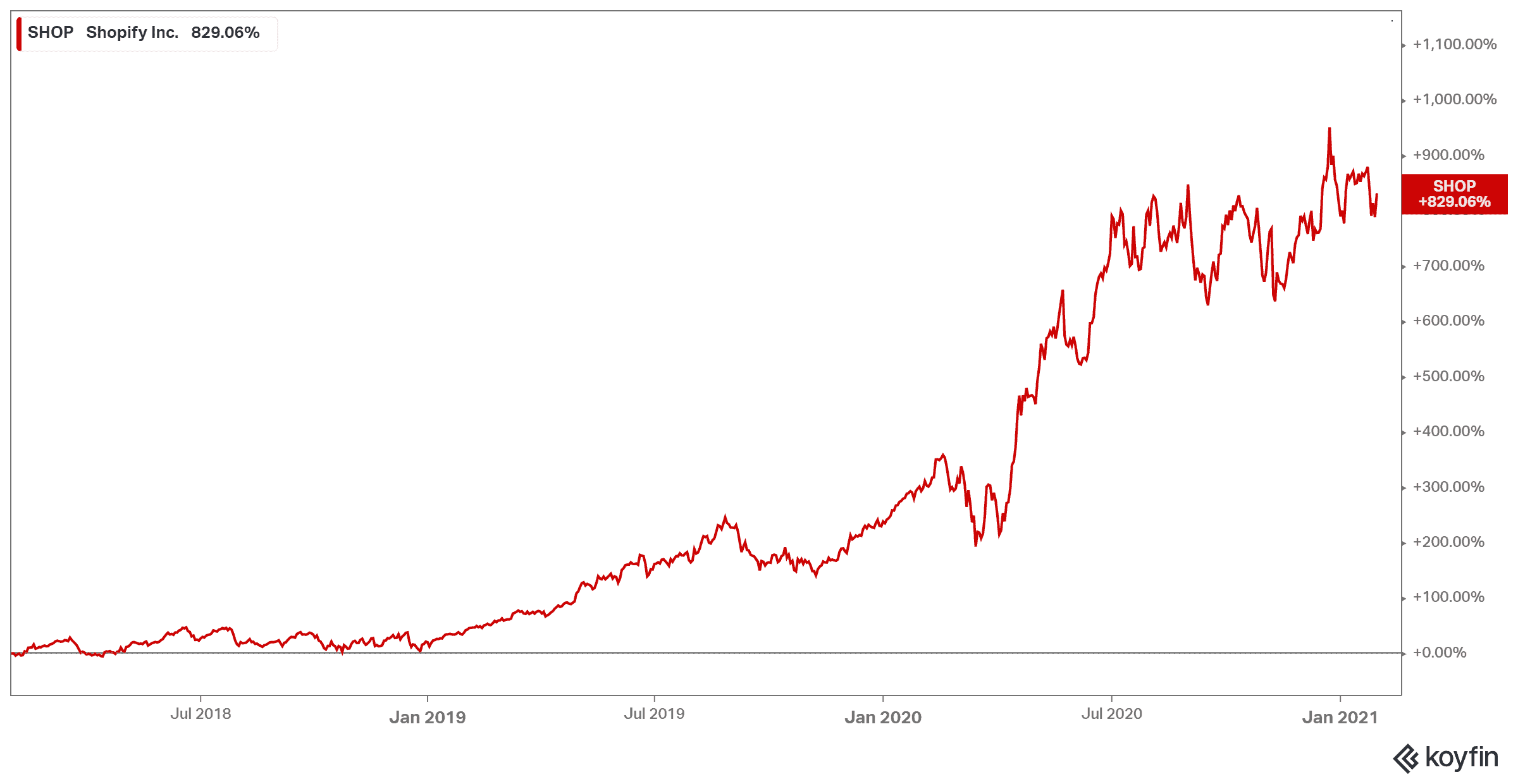

If you think that Shopify (TSX:SHOP)(NYSE:SHOP) is going to suddenly drop back to the three-digit range, you’re nuts. Analysts just could not foresee how gangbusters Shopify stock would get only a year or two ago. Forget that it’s overvalued. Forget its price-to-earnings ratio. This stock is here to stay and here to grow.

So, it’s time to get realistic about where Shopify stock is headed. Is future growth going to be slower? Or are we in for dips in the near future? Or, on the flip side, is it going to double, as e-commerce continues to boom? Here’s what the bulls and bears are saying.

Bulls

It’s easy to be bullish about Shopify stock. The company continues to see revenue increase year over year by leaps and bounds. Most recently it reported revenue was up by 96% in the last quarter, and with positive net income. And no one could have foreseen where this enormous growth would come from.

The pandemic has been good for Shopify stock. The company recently reported that “[in] 2020, an entrepreneur on Shopify made their first sale every 28 seconds versus every 52 seconds in 2019.” That’s enormous. But here’s something even crazier to consider. E-commerce was supposed to be where it is now in a few years. The future has arrived, and there’s no going back.

Every company involved in e-commerce has seen massive growth through online sales. Shopify stock is set to continue soaring, as e-commerce continues to drive growth. Businesses need an online presence, and Shopify is a household name owners will think of first. This will continue to drive revenue as subscriptions remain high. So, the future looks bright for Shopify stock.

Bears

But growth like this cannot last forever. The company will eventually run out of new and exciting products, and it will hit a plateau on business signups. And the main problem with Shopify stock is what’s driving share prices right now: small- and medium-sized businesses (SMBs).

While these businesses need an online presence, they’re still struggling during the pandemic. Should these businesses need to shed cash, or if they go bankrupt as the economy struggles over the next few years, there could be a massive decrease in revenue with Shopify stock. After such a lofty 2020, we could see an enormous pullback in the years to come.

Meanwhile, the company continues to acquire and invest. Management could be counting their chickens before they’re hatched. By that I mean they’re counting on recurring revenue that might actually not be there next year. I’m not saying the company will lose its large clients, but every business counts. This could be a huge blow should the economy take down SMBs.

Foolish takeaway

If you’re a long-term holder of Shopify stock, then you shouldn’t have too much to worry about — even at today’s lofty prices. If there is a pullback, that could be a great time to buy in. If it falls by 10% in the near future, that would be ideal. But, really, any dip would be a great time to buy in, as you cannot count on this stock collapsing.

Should that happen and you have the stock, take a breath. The company is here to stay and is likely to rebound eventually. Every company has their ups and downs, and Shopify will, too. But if you’re in for the long haul, Shopify stock is likely to be that stock you were glad you bought way back when.