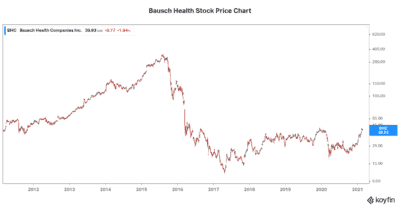

Bausch Health Companies Ltd. (TSX:BHC)(NYSE:BHC) stock certainly has a sordid history. So can we include it on our stocks to buy list? I mean, the company engaged in numerous questionable decisions, seemingly all in the goal to grow at all cost. For example, Bausch Health piled on the debt as it continued to fuel massive growth via acquisition. As well, the company instituted obscene drug price increases. And then there were the accounting “irregularities,” which all blew up a few years ago. I highlighted some of this in a Motley Fool article from that time. Many investors lost a lot of money as the stock tumbled.

But today, things are different. Here’s why Bausch Health Companies stock has soared 45% in 2021 — and why many of us at Motley Fool believe it’s one of the best stocks to buy now.

Carl Icahn buys an 8% stake in Bausch Health

Activist investor Carl Icahn has set his sights on Bausch Health. Clearly, he thinks this is a stock to buy. He’s known for pushing companies toward shareholder value creating changes. So his involvement is a positive thing. His firm will get two seats on the board.

All the changes that will come of his involvement are not clear yet. But one thing his purchase does say is that he thinks Bausch Health stock is undervalued. Coming from famed investor Carl Icahn, it’s a significant vote of confidence. So among the possible changes we will probably see would be changes in leadership. Also, changes to compensation and bonus targets to further align management with shareholders.

The company has already announced plans to spin off its eye health business into an independent public company. This makes sense. It would give Bausch Health a rerating as the deleveraging potential would be significant. Emerging from this spin-off will be two more focused companies. They would presumably be more successful due to the lower leverage and greater focus, giving us good reason to add Bausch Health stock to our stocks to buy now list.

A stock to buy as the business improves

In the meantime, we can already see noticeable improvements in Bausch Health. The company is recovering from the pandemic, and debt is being reduced; cash flows have been exceptional. Operating cash flow was $1 billion in 2020, which was used to pay off $900 million of debt. Let’s take a moment to recall that the company’s heavy debt load has been a real issue.

It has contributed to keeping the stock price low and undervalued. Investors don’t like the risk that heavy debt loads bring to the table, which makes sense. However, buying this stock now as progress is being made also makes sense.

Now, debt is being reduced and cash flows are strong. There’s pent-up demand for different procedures. Bausch will benefit from this tailwind in 2021. Revenue should therefore see good growth. In fact, management’s guidance for 2021 revenue is $8.6 billion to $8.8 billion. This translates to a revenue growth rate in the high single-digit range.

While that may not sound like much, it’s great news. Meaningful revenue growth has eluded Bausch Health in the last few years. In fact, revenue was falling. In 2019, Bausch posted an anemic 2% revenue growth rate. Ever since this company blew up a few years ago, it hasn’t been able to show its true potential. 2021 will be an important turning point. Stocks to buy now are stocks that are benefitting from multiple catalysts.

he bottom line

Bausch Health stock is a Canadian healthcare giant. Its performance history doesn’t look like a defensive stock’s performance. But it actually does have many defensive characteristics simply because it’s a healthcare stock. Going forward, the focus will be on prudently growing the business. And of course, on shareholder value creation. This company is emerging as a sensible healthcare stock to buy and own for the long term. It’s making good progress, but Bausch Health stock is still undervalued today. I don’t expect this to last much longer. This makes it a stock to buy now.