Shopify (TSX:SHOP)(NYSE:SHOP) stock benefitted greatly from the lockdowns and the shutdowns. Its e-commerce platform was already starting to take off. The pandemic just pressed fast forward on this trend. As businesses flocked to the e-commerce facilitator, Shopify’s stock price soared.

Today, the vaccine is making its way through populations. We can really see the beginning of the end of the virus and its associated economic pain. This is causing investors to shift focus. There are many sectors and stocks that are grossly undervalued. It is these stocks that have borne the brunt of the shutdowns. But today, it’s also these stocks that are undervalued. Stocks like Shopify, however, are widely held. They’re arguably overvalued (at least in the short term) and due for a correction.

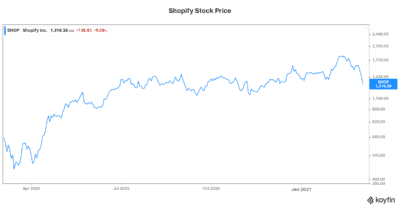

We are seeing just this. Shopify stock is down almost 25% from its 2021 highs. Let’s look at this more closely.

Shopify stock falls as investors rotate into other sectors

Would you be surprised if I told you that Shopify stock is actually down in 2021? Well, that’s exactly the situation. After rising 30% in the first month and a half of 2021, the stock has actually fallen right back down to below where it started the year.

The sector rotation is real. Many tech stocks are falling as a result. And many value stocks are rising. For example, 2021 is proving to be the year for the energy sector. All of the bits and pieces have lined up to create a perfect storm in this sector. Falling supply combined with rising demand is taking energy stocks higher. Cash flows in the sector are booming. Oil prices are booming. And energy stock prices are keeping up, also booming. After years of being in the doghouse, this sector started the year as so grossly undervalued. As the year progresses, we continue to see just how and why this sector is still an essential one.

Shopify stock price falls as the company signals slower growth ahead

In 2020, lockdowns were forced upon us. It was a world where many of us were nervous to head outside. Our traditional way of shopping was not an option. So, forced into a corner, we migrated online. Online shopping, or e-commerce, is certainly a good option to complement in-store shopping. But just as travel was artificially stunted in 2020, e-commerce was artificially uplifted.

Given this, it’s easy to see how Shopify management is guiding to slower revenue growth for this year. Some of this migration and change of habit will stick. But the extent of it will slow down. 2021 will not be a year like 2020. For example, it will reflect a reopening of brick-and-mortar stores. Also, it will reflect a return to in person shopping. And lastly, it will be a year where many jobs return. This will likely make the e-commerce option less appealing for many.

So, 2021 will see slower revenue growth. This is one strike against Shopify stock. But it doesn’t end there. 2021 will also see Shopify invest heavily in the business. The goal of this is so that the company will be stronger and better positioned in the long run. For example, investments into Shopify fulfillment will optimize its distribution network and enhance the overall merchant experience. Also, investments in Shop App will reduce friction for buyers at all points. This will create value for merchants and buyers.

While these investments are positive for the long term, they will obviously create negative pressure in the short term. Increased expenses will translate to lower earnings.

Motley Fool: The bottom line

Shopify stock is in the midst of a major correction. It doesn’t mean its business is a bad one. It simply means that the stock got ahead of itself. Take this time to consider your position on the stock. Be patient and wait it out.