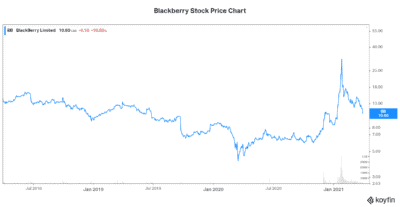

BlackBerry (TSX:BB)(NYSE:BB) stock is really being tested again today. The Reddit-induced run-up in BlackBerry’s stock price is over. Now, we’re back to the fundamentals. The long-term fundamentals remain positive. But the short-term story is a little noisier.

So, why is BlackBerry stock down 10% today?

BlackBerry’s earnings results send the stock tumbling

BlackBerry reported its fourth quarter fiscal 2021 earnings result yesterday. It was good in some ways but concerning in others. First, let’s tackle the good news. BlackBerry QNX is at the forefront of transforming automobiles into connected systems today and autonomous vehicles tomorrow. In the quarter, BlackBerry QNX continued to see a recovery after being hit hard in the early days of the pandemic.

BlackBerry’s software has long been used for infotainment systems, acoustics, and dashboard functions. Its expertise has more recently been extended. It now includes more advanced technologies such as Advanced Driver Assistance Systems. These systems are designed to enhance driver performance. They do this by automating functions, giving warnings, and intervening when necessary.

So, back to the good news of the day. BlackBerry QNX is bouncing back to pre-pandemic levels. In fact, the company expects billing growth to be in the double-digit range for fiscal 2022.

But right now, revenue growth remains elusive for BlackBerry. Should we give up on the stock like many investors seem to be doing today? I mean, BlackBerry’s stock price is down 10%!

I don’t think we should give up on the stock. Actually, I’m a buyer today on this weakness.

BlackBerry’s stock price falls on revenue uncertainty

So BlackBerry’s CEO said a lot on the earnings call. Most importantly, he said that software and services revenue is bouncing back to pre-pandemic levels. But even pre-pandemic revenue at BlackBerry was problematic. This is because the company has been in the building phase. The transitioning of its business model away from phones has been a long road.

Even today, BlackBerry remains in the building phase. But the light at the end of the tunnel is becoming clearer. For example, BlackBerry has won many industry awards for its software. These awards were for its cybersecurity and connected car software. This speaks to the level of quality of BlackBerry’s offering. At the same time, BlackBerry is beginning to see a resurgence of interest. This is reflected in the double-digit billings growth.

Patent sales to provide BlackBerry with an infusion of cash

The problem here and a major reason for BlackBerry stock’s weakness today is simple. The company is in negotiations to sell off a big chunk of its patent portfolio. This has and will continue to negatively affect licensing revenue. But I view this as short-term pain for long-term gain, because it’ll result in greater focus. BlackBerry is holding onto patents in its focus areas, cybersecurity, and connected cars. It’ll also result in a cash inflow. This cash inflow will be put to use to speed up BlackBerry’s growth. For example, acquisitions may be made, there may be more spending on marketing, sales, and tech. This will all further the company’s penetration of its industries.

Motley Fool: The bottom line

BlackBerry stock is in a free fall today. While the future does have some uncertainty for BlackBerry, I’m comforted by the following facts. First, I believe that the Reddit-induced hype buying is out of the stock at this point. Second, I believe that BlackBerry is on the cusp of big things in both of its businesses. With its award winning software and its partnership with Amazon Web Services, BlackBerry is in a strong position today. I would buy today at these levels.