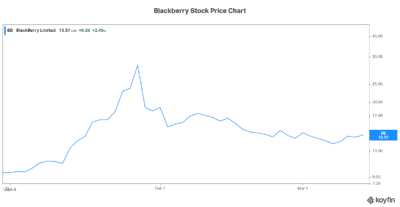

BlackBerry (TSX:BB)(NYSE:BB) stock has sure tested us. I know it’s tested me. It’s tested my ability to remain level-headed in the face of huge stock price swings. It’s also tested my patience. Today, BlackBerry’s stock price is trading at roughly $13. It’s a far cry from the highs of its Reddit-induced rally. But it’s still 55% higher so far in 2021.

So, what do we do with this stock that has so much potential yet seemingly so much risk and uncertainty?

BlackBerry stock: How did we get here?

Let’s step back a bit from all the noise. After all, I think that’s a good exercise. Back in late 2020, I wanted to buy BlackBerry stock. But I was waiting for it to fall to closer to $5. That was my target entry point, and I was patiently waiting to pull the trigger. BlackBerry’s stock price is currently $13. So, what should I do now? Well, two things happened that should inform my decision.

First, Amazon Web Services and BlackBerry announced a partnership. This is a fundamental change worthy of a revaluing of the stock. This partnership will develop and market BlackBerry’s Intelligent Vehicle Data Platform, IVY. It brings together two leaders in their own right. The result will be a faster adoption of auto connectivity. It’ll mean a standardized option for car connectivity — one that can be used across auto makers and platforms. In my view, this deal will cause this market to explode in short order.

Second, the Reddit-induced rally took BlackBerry stock into the stratosphere. This was an emotional, non-fundamental move. Today, the stock has settled down from this artificial high. I think that most, if not all, of this is out of the stock.

BlackBerry stock: A long-term buy

So, I’m fully convinced that BlackBerry is a strong long-term buy. But I’m fussing over my entry point into the stock. This may not be constructive, but I guess it’s one of those investing traps that one can fall into. I mean, it’s not like BlackBerry stock is still trading at $45. It was an easy decision back then. Now, it’s at $13. The decision is less clear.

Here’s what I mean. At $13, BlackBerry is trading at a price-to-sales multiple of six times and a price-to-book multiple of 3.2 times. These are not crazy unreasonable multiples for a growth stock. The problem is that I feel the market in general is at risk of a correction.

As for BlackBerry, its growth rate is huge. BlackBerry’s QNX software is in a great many cars. It will be in many more cars. The global market size is widely expected to increase threefold in the next five years. In 2020, the market was valued at more than $60 billion. By 2025, it is expected to be more than +$180 billion. And this is just one of BlackBerry’s promising businesses.

The other business that BlackBerry is in is the cybersecurity business. This is another business of the future. And it’s another one where BlackBerry’s technology is first rate. The growth here is steady and lasting. Demand growth for cybersecurity will grow at a healthy clip, as remote working increases and as security risks increase. Research suggests that the global cybersecurity market is expected to grow from $149 billion in 2019 to $210 billion in 2023.

Motley Fool: The bottom line

BlackBerry stock is a buy at $13. The only thing that’s stopping me from buying is my view of the market in general. It’s hard to tell what will happen in that respect. However, I think that in the long run, BlackBerry stock will prove to be an excellent buy today at $13.