On Wednesday, Dollarama (TSX:DOL) unveiled its latest financial results and new growth targets. The low-cost retailer saw its sales in the fourth quarter fall short of analysts’ expectations as the company grapples with tougher public health measures due to the pandemic.

Slight decline in profits, increase in sales

For the fourth quarter ended January 31 – which included the critical holiday season – net income was $173.9 million, or $0.56 per share, down from $178.7 million, or $0.57 per share, a year ago.

Sales totalled $1.10 billion, up 2.8%, thanks to the addition of new stores. Comparable sales, however, contracted by 0.2%. Overall, consumers spent more on each visit, which offset the drop in traffic.

Analysts were forecasting quarterly revenue of $1.13 billion and earnings per share of $0.56, according to financial data firm Refinitiv.

The discount store chain said its business was hit due to stricter measures taken by provincial authorities in December, including tighter in-store capacity limits and a temporary ban on the sale of non-essential items in Quebec stores.

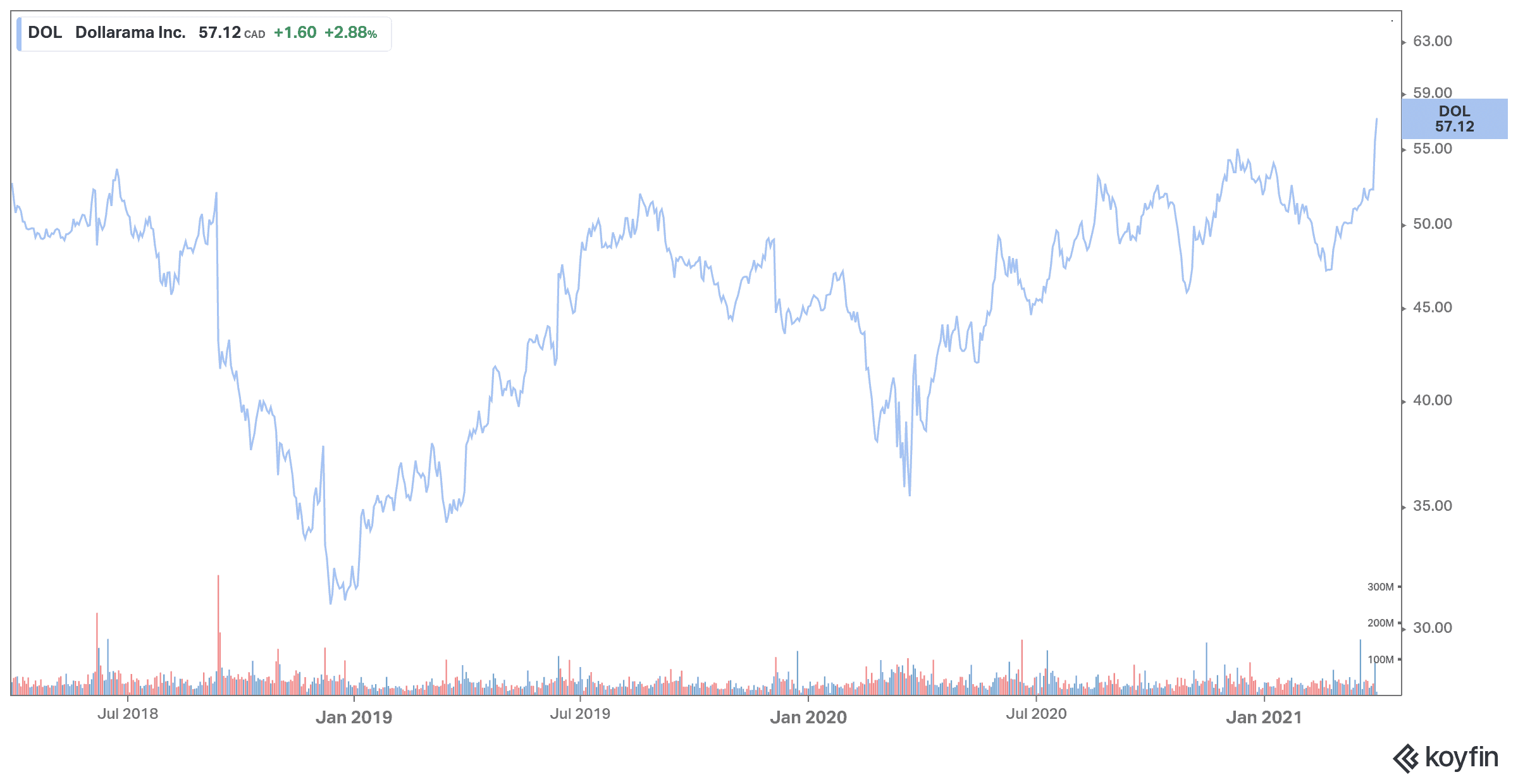

However, the company said sales momentum had returned as restrictions eased in many parts of the country, sending its shares up nearly 6.3% to a three-year high. Dollarama stock continued to rise on Thursday.

“We’re already seeing Easter being strong right now, and it’s a week in advance also (versus a year earlier), and summer sales are doing very well, which they weren’t last year,” Michael Ross, the company’s former chief financial officer who is now an adviser, said on an earnings call.

In 2020, Dollarama saw its sales increase by 6.3%, reaching $4.03 billion. Management attributes this growth to higher same-store sales (+3.2%) and new branch openings.

This increase was recorded despite sanitary measures, the closure of some stores during lockdowns, and Quebec’s ban on the sale of non-essential products at the start of winter.

Management says it has seen an increase in demand for seasonal items, household and cleaning products, hygiene and health products as well as food products.

Dollarama’s last fiscal year net income was $564.3 million, or $1.81 per common share, compared to $564 million, or $1.78 per share, in 2020.

In fiscal year 2022, sales are expected to rise by 10.20%, and profit by 26.70%.

Dollarama said it would open more than 600 new stores in Canada by 2031, bringing its total number of stores to 2,000. That’s an update from its previously disclosed target of 1,700 stores nationwide by 2027. The new target is an increase of about 50% from the current size of its network, which, as of January 31, had 1,356 outlets.

“Based on our experience, our historical performance and what we see going forward, we feel very confident in raising our long-term store target,” Chief Executive Neil Rossy said on a conference call with analysts on Wednesday.

Despite the impacts of the pandemic, the Montreal company has just opened 65 new stores in recent months.

This year, the retailer plans to open between 60 and 70 new branches and investments are expected to range between $160 and $170 million.

The company has announced that it will increase its quarterly dividend by 7% and intends to resume share buybacks in 2022. The dividend yield is currently 0.32%.

Dollarama stock is a buy

Dollarama is the kind of stock you want to own during a pandemic for its resilience. Analysts have an average price target of $60.21, which represents an upside of about 6% from the current price.