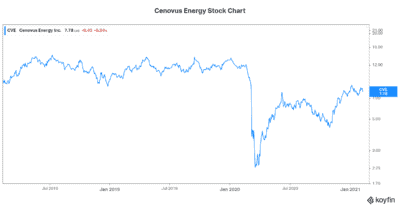

Cenovus Energy Inc. (TSX:CVE)(NYSE:CVE) enters 2021 as a new company that includes Husky Energy’s operations and assets. It also enters 2021 facing a new macro-economic environment. For example, oil and gas prices are higher. Also, the COVID-19 vaccine is making its way to global populations. All of this gives me hope for 2021. It gives me hope for stocks like Cenovus Energy stock. This stock is therefore a stock to buy in 2021.

Cenovus Energy reported its 2020 results today. And with that, the company leaves 2020 in the dust. This year will be different. Cenovus Energy has emerged in 2021 as a new company facing new possibilities. Read on to find out why you should buy Cenovus Energy stock now.

The hallmarks of a bad year – buy Cenovus Energy stock now at cheap valuations

But first, let’s recognize that in 2020, oil and gas prices were hit hard. The pandemic was the final blow to an already reeling energy sector. Demand cratered and commodity prices followed. Many smaller oil and gas companies went under. In fact, all oil and gas companies felt the sting. It was a sobering year.

That said, with every difficult situation, there’s usually a silver lining. This once in a lifetime year brought with it once in a lifetime valuations for the sector. The purchase of Husky Energy happened at these once in a lifetime valuations. Husky is a good strategic fit for Cenovus. It’s also a perfectly timed purchase. It was acquired at cyclical lows. Cenovus had the financial ability and the foresight to make this deal.

Buying at cyclical lows is a real long-term value generator. Cenovus is a stock to buy for this alone. But there’s more. It also brought with it many strategic benefits. It is these benefits that I would like to focus on.

Cenovus Energy to extract $1.2 billion in synergies in 2021 from Husky acquisition

So as I said, 2021 will be a very different year for Cenovus. For example, it’s now the third largest Canadian oil and natural gas producer. It’s also the second largest Canadian-based refiner and upgrader. Furthermore, its Husky acquisition will result in approximately $1.2 billion in synergies. This is huge. For a company that lost $2.3 billion in 2020, this really moves the needle. It makes Cenovus a top stock to buy now.

One of the ways that Husky will achieve this is through layoffs. In fact, 20% to 25% of the combined workforce is facing job cuts. Job losses resulting from this merger is a sad thing. But as far as Cenovus is concerned, it’s a matter of survival. These same job losses play a big part in the synergies that Cenovus will enjoy as a result of this merger. They’re part of what will take the company to the next level.

This stock to buy now will rally on the rising tide of oil and gas prices

Oil and gas prices have rallied big recently. If this holds up, it’ll change the fortunes of many in 2021. Allow me to illustrate this. In 2020, Husky’s average realized crude oil sales price was $28.82 per barrel. At this price, Husky’s cash from operating activities was a mere $272 million. In 2019, Husky’s realized crude oil price was $53.95 per barrel. At this price, Husky’s posted operating cash flow of a whopping $3.3 billion.

These results speak for themselves. Today, crude oil is trading at almost $60. In 2021, Cenovus will have the added benefit of its Husky acquisition. This will mean greater efficiencies, greater cash flows, and greater stability.

The bottom line

I hope I have conveyed to my readers that Cenovus’ 2020 results are not reflective of what to expect in 2021. This year, Cenovus’ experience will be so far removed from its 2020 experience. Yet, expectations for the company and the stock remain low. Low valuations combined with a rapidly improving outlook make Cenovus Energy a stock to buy now.