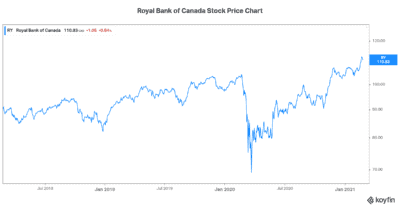

Royal Bank of Canada (TSX:RY)(NYSE:RY) stock has soared to new highs in 2021. It’s amazing what a difference a year makes. I mean, it was only a year ago when everything started to fall apart. The COVID virus was discovered, and the world was paralyzed with fear and uncertainty. And stock markets obviously reflected this. Royal Bank’s stock price fell 35% in one short month.

So, today, Royal Bank stock has already more than recovered these losses. This is pretty exceptional. Even more exceptional is the rebound of its underlying businesses. I’ve always said that Royal Bank would survive the COVID crisis and that it would thrive again. Although, I would not have predicted that it would happen so quickly.

First-quarter fiscal 2021 results were stellar. But what lurks in the background might send Royal Bank’s stock price tumbling once again in 2021.

Royal Bank stock: Optimism abounds

So, I’d like to start off by highlighting the change in management’s tone on the earnings call. Back in December, the bank was overweighting its downside scenarios. These scenarios reflected the uncertainty and risk regarding the speed of the economic recovery. Since then, we have two highly effective vaccines. Also, we have a vaccine rollout plan that is being implemented. And we have a business that’s recovering on all fronts.

First-quarter results were strong at Royal Bank. Earnings per share rose 11%. All of the banks businesses saw strong growth. The Royal Bank franchise continued to capture market share. The benefits of its scale and diversification are on full display.

The strong first-quarter results from Royal Bank were not a surprise. Royal Bank follows strong performances from other Canadian banks. From this perspective, we can see every reason to buy Royal Bank stock. But there are headwinds building in the background. And they suggest a cautious tone — for now at least.

Impaired loans at Royal Bank may accelerate into 2021

The third wave of the virus seems to be an inevitable reality. The new variants have been found all over Canada. And some experts say this wave might even be worse than the first two. This will cause additional disruptions in the economy. Royal Bank has thus far survived the crisis relatively unscathed. This is largely due to government support. But government supports are ending in the summer. The future is therefore once again riddled with risks.

Royal Bank still fully expects delinquencies and impairments to escalate in 2021. Depending on the impact of a third wave, provisions for credit losses might tick up again this year. Right now, allowances for credit losses are more than $2 billion higher than pre-pandemic levels. This will likely move higher as we progress into 2021.

The fact is that there are many struggling areas of the economy. And this third wave will just accentuate problems. Also, government programs are ending this summer. Was all the damage simply delayed until another day? Did the mitigation only serve to delay the inevitable? This remains unclear.

Motley Fool: The bottom line

Royal Bank stock is at a crossroads. On the one hand, it’s trading at highs amid a spectacular comeback. On the other hand, it’s facing more difficult times ahead. I think there’ll be better times to buy this stock. This fact notwithstanding. I still believe that Royal Bank is a top bank stock to own for the long term.