Natural gas stocks are soaring in 2021. If you’ve been paying attention to the energy situation, you’re not surprised. If this rally is sparking your attention, welcome. The natural gas story is one of misunderstandings. It’s also one that provokes strong emotions. But most importantly, the natural gas story is one of opportunity. In this article, I will discuss this as well as the stocks to buy as a result. These include Peyto Exploration and Development (TSX:PEY) stock, Birchcliff Energy (TSX:BIR) stock, and Cenovus Energy (TSX:CVE)(NYSE:CVE) stock.

Natural gas prices skyrocket

So, natural gas prices have really taken off in 2021. They’re up 30% year to date, and they show no signs of stopping. In fact, natural gas prices have been building strength since mid-2020. I think this strength is very fitting, considering the fundamentals. The natural gas industry has struggled under perpetually low prices. But natural gas markets are in a tight supply position — they aren’t oversupplied.

The current cold weather blast is lighting a fire under natural gas prices in North America. In the U.S., this has resulted in many warnings to conserve energy. We can see that the natural gas grid is being stressed — so much so that natural gas storage will likely be quickly be depleted. And natural gas producers are struggling to keep up with the demand.

But this is just the short-term story. There’s a bullish story for natural gas in the long run as well. Natural gas will be the transition fuel. Natural gas is still the cheapest and most abundant fuel source. It’s not as dirty as many alternatives. And it’ll be needed for decades to come. The market has not priced this in. I think it’s just a matter of time.

In light of all of this, keep reading for three natural gas stocks to buy now. These stocks will rise with the tide. They have a favourable short- and long-term outlook.

Peyto stock: Low costs drive profitability

Peyto is one the lowest-cost natural gas producers in Canada. It has a history of strong capital efficiencies. And the company has always been a well-run energy company. It has always been a shining example of capital discipline in an industry that too often lacks it.

So, today, Peyto stock is up more than 80% in 2021. These returns are a reflection of more than just the current winter weather. They’re a reflection of a sea change in the natural gas industry: a realization that natural gas is not going anywhere.

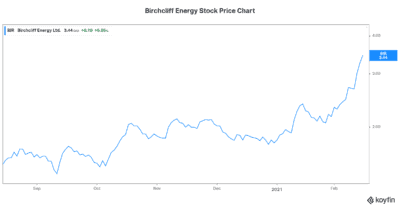

Birchcliff stock: Big exposure to natural gas prices

Birchcliff Energy is a natural gas producer based in prolific basins in Western Canada. Its production is heavily weighted toward natural gas, at an almost 80% weighting. This leaves Birchcliff with significant exposure to these rapidly rising natural gas prices.

And this has not gone unnoticed. In fact, Birchcliff stock has rallied almost 90% in 2021. Going forward, rising natural gas prices will prop up Birchcliff’s cash generation and cash reserves.

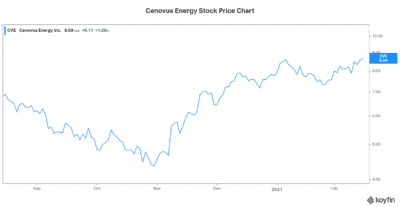

Cenovus Energy stock: A leading integrated company with increasing natural gas exposure

Cenovus Energy is not as natural gas focused as the others. But its well-diversified business brings many advantages. While natural gas only accounts for 15% of Cenovus’s total production, there’s still an opportunity. For example, Cenovus’s natural gas assets in B.C. and Alberta are high quality. Also, there’s a lot of room to increase production in the right pricing environment. And even before the most recent price spike, Cenovus management signaled their intention to do just this. This is based on their long-term optimistic view of natural gas.

Motley Fool: The bottom line

In closing, I would like to highlight the increasingly attractive fundamentals of natural gas. This is a near-term bullish story. But it’s also a long-term story. It has all the hallmarks of being the next commodity boom cycle. Stocks to buy to take advantage of this are Peyto stock, Birchcliff stock, and even Cenovus Energy stock.