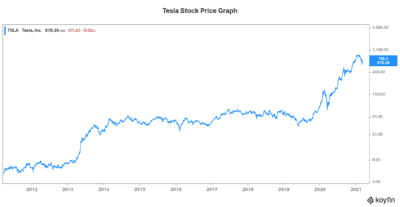

Tesla Inc. (NASDAQ:TSLA) has been all the rage. Its success in getting electric cars to the market is nothing short of transformative. Electric vehicles are here to stay. But Tesla’s stock price is reflecting a lot of the good news. It’s also widely held.

Isn’t it time to search for another EV stock that has yet to benefit from this massive industry?

Battery-powered EVs are not the only alternative to internal combustion engines

Cars aren’t the only vehicles that are polluting our environment. In fact, buses and trucks are big contributors as well. And battery electric vehicles aren’t the only type of clean electric vehicle.

Tesla is the leader in battery-electric vehicles for cars. But Ballard Power Systems Inc. (TSX:BLSP)(NASDAQ:BLDP) is the leader in fuel cell electric vehicles for heavy duty vehicles. Heavy duty vehicles refers to buses, trucks, rail, marine, and even aircraft. Battery-powered electric vehicles are a fine solution for cars. But they lack a few things. Most notably, they lack power — the kind of power that’s required to move heavy duty vehicles is on a whole other level.

Enter the fuel cell. Fuel cell electric vehicles have key benefits, such as power. Also, their fast and smooth acceleration. They also address many of the battery limitations. For example, they offer long range and fast refueling. This translates to full route flexibility.

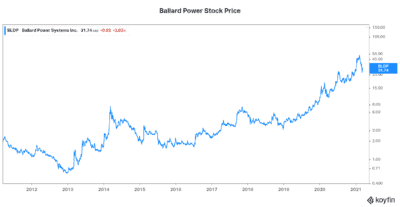

Ballard Power stock is just beginning its rise

Fuel cell engines are quickly rising in popularity and adoption. Fuel cell engines generate their electricity from hydrogen, which is the most abundant element in the universe. It’s light, colourless, odourless, tasteless and non-toxic. This gas is a clean alternative to battery powered electric vehicles. In fact, fuel cell vehicles have a far superior performance to that of battery vehicles.

I view Ballard as being where Tesla was about a decade ago. Back then, Tesla was under the radar of most investors. The company was still trying to innovate its way into the passenger car market. And there were many disbelievers. Tesla has since won over the investor community and the auto industry. We are believers. Also, Tesla stock has since skyrocketed in a move that will certainly go down in history.

The next Tesla?

Ballard Power stock is still in the early stages of its rise. The fuel cell still has many disbelievers. Yet, fuel cell powered buses and trucks are changing the heavy duty vehicle market. Fuel cells are being adopted at an increasingly rapid rate. This global trend can be seen in Europe, China, Australia, the U.S., and Canada. For example, there are currently over 1,000 Ballard fuel cell buses and over $2,200 Ballard fuel cell trucks in China today. This translates to a market share of 45%.

So Ballard stock is beginning to reflect this revolution in heavy duty vehicles — just as 10 years ago, Tesla’s stock price was beginning to reflect its revolution. Ballard Power stock is up 650% in the last three years.

Momentum in the fuel cell industry is building. Momentum for Ballard is certainly building along with it. Ballard’s sales pipeline grew 55% in 2020. And Ballard is seeing interest in its fuel cells across the board. An example of this comes from our own backyard. CP Rail recently announced a new hydrogen-powered pilot project. The company will test North America’s first hydrogen powered freight locomotive. And Ballard’s fuel cells will be used.

Ballard estimates that by 2030, the market for fuel cell trains will be $4 billion. They estimate the market will be $100 billion for trucks. For buses, it will be $14 billion; for marine transportation, it will be $13 billion.

The bottom line

Tesla’s battery electric cars are certainly revolutionizing the passenger car market. But today, Tesla’s stock price is certainly reflecting much optimism. Ballard Power stock, on the other hand, is still far less known with much more skepticism. This offers investors a once-in-a-lifetime opportunity to buy Ballard Power, an EV stock on the rise.