Over the last year, Bitcoin has exploded in popularity, resulting in stocks like HIVE Blockchain Technologies (TSX:HIVE) rallying considerably. Bitcoin is already a highly volatile investment with major upside potential. So, when you take stocks like HIVE that are leveraged to the price of Bitcoin, the growth potential is incredible.

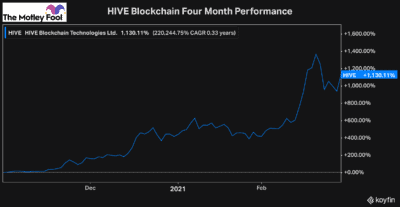

In just the last four months alone, HIVE stock has gained more than 1,130%.

This insane growth is sure to catch the eye of many investors. After all, gaining over a thousand percent in just a few short months is not something you see every day.

However, before considering an investment in HIVE stock, it’s important to understand the risks fully. This is the case with any investment, but especially when you’re considering a stock that’s as volatile as HIVE.

So, with that being said, here are some of the main considerations to consider before buying HIVE stock.

HIVE stock

Bitcoin has been around for over a decade now, yet it continues to face a tonne of controversy as the first cryptocurrency. However, many are now realizing the potential Bitcoin has as a monetary figure and the potential that blockchain technology has in general.

Although it has a tonne of potential and has rallied at incredible rates, Bitcoin is still very risky due to its volatility. That’s why it’s crucial investors are careful when investing in the cryptocurrency and take long-term positions.

Highly volatile investments can be dangerous if you aren’t ready for them. However, they can also offer significant buying opportunities during dips if you know to invest for the long term.

With any cryptocurrency mining stock, like HIVE, the volatility is going to be even more severe. So, it’s crucial investors do their research and are aware of the risks at all times, so you don’t over-expose yourself or take too big of a position all at once.

How is HIVE different from Bitcoin?

Besides being more volatile than Bitcoin, there are few other key differences that separate mining stocks like HIVE from owning the actual cryptocurrency.

First of all, HIVE mines more than just Bitcoin. This is positive for several reasons, mostly because it offers diversification from being tied solely to Bitcoin’s price performance.

Another major difference is that owning a mining company isn’t a straightforward business. Bitcoin mining is especially competitive. So, in addition to needing the price of Bitcoin to increase in the long run, investors need to count on HIVE to continue to execute well.

The fact that HIVE is a diversified miner is a major positive. Like I said before, Bitcoin mining is some of the most competitive of any cryptocurrency. So, finding other, less-competitive cryptocurrencies to mine helps to lower the risk of its operations.

And because it’s not tied solely to the price of Bitcoin, HIVE stock is a lot less risky than a traditional Bitcoin miner. With that being said, though, it’s still going to be significantly volatile.

Bottom line

With the major momentum in Bitcoin, HIVE is offering investors incredible capital gains potential. The stock isn’t without significant risks, though, so make sure you’re aware of the dangers.

Any opportunity that can earn you such significant returns over the long run shouldn’t be ignored. So, if you’re thinking of gaining exposure to Bitcoin and want a high-risk, high-reward stock, HIVE is the choice for you.