Tesla (NASDAQ:TSLA) didn’t have an easy rise to the top. The company has years behind it of execution issues and criticism of production, making many believe the stock couldn’t get back to its once-great highs. But this company certainly proved critics wrong.

The company bumped around the US$70 range for about three years until it finally started to soar, only to plummet with the crash. However, since then shares have skyrocketed. As of writing, shares are up an incredible 1,083% since the March 2020 market crash!

The biggest jump, of course, came in November 2020. That was due to the United States presidency officially moving over to Joe Biden’s administration. Biden’s administration promised a return to focusing on green initiatives, including electric vehicles (EV). Since then, the administration has promised move after move of EV initiatives, including most recently replacing 650,000 federal vehicles with EVs.

The company continues to be ahead of the curve thanks to its innovative technology. It could be the first auto manufacturer to have a completely autonomous vehicle. Of course, this all makes shares in the company completely overvalued. So, what are other options investors can consider?

Think EV related

While Canada doesn’t have an EV manufacturer like Tesla, there are other companies to consider. First, you can think about companies that would use EVs. That should spring to mind a company like Facedrive (TSXV:FD). The ride-sharing company has its hand in a number of EV-related ride-share baskets. It can deliver everything from a pizza to mail to medicine. The company came on the market at exactly the right time, as EVs continue to grow in popularity and get government support.

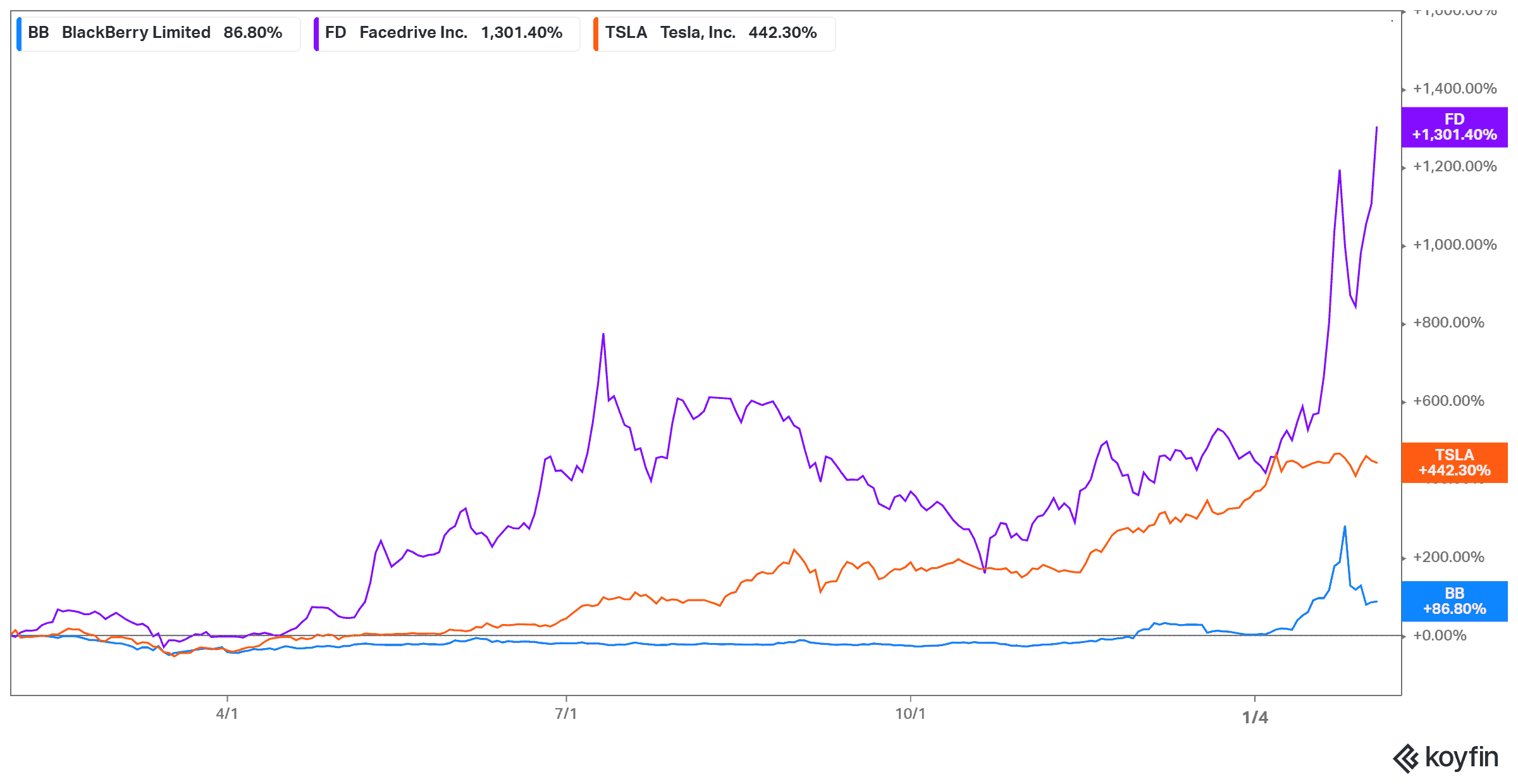

The company has a similar Tesla-like trajectory over the last year, growing 1,307% during that time. Yet, of course, it doesn’t have the history that Tesla has, putting its price-to-book (P/B) ratio at an astounding 203.8 as of writing. But the company has so much room to grow to match competitors that aren’t in the EV space. Time will tell if the company is up to it, but with shares a fraction of the cost of Tesla, and EV popularity booming, this stock is likely to continue soaring upwards in the next year.

Think EV use

All of those autonomous vehicles have to get their technology from somewhere, and that somewhere is moving more towards BlackBerry (TSX:BB)(NYSE:BB). The company has entered several methods of cloud security, and that includes with autonomous vehicles. BlackBerry stock has soared from a number of headlines that promise a strong future for the company.

The one that investors should pay attention to is the partnership with Amazon Web Services. The pair will try and create a seamless cloud system for autonomous vehicles. While it’s not specific to EVs, with more and more companies creating EVs that means more and more companies will likely use BlackBerry’s strong technology. All this sent shares soaring in the new year, but shares in BlackBerry stock have stabilized since then. If you’re looking for a company that will continue to climb as news hits, then this also could be the one. The company has as far more reasonable 5.5 P/B ratio and is like Tesla in that it has a long history in technology innovation.

Foolish takeaway

The EV market was valued at $162.34 billion in 2019. Analysts predict it could be worth $802.81 billion by 2027 for a compound annual growth rate (CAGR) of 22.6%! For those companies that support this growth, it’s clear a long-term hold would be a solid investment.