Dividend stocks are stocks that regularly give cash back to shareholders. Top dividend stocks to buy those that pay generous dividends. They’re also stocks whose dividend payments can be relied upon. In short, dividend stocks have a place in every investor’s portfolio.

Without further ado, here are three top dividend stocks to buy now. 2021 might be a difficult year for the stock market. These dividend stocks will provide protection.

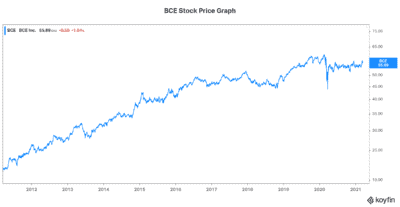

BCE stock: A top dividend stock to own for decades to come

BCE (TSX:BCE)(NYSE:BCE) is Canada’s largest telecom services company. Its position is backed by an extensive reach of its world-class wireless and fibre networks. It’s also backed by BCE’s financial health and financial strength.

Today, BCE is a dividend stock that’s yielding above 6%. It’s a rate that has historically been reserved for higher-risk stocks. Today, it’s BCE’s dividend yield. This makes BCE a very attractive stock to buy. A 6% dividend yield guarantees a 6% annual return. Today’s market has meaningful downside risk, in my view. BCE stock has shown its resiliency. It’s also shown its ability to create shareholder value. Clearly, BCE is a telecom leader that doesn’t rest on its laurels. As the company continues to invest in its network, its future success will be sealed.

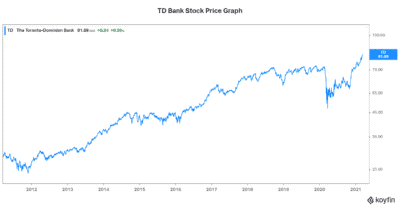

TD Bank stock: A top stock to buy for exposure to economic growth

Banks are a barometre of the economy. They help fuel economic growth, and they help us through economic hardship. As the economy rises out of the economic hardships of 2020, Toronto-Dominion Bank (TSX:TD)(NYSE:TD) will be there.

TD Bank is one of Canada’s largest banks. It benefits from product and geographic diversification. And the bank’s scale is unmatched. All of this has given TD Bank a place as one of Canada’s two largest and most successful banks. It’s also contributed to TD Bank’s exceptional financial performance. For example, TD Bank stands out for its years of success in driving efficiencies. The bank has an industry-leading ROE and a conservative approach that mitigates risk.

TD Bank’s stock price has rallied almost 14% in 2021. Its dividend yield is almost 4%.

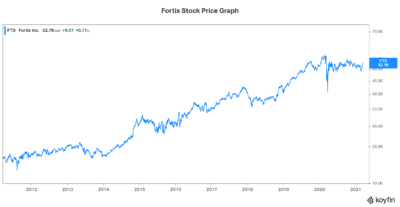

Fortis stock: A top dividend stock to buy for safety and security

Fortis (TSX:FTS)(NYSE:FTS) is a stock to buy for defensiveness. It is insensitive to economic performance. It’s the beneficiary of a highly regulated and essential business. And it has decades of top-notch performance and reliability.

All if this culminates into one fact: Fortis’s 47 years of consecutive dividend growth. This is a big accomplishment — one that investors can take comfort in. And looking ahead, Fortis is expecting more in the way of dividend increases. In fact, the company’s guidance is for a 6% average annual dividend-growth rate to 2025. The chart below illustrates the massive gains that Fortis stock has given investors over the last 10 years.

Motley Fool: The bottom line

The three dividend stocks to buy that I’ve listed in this article share a few of things in common. For example, they’re all leaders in their industries. Also, they all have a strong history of dividend growth and shareholder value creation. And finally, they are all somewhat defensive or highly defensive. In short, these top dividend stocks are stocks to buy in 2021.