Any company that disrupts a massive, long-standing industry is an incredible business. So it’s clear that Tesla Inc (NASDAQ:TSLA) is one of the most revolutionary companies today.

Very few companies dominated the massive auto industry for years enjoying significant barriers to entry — until Elon Musk came along and disrupted the whole industry, forcing a tonne of innovation from all the competing companies.

His revolutionary electric vehicle — as well as self-driving technology — will be one of the biggest shifts and changes the industry has ever seen.

All of this incredible potential is understandably making investors optimistic about Tesla. That optimism has translated into a major share price growth over the past few years. 2020 was a particularly incredible year for Tesla when the stock gained a whopping 748%.

However, as I mentioned a few weeks ago, Tesla has become far too overvalued. Stocks like Tesla certainly deserve a premium for their potential. But when they have just 2% of the global market and are worth more than all other companies combined, the valuation is extreme.

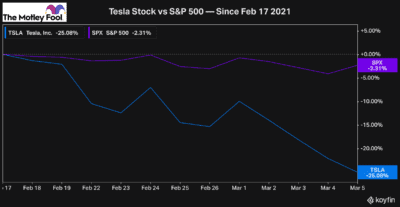

Since that article, in the last few weeks, Tesla has lost over 25% vs. the broader market of 2%. That’s more than 10 times as much as the market. You may be wondering if Tesla is such a great company, how has its stock lost a quarter of its value in just a few short weeks.

Tesla is a case of great company, way overvalued stock. So unfortunately, despite all of its attractive qualities, it’s not investable today.

On the positive side, there are a tonne of high-quality Canadian stocks worth an investment today. Here is one of the best to consider.

A top Canadian energy stock to buy instead of Tesla

Rather than Tesla, one of the best Canadian stocks to buy today is Freehold Royalties Ltd. (TSX:FRU). Freehold has been one of the top value stocks in Canada for a while as the pandemic impacted the energy industry quite considerably.

Over the past few months, though, energy stocks have been some of the top performers as oil prices rise and the industry makes a big recovery.

Freehold receives a royalty payment from companies producing energy on its land. In total, Freehold has interests in hundreds of different operations, which makes it a great stock to play the energy recovery as it’s well-diversified.

And with energy stocks rallying rapidly lately, Freehold now has a tonne of momentum. Yet despite the major rally the last few months, it still has a lot more upside potential.

The company continues to see a recovery in its business. Only a few weeks ago, when I recommended Freehold, I mentioned this recovery in energy production would likely lead to a dividend increase soon. And that dividend increase materialized on Friday when the stock increased its monthly payout by a whopping 50%.

Bottom line

In addition to Freehold still being undervalued and offering an attractive 4.6% dividend, it also has significant momentum, unlike Tesla. Freehold isn’t the only high-quality stock that’s a better buy than Tesla today, either. Tesla’s valuation is just too rich at the moment.

So although the company is a great business, I would pass on the stock for now and instead find other high-quality stocks that offer investors much more value today.