And the relentless focus on improving Suncor’s operations reflect a higher standard that Suncor has come to be known for.

Foolish bottom line

Suncor stock is a buy today because it’s undervalued. And it’s a buy because of the improving demand/supply fundamentals of the oil and gas sector.