Energy stocks like Suncor Energy (TSX:SU)(NYSE:SU) have long been a source of stress for many investors. Those who’re invested in them have been losing money. Those not invested in them have been acutely aware of their effects on the environment. Today, we find ourselves in a changing world once again. Soaring oil and gas prices are forecasting massive fortunes for energy companies. So, are energy stocks the stocks to buy in 2021?

Let me show you how the perfect storm has formed for energy stocks.

Energy stocks rally as oil prices rally

There’s no question — oil and gas demand is rising. Furthermore, it will continue to rise as economies open up again. The price of oil is up over 100% versus last year. This is because the vaccine is changing the landscape once again. And this time, this change is extremely positive for energy companies. More road trips are coming. More flights will take off. And more business in general will happen. This will fuel a massive demand spike in 2021 versus 2020.

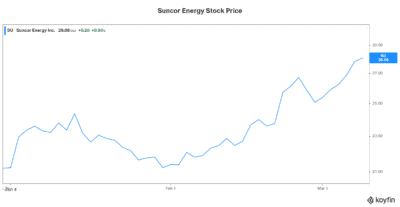

Stocks like Suncor Energy stock are already anticipating this. Suncor stock has soared almost 30% so far in 2021.

Suncor is Canada’s leading integrated energy company. It’s an operational leader in oil sands, exploration, refining, and marketing. This integrated businesses model makes Suncor stock so interesting. Rising oil prices and improving fundamentals will allow Suncor to shine. For example, operating losses were significantly lower in Q4 versus Q3. Combined with significant cost savings, stronger oil prices are really impacting the bottom line. We can look ahead to more of this in 2021. 2020 is now in the rear-view mirror.

Energy stocks benefit from falling supply

Now, let’s take a look at the supply side of the equation. As we know, energy companies have really scaled back on their capital expenditures over the last few years. This means that production growth has slowed and that there’s lower supply in the marketplace. Ultimately, lower supply means higher oil prices.

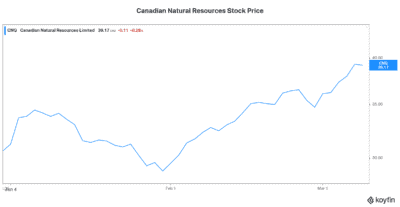

Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) stock has also been pricing in this rebound. Up almost 30% as well, Canadian Natural Resources stock is another leader in this sector.

Canadian Natural Resources is Canada’s best-in-class oil and gas stock. Its long-life, low-decline assets are gems. They require comparatively low capital expenditures. They also provide a high degree of predictability.

Because of this, the company churns out massive amounts of cash flow. 2020 cash flow came in at $5.3 billion. Free cash flow was also strong at $690 million. This means that after capital expenditures and dividends, CNQ still had almost $700 million of cash flow available. This is huge. This foretells a very prosperous 2021.

Energy stocks have been decimated and are now top value stocks

Finally, I would like to add valuation to the picture here. The last few years have been a disaster for energy stocks. For example, because of environmental concerns, energy stocks have been shunned by investors. Also, unfavourable supply/demand fundamentals have plagued the oil and gas industry. Lastly, pipeline constraints in Canada have crippled the system.

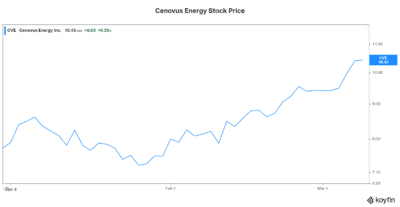

Because of all this, energy stocks were decimated. They were and still are trading at deep-value valuations. Cenovus Energy (TSX:CVE)(NYSE:CVE) is one company that took advantage of this. Cenovus bought Husky Energy stock at deeply undervalued levels in a brave and brilliant move. It will create massive amounts of shareholder value. As the energy sector improves, this will become increasingly obvious. Cenovus’s Husky Energy stock acquisition will be looked at as one of the brilliant moves of 2020.

Motley Fool: The bottom line

Energy stocks like Suncor stock are rallying off of lows, as a new bullish oil and gas cycle is starting. Oil and gas will be needed for years to come. It is the cheap energy that will aid a global economic recovery. Today, stocks like Suncor, Canadian Natural Resources, and Cenovus are on the way up. Consider buying them, so you too can share in the upside.